Spark (SPK) price has dropped by more than 17% in the last 24 hours, but some indicators suggest that selling pressure may ease.

The weekly gain is still around 200%. However, several technical and on-chain indicators imply that the rally could restart if key resistance is broken.

Exchange Outflows Suggest Slowing Selling Pressure

One of the first signs that sellers might retreat is the recent decrease in exchange balances. In the past 24 hours, SPK exchange holdings have decreased by 5.33%, approximately 21 million Tokens. This suggests a reduction in immediately sellable Tokens.

Simultaneously, the top 100 wallets increased their holdings by 0.3%, reaching a total of 9.97 billion SPK. Whales also participated with a slight 0.08% increase in purchases.

This change indicates that most whales have already realized profits. This creates a situation where new selling pressure could decrease unless the price falls further.

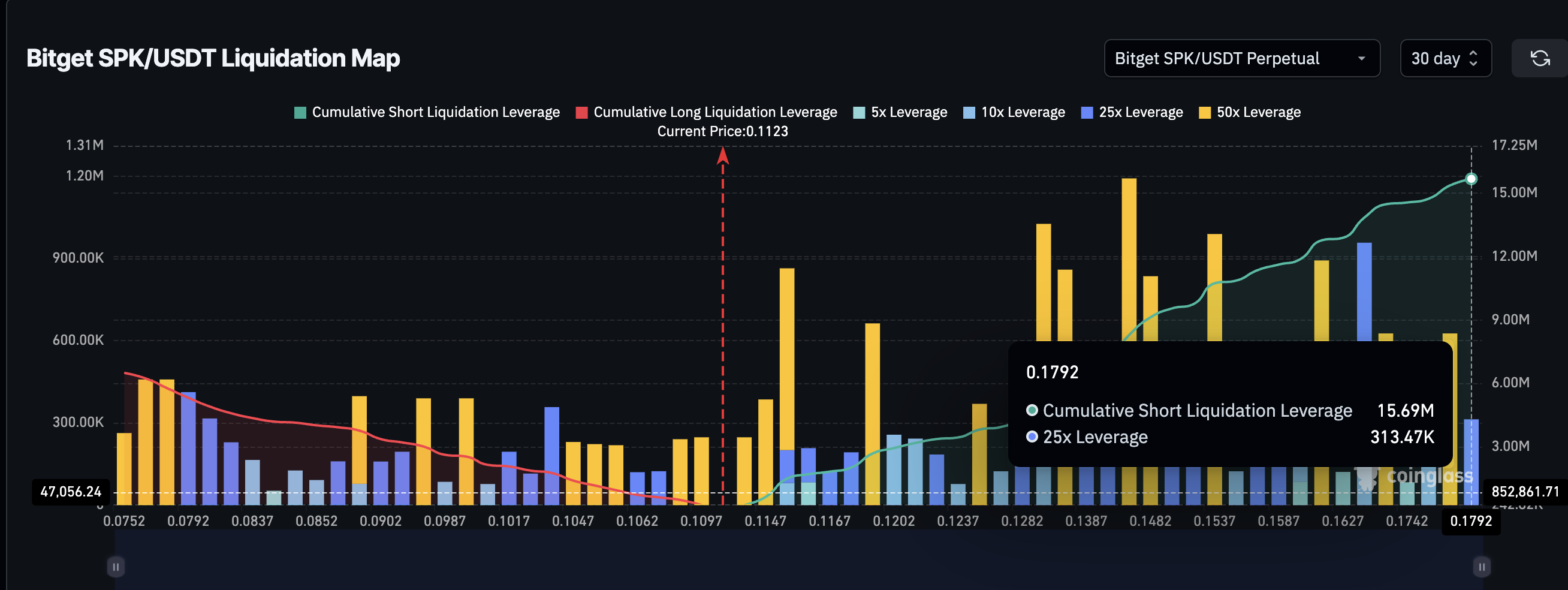

Metrics Suggest Potential Short Squeeze Above $0.13

Spark (SPK) price remains around $0.11. However, breaking $0.13 could trigger a strong short squeeze, as revealed in the liquidation map of leveraged products.

