Galaxy Digital Deposits $433 Million in BTC to Exchanges

According to Arkham data, Galaxy Digital transferred 3,750 BTC ($433 million) to multiple centralized exchanges in the past 20 minutes. Subsequently, it transferred 1,500 BTC ($176 million) to 6 anonymous addresses within 10 minutes.

Galaxy Digital Adds Additional $330 Million BTC Deposit to Exchanges

LookOnChain reported that "Galaxy Digital deposited an additional 2,850 BTC ($330 million) to multiple centralized exchanges 11 minutes ago. Selling pressure continues." It is known that Galaxy Digital sold 10,000 BTC in the past 3 hours and withdrew $370 million USDT from exchanges.

Galaxy Digital Appears to Sell 10,000 BTC... Withdraws $370 Million USDT

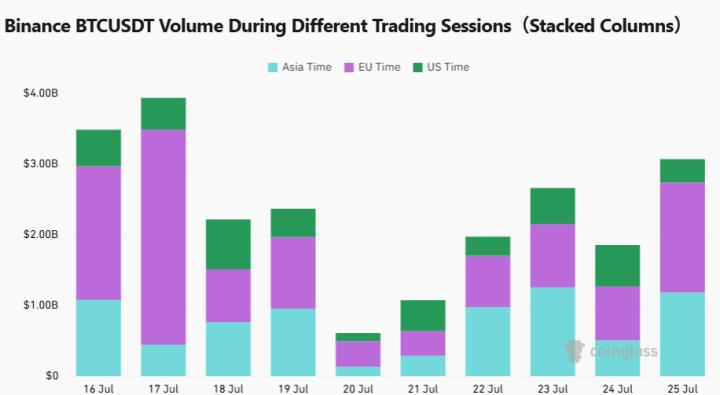

LookOnChain revealed via X that "Galaxy Digital sold 10,000 BTC ($1.02 billion) and withdrew a total of $370 million USDT from Binance, OKX, and Bybit over the past 3 hours. Meanwhile, Bitcoin price has dropped by more than 3% in the past 8 hours."

$102 Million in Futures Positions Liquidated in the Past Hour

Futures positions worth $102 million were forcibly liquidated on major exchanges in the past hour.

Over 24 hours, futures positions worth $667 million were forcibly liquidated.

BTC Spot ETF Sees Net Inflow... 312.1 Billion Won

According to Trader T, $226.66 million (312.1 billion won) was net inflow into US Bitcoin spot ETFs on the 24th (local time). This marks a return to net inflow after 4 trading days. Fidelity FBTC received $106.58 million, Vaneck HODL $46.36 million, BlackRock IBIT $32.53 million, and Bitwise BITB $29.83 million. No ETFs experienced net outflows that day.

ETH Spot ETF Continues 15th Consecutive Day of Net Inflow... 318.2 Billion Won

According to Trader T, $231.23 million (318.2 billion won) was net inflow into US Ethereum spot ETFs on the 24th (local time). This marks the 15th consecutive day of net inflow. Fidelity FETH received $210.06 million, Grayscale Mini ETH $25.34 million, while Grayscale ETHE saw $18.54 million in net outflows.

Hong Kong OSL Raises 4.126 Billion Won... Plans Stablecoin Issuance

Hong Kong digital asset company OSL Group announced it will raise 23.5 billion Hong Kong dollars (4.126 billion won). 30% of this will be used for expanding new businesses including stablecoin and payment services.

Nasdaq-listed Windtree Aims to Raise Up to $520 Million for BNB Investment

Nasdaq-listed biotech company Windtree (WINT) announced plans to raise up to $520 million for BNB investment. Windtree previously signed a $60 million stock purchase agreement with Build and Build and an additional $20 million stock purchase agreement.

EigenLabs Introduces Multi-Chain Validation... Enhancing AVS Scalability

The Block reported that EigenLayer (EIGEN) developer EigenLabs has introduced multi-chain validation. This change expands the operational method of Actively Validated Services (AVS), allowing deployment across multiple chains including Layer 2 networks, beyond the previous Ethereum Layer 1 limitation. This feature is available on Coinbase's Layer 2 network Base's Sepolia testnet and is planned for mainnet release.

KGeN Surpasses $30 Million in Annual Recurring Revenue... "Targeting $100 Million in Next 12 Months"

Decentralized identity and reputation verification protocol KGeN announced via official channels that its protocol ARR exceeded $30 million as of June 2025. The KGeN team explained that they achieved this milestone 32 months after project launch, with a goal of achieving over $100 million ARR in the next 12 months, considering top AI company growth trends. This would result in $1 million revenue per employee.

