Author: Ethan, Odaily

"2021 was the year of Layer 1 competition, and 2024 is the carnival of Meme. So, what direction will the market's main theme take in 2025?"

This question that sparked heated discussion on X platform is being clearly revealed by mainstream capital: With the successful legislation of the GENIUS Act and stablecoins officially incorporated into the U.S. sovereign regulatory framework, a new multi-dimensional financial narrative integrating "Stablecoin × RWA × ETF × DeFi" is rising forcefully.

In this profound evolution of cross-chain finance, the core focus is no longer Bitcoin or Meme coins, but the struggle between Ethereum and Solana for a new and old order. The two public chains have essential differences in technical architecture, compliance strategies, expansion paths, ecosystem construction models, and even value foundations.

Currently, this competition that will determine the future landscape has entered a critical stage where capital is making fierce bets with real money.

Capital Betting Preference: From "BTC Faith" to "Choose between ETH/SOL"

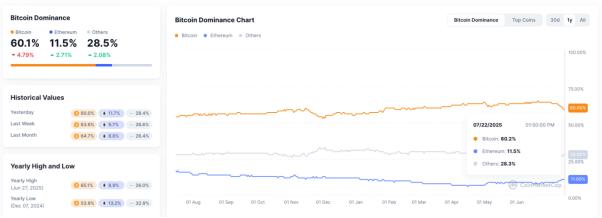

Unlike previous crypto bull markets driven by macro monetary factors with uniform rises and falls, the 2025 market shows clear structural differentiation. Head projects are no longer moving in sync, and funds are concentrating bets on selected battlefields, with a trend of survival of the fittest.

[The rest of the translation follows the same professional and precise approach, maintaining the original structure and technical terminology.]As BTC stabilizes at $120,000, ETH approaches $4,000, and SOL returns above $200, high volatility accompanies high enthusiasm, which itself is a prelude to brewing new narratives and major fund repositioning. What we see is not speculative frenzy, but an increasingly shorter feedback loop between "on-chain behavior and price response".

This is a model driven by consumption data to trade expectations, which ETH cannot achieve, but SOL has become the paradigm.

Whale Game and Policy Catalysis: Who Can Absorb the Major Funds' Repositioning Bullets?

Technical applications determine a public chain's "narrative potential", while funds and policies determine its "trading capacity" - especially after BTC breaks $120,000 and the market enters the main upward wave, identifying the next stage's "fund convergence area" is crucial.

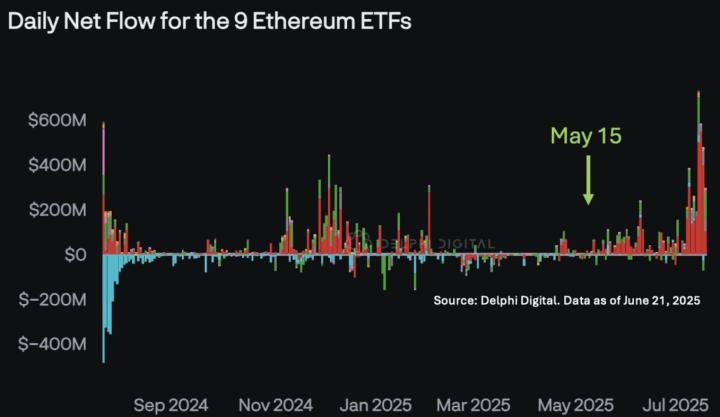

On-chain data shows that since Q2 2025, three major institutions' "on-chain positioning" behaviors have shown completely different strategies: Grayscale continuously increased ETH holdings from May to July (cumulative 172,000 tokens, about $640 million), clearly used for its spot ETH ETF base position construction; Jump Trading has frequently rebalanced on Solana since June, focusing on BONK, PENGU, and Jupiter, and accumulated nearly 280,000 SOL through multiple addresses; DeFi Development Corp and Upexi, two listed companies, have continuously announced SOL increases, forming holdings of over a million tokens (total market value near $500 million) and achieving significant floating profits.

This is not a simple "win-lose" bet, but market stratification: ETH is a "structural asset allocation", SOL is a "short-cycle volatility tool".

Policy wind direction differentially boosts "dual-line growth". On July 19, US President Trump formally signed the GENIUS Act (US Stablecoin National Innovation Guidance Act), with the first federal stablecoin regulatory framework landing, coupled with Coinbase and BlackRock submitting S-1 spot ETH ETF files, making the path of "ETH inclusion in compliance framework" increasingly clear. Meanwhile, Solana team collaborates with exchanges like OKX and Bybit to promote "compliant consumption asset issuance" experiments. For example, OKX launched a Solana chain asset-specific Launchpad in July and introduced light KYC mechanisms for Meme coin issuance.

This "two-way compliance" means policy dividends are being distributed differentially according to application scenarios, fund attributes, and risk preferences: ETH continues to absorb traditional capital, while SOL becomes a compliant experimental field for young users and consumption scenarios.

Short-term policy expectations: ETH benefits more obviously, SOL faces fewer restrictions. Although ETH is at the forefront of policy dividends in ETF and RWA aspects, it also faces multiple thresholds from SEC in securities attribute determination and staking classification. The SOL ecosystem, with less involvement in centralized issuance and complex staking channels, makes its tokens and applications easier to enter the regulatory "gray safety zone". This leads to ETH's upward path being more stable but longer-cycled, while SOL's path is steeper and more volatile.

Who Defines the Future? Hedging Allocation, Not Either-Or

From the market path after BTC breaking $120,000, the differences between ETH and SOL are no longer a linear question of "who replaces whom", but a distributed answer of "who defines the future in what cycle".

ETH is the Medium-to-Long-Term Narrative Protagonist under Structural Support

Under the GENIUS Act, the path for ETH to enter the financial compliance system is clear. Whether pushing spot ETF or positioning as a "clearing layer" in RWA models, it becomes the "core asset" for Wall Street's blockchain asset allocation.

From the positioning logic of institutions like BlackRock and Fidelity, ETH is evolving from a "Gas Token" to a "basic financial platform", with its valuation anchor shifting from on-chain activity to Treasury yield models and Staking rates. ETH's victory is not through explosion, but through sedimentation.

SOL is a Short-Term Detonator in Structural Cracks

In contrast to ETH's stability, SOL has become the main battlefield for fund gaming in high-frequency trading, Meme coin narratives, terminal applications, and native consumer goods (like Saga phones). From BONK to PENGU, to JUP's governance experiments, Solana has built a high-liquidity, high-penetration "native narrative market".

Combining on-chain actual performance: SOL's TPS, cost, and terminal response speed continuously lead; SVM ecosystem's independence also helps it escape EVM ecosystem's involution and redundant construction.

More importantly, SOL is one of the few "narrative low points capable of and willing to bear funds with high volatility", becoming the core short-cycle option for capturing "rapid fund rotation response" after BTC launches the main upward wave.

Therefore, this is not a "selection question", but a "cycle gaming question":

For mid-to-long-term funds optimistic about institutional changes and betting on traditional capital's structured entry, ETH is the first choice. For short-cycle participants hoping to capture fund rotation and narrative explosion opportunities, SOL provides more tension-filled Beta exposure.

Between narrative and system, volatility and sedimentation, ETH and SOL may no longer be opposing options, but constitute the optimal combination under a time mismatch.

Who defines the future? Currently, the answer might not be a single project, but a continuous fine-tuning process of this "combination weight".

Recommended Reading:

Crypto Beast Operates $ALT Crash, KOL Collapse Story Adds Another Stroke