The map shows a dense cluster of short liquidation levels starting at $0.11 and thickening between $0.13 and $0.17. This cluster represents the most likely area for high-leverage short positions (25x to 50x) to be liquidated. If SPK rises to this range, these liquidations could trigger a chain reaction of forced buying, potentially driving the price higher.

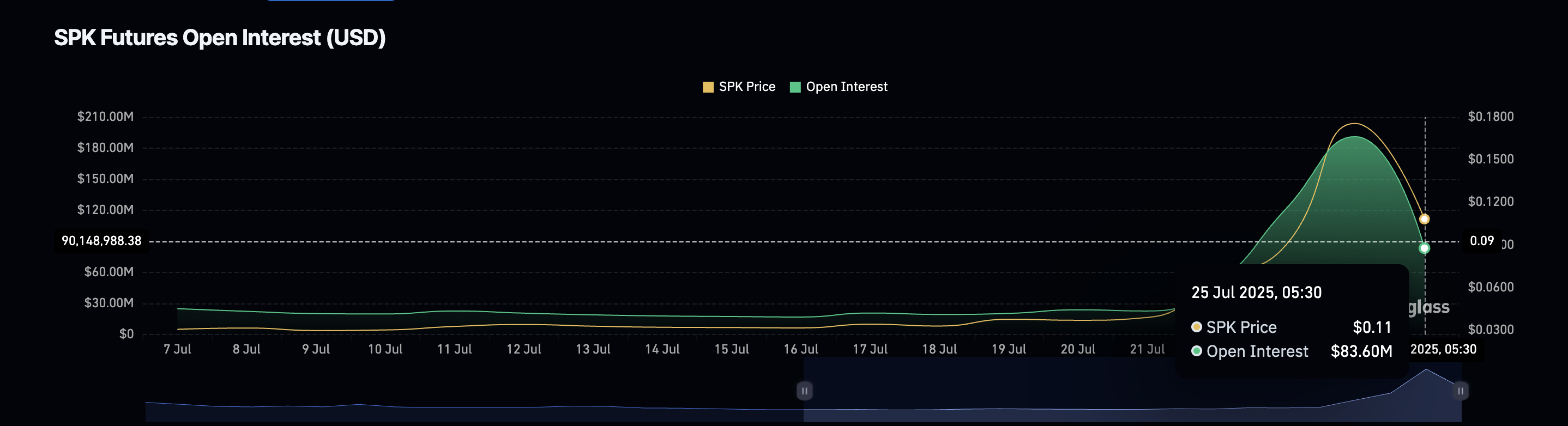

Open interest supports this possibility. While it has decreased by 60% from $190 million to $83.6 million in recent days, it remains high. This suggests many traders are still actively participating in the market, with a significant number holding short positions according to the liquidation map. This sets the stage for a potential liquidation-driven rally if key resistance is broken.

These indicators, the liquidation cluster above $0.13, and still-high open interest suggest a potential breakout that could trap late short sellers. If $0.13 is breached, Spark (SPK) could trigger another rally due to new demand and forced buying of short positions.

Token Technical Analysis and Market Update: Want more such Token insights? Subscribe to the daily crypto newsletter by editor Harsh Notariya here.