Smarter Web Company Purchases Additional 225 BTC

UK-based web development company Smarter Web Company (SWC) announced the purchase of an additional 225 BTC. They currently hold 1,825 BTC.

LineKong CEO: "All Companies Will Have Cryptocurrency Departments"

As cryptocurrency enters the mainstream, predictions suggest all companies will establish cryptocurrency asset management as a core department. LineKong's co-founder and CEO Wang Feng stated, "Bitcoin and Ethereum's integration into the mainstream is an inevitable trend. Stablecoins will deeply penetrate all companies and industries, and tokenized stocks will evolve beyond coin-stock combination to coins replacing stocks. In the future, regardless of listing status, all companies will form cryptocurrency departments, and cryptocurrency talent will become high-salary key competitive assets like AI talent."

SIGN Partners with US E-Sports Team NTMR... Participating in EWC 2025

Global token distribution platform and on-chain verification protocol SIGN announced the creation of 'Sign Esports' through collaboration with Florida-based E-sports team NTMR. Sign Esports will debut with a new orange-branded identity at the 2025 E-Sports World Cup (EWC). NTMR is a leading North American E-sports team, highly rated in major titles like Overwatch 2 and Rainbow Six Siege.

Spartan Group Deposits $3.06 Million SYRUP to Binance

Arkham reported that the estimated address of cryptocurrency venture capital firm Spartan Group unstaked and deposited 5 million SYRUP ($3.06 million) to Binance 10 minutes ago.

KB Kookmin Bank Applies for Dollar and Yen Stablecoin Trademarks

According to the Korea Economic News, KB Kookmin Bank, which was the first commercial bank to apply for a won stablecoin trademark, applied for dollar and yen-related stablecoin trademarks on the 22nd. These include 27 trademarks combining USD (dollar), JPY (yen) with their brand KB, and stablecoin indicators like ST, S, C, such as 'USDKB', 'JPYKB', 'USDST', 'USDC', 'JPYH', 'JPYONE'. A bank official stated, "This was primarily registered to secure foreign currency stablecoin trademark rights."

DeFi App Raises $4 Million Investment

According to The Block, DeFi trading platform DeFi.app has raised $4 million in investment. The investment was led by Mechanism Capital, with participation from DCF Capital Partners, Coinbase's former CTO Balaji Srinivasan, Compound Capital, and George Ball Group.

Analysis: "BTC Lightning Network to Process 5% of Stablecoin Trading Volume by 2028"

An analysis suggests that the Bitcoin Lightning Network could gradually increase its share of stablecoin trading volume in the next 2-3 years. Graham Krizek, CEO of Lightning payment provider Voltage, told Cointelegraph that as institutional and individual Layer 2 network adoption increases, the Lightning Network will process at least 5% of global stablecoin trading volume by 2028. Currently, major issuers like Tether (USDT) and Circle (USDC) have not fully entered Lightning, and stablecoin trading volume is nearly zero, but full-scale growth is expected to begin in the second half of this year.

Analysis: "BTC Temporary Adjustment... Maintaining Bullish Trend"

Crypto data analysis firm SwissBlock stated, "Although BTC broke through the lower box range and declined, it is merely a temporary adjustment due to fund circulation. The current BTC risk index is at 0, showing no overheating, and the technical structure remains intact. The overall trend is still bullish, and adjustments in the low-risk range can be seen as entry opportunities."

Binance Alpha Adds TREE

Binance Alpha announced the addition of TREE on July 29th. Binance Alpha is an on-chain trading platform within the Binance Wallet, focusing on listing early-stage coins. Alpha coins may be listed on Binance spot and perpetual futures in the future.

Bithumb Delists WOM and KWENTA

Bithumb announced the delisting of WOM Token and Kwenta on August 25th at 3 PM.

Binance Alpha Temporarily Suspends PUNDIAI Trading

Binance Alpha temporarily suspended trading of PundiAI (PUNDIAI) due to token contract swap support and will resume trading through a new contract at 4:30 PM Korean time today.

Upbit Suspends STX Deposits and Withdrawals

Upbit announced through its official website that it will suspend STX deposits and withdrawals from 12 PM on the 29th due to the Stacks (STX) hard fork.

Upbit Suspends TT and LTC Deposits and Withdrawals

Upbit announced through its official website that TT and LTC deposits and withdrawals will be temporarily suspended from 11 PM this month due to wallet system maintenance.

BTC Falls Below $116,000

According to Coinness market monitoring, BTC has fallen below $116,000. On the Binance USDT market, BTC is trading at $115,889.11.