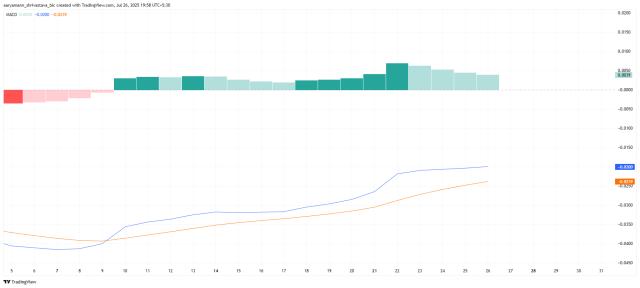

According to X user “ai_9684xtpa,” a suspected 14-year-old Bitcoin (BTC) wallet transferred 14,273 BTC to exchanges via Galaxy Digital. The coins are valued at a whopping $1.67 billion. According to on-chain data, more than 10,000 BTC were traded on Binance in just four hours. The movement coincides with Bitcoin’s latest price dip.

According to @ai_9684xtpa, 14,273 BTC (~$1.67B) suspected to belong to a 14-year BTC whale were transferred to exchanges over the past 12 hours via Galaxy Digital, including 5,690 BTC in the past hour. On-chain data suggests real selling: over 10K BTC were traded on Binance in 4…

— Wu Blockchain (@WuBlockchain) July 25, 2025

Will BTC Face Further Correction?

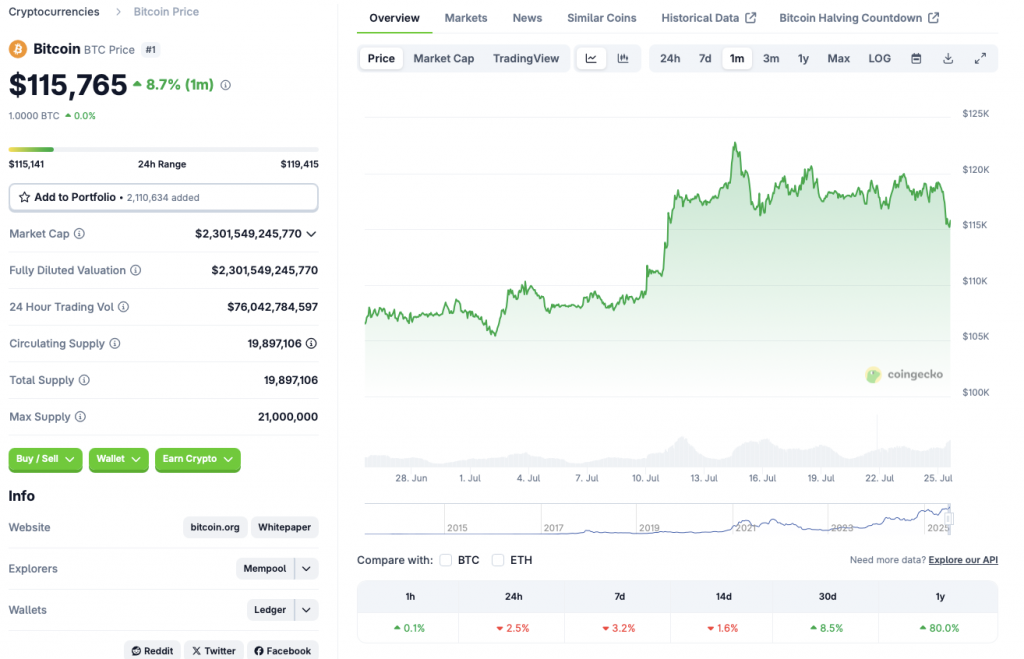

Bitcoin (BTC) experienced one of its most significant rallies over the last few weeks. The asset climbed to a new all-time high of $122,838 on July 14. The incredible rally was likely due to increased ETF inflows from financial institutions and corporate treasury buys. BTC’s price has since declined to the $115,000 level.

According to Coingecko’s BTC data, Bitcoin has faced a substantial price dip over the last few days. The original crypto is down 2.5% in the daily charts, 3.2% in the weekly charts, and 1.6% in the 14-day charts. BTC continues to maintain some gains in the monthly and yearly charts, rallying 8.5% and 80%, respectively.

BTC seems to have a supply gap at the $110,000 to $115,000 level. There is a possibility that the asset will dip to $110,000 before picking up steam. The latest correction could be due to increased profit-making after the asset’s climb to a new all-time high. Increased volatility may have spooked retail investors.

Also Read: Novogratz Bets on ETH: “Could Beat Bitcoin in 6 Months“

BTC’s latest correction could also be fueled by the upcoming FOMC meeting. Market participants are eagerly waiting for the Federal Reserve’s stance on the US economy. A hawkish stance could lead to BTC’s price dipping further. There is also a chance that the Federal Reserve will cut interest rates after its next meeting. A rate cut could lead to an increase in risky investments as borrowing becomes easier. How the market pans out over the coming weeks is yet to be seen.