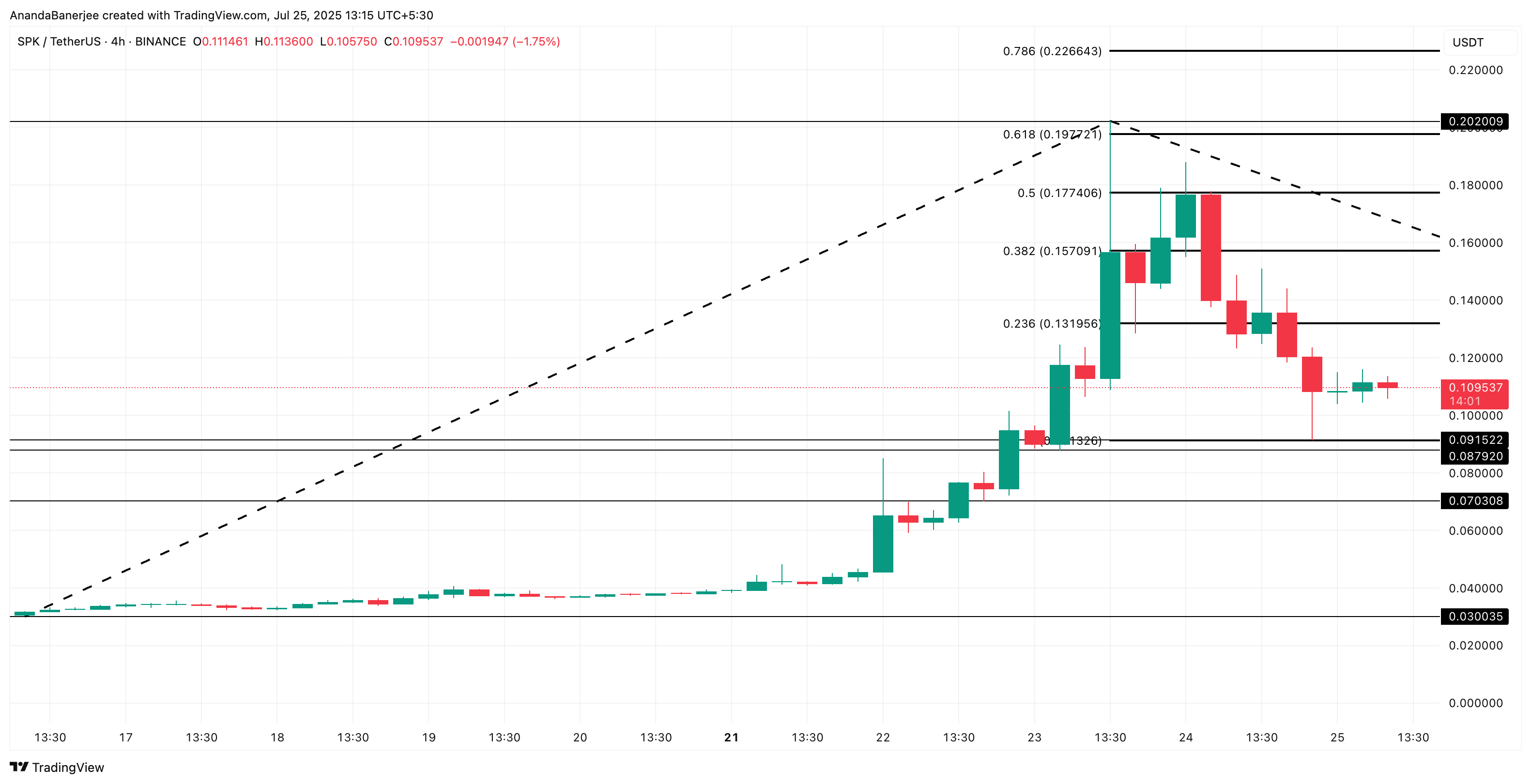

Spark (SPK), Focus on Key Breakout Zones

On the 4-hour chart, the 0.236 Fibonacci extension level is located at $0.13, which is the point where a strong liquidation trigger begins. Above that, resistance exists at $0.15 and $0.17, and if the breakout accelerates, it could extend to $0.202.

During previous rallies, the $0.15 resistance did not have a significant impact, but $0.17 provided substantial resistance when Spark (SPK) attempted another move.

If SPK price breaks $0.13 with momentum, short liquidations could drive a sharp 70% rise to the $0.17 area. However, falling below $0.09, which is a major support area and the retracement level used to draw the Fibonacci extension, could invalidate the bullish hypothesis.