Amid a conservative valuation trend across Ethereum network-based assets, large-scale purchases are being made by whale wallets, focusing on assets like PEPE and ENS.

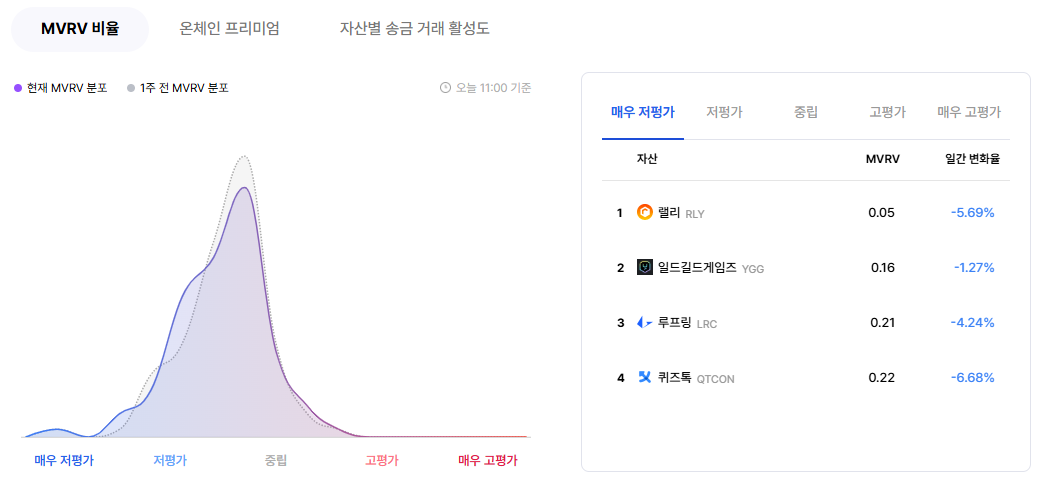

According to Upbit Data Lab as of 9 AM on the 25th, among 99 listed Ethereum-based assets, 47 assets were located in the neutral zone, followed by undervalued (51 assets) and overvalued (1 asset) assets.

The fact that multiple assets are currently undervalued suggests a conservative valuation trend across the market. The analysis indicates that with a low proportion of overvalued assets, there are minimal overheating concerns, and a stable price reorganization process is underway.

Extremely Undervalued ▲Rally(RLY) ▲Yield Guild Games(YGG)

Undervalued ▲Radworks(RAD) ▲Synthetix(SNX) ▲ApeCoin(APE) ▲GitCoin(GTC) ▲Safe(SAFE)

Neutral ▲Hyperrain(HYPER) ▲Pendle(PENDLE) ▲Aave(AAVE) ▲Mantle(MNT) ▲Chainlink(LINK)

Overvalued ▲Ethereum(ETH)

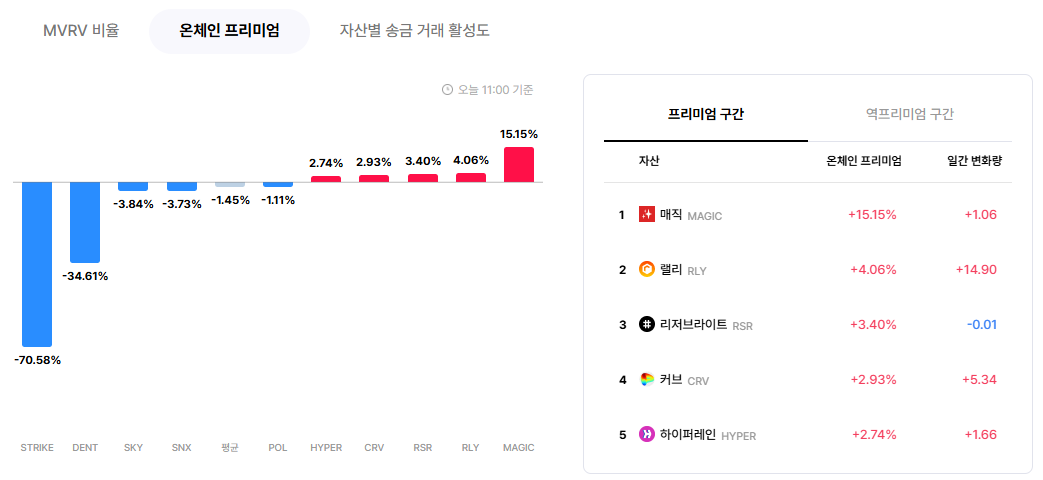

The average on-chain premium for the Ethereum network is -1.45%, up 0.02 percentage points from the previous day. This indicates that the trading price on the blockchain remains lower than on centralized exchanges, maintaining a 'reverse premium' state. Generally, this suggests the presence of on-chain selling pressure and that investors are trading at lower prices in a decentralized environment.

Premium Assets ▲Magic(MAGIC, +15.15%) ▲Rally(RLY, +4.06%) ▲Reserve Rights(RSR, +3.40%) ▲Curve(CRV, +2.93%) ▲Hyperrain(HYPER, +2.74%)

Reverse Premium Assets ▲Strike(STRIKE, –70.58%) ▲Dent(DENT, –34.61%) ▲Sky Protocol(SKY, –3.84%) ▲Synthetix(SNX, –3.73%) ▲Polygon Ecosystem Token(POL, –1.11%)

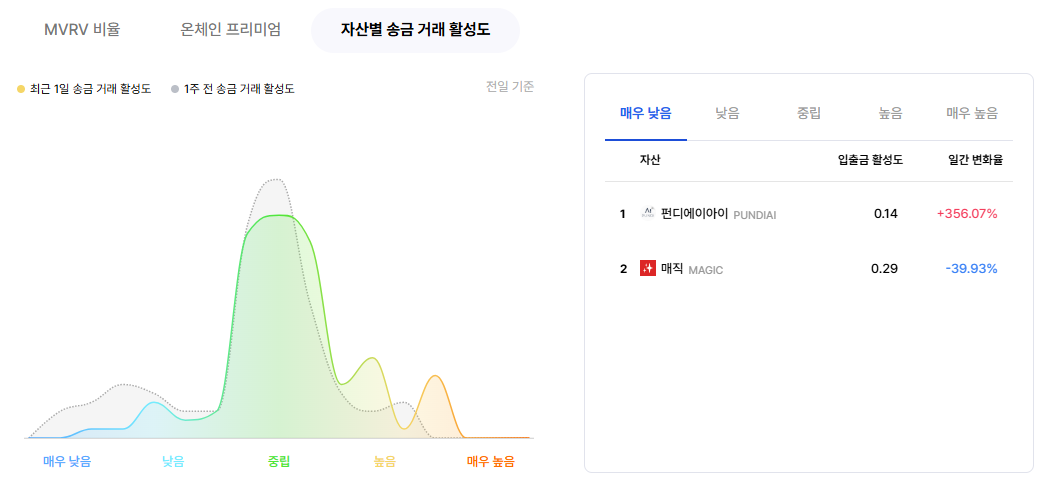

Based on the transfer activity of blockchain-based assets, as of the 25th, 63 assets had daily transfer counts below the 30-day average, more than the 41 assets that exceeded it. Overall, blockchain activity appears to be declining.

Very Low ▲PundiX(PUNDIAI) ▲Magic(MAGIC)

Low ▲Cobak Token(CBK) ▲Taiko(TAIKO) ▲Omni Network(OMNI) ▲PolySwarm(NCT) ▲Bounce Token(AUCTION)

Neutral ▲Moca Network(MOCA) ▲RedStone(RED) ▲Decentraland(MANA) ▲Reserve Rights(RSR) ▲ApeCoin(APE)

High ▲Basic Attention Token(BAT) ▲Hyperrain(HYPER) ▲Sky Protocol(SKY) ▲Bancor(BNT) ▲USDS(USDS)

Very High ▲Kernel DAO(KERNEL) ▲Axelar(AXL) ▲MyShell(SHELL) ▲Balance(EPT) ▲Ethereum Name Service(ENS)

Ethereum Asset On-Chain Trends

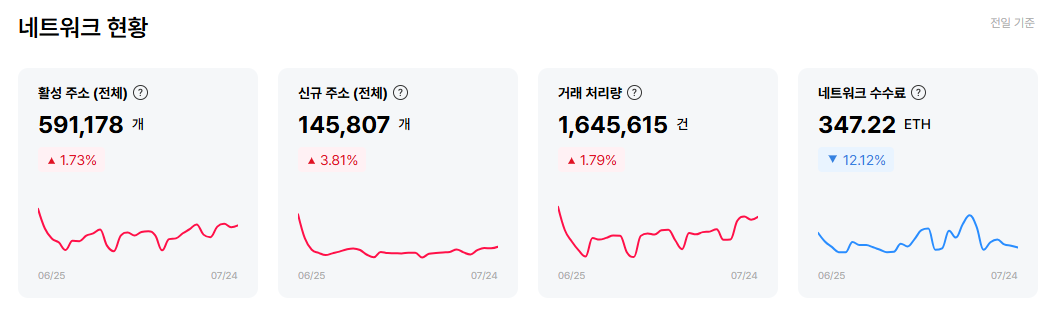

Most Deposits in Disclosed Exchange Wallets ▲Ethereum(ETH, 0.18 trillion won) ▲Pepe(PEPE, 311.4 billion won) ▲Ethereum Name Service(ENS, 217.8 billion won) ▲Newton Protocol(NEWT, 86.7 billion won) ▲Uniswap(UNI, 46.6 billion won)

Most Deposits in Top Ethereum Wallets ▲Tether(USDT, 171.14 billion won) ▲Aave(AAVE, 20.4 billion won) ▲The Graph(GRT, 13.5 billion won) ▲Beam(BEAM, 97.02 million won) ▲Blur(BLUR, 79.70 million won)

Largest Holdings in Top Ethereum Wallets ▲Ethereum(ETH, 15.566 trillion won) ▲Tether(USDT, 1.435 trillion won) ▲Shiba Inu(SHIB, 232 billion won) ▲USD Coin(USDC, 228 billion won) ▲Chainlink(LINK, 158 billion won)

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>