The GENIUS Act provides clear advantages in expanding global accessibility to dollars through stablecoins. However, some restrictions open new paths for growth in other areas of the cryptocurrency industry. In particular, this act prohibits stablecoin issuers from paying interest to holders.

This restriction causes problems for institutions and advanced investors seeking returns. Fortunately, DeFi provides various mechanisms for generating income. As the GENIUS Act is implemented, the role of DeFi in the market could be strengthened.

GENIUS Act, Capital to DeFi?

The GENIUS Act, officially signed into law, is already seeing a spread of the stablecoin market worldwide.

Now the United States supports the use of these digital assets with a comprehensive framework that provides sufficient consumer protection and financial stability. Adoption is expected to surge.

Interestingly, the restrictions of this act, especially the prohibition on stablecoins providing returns, could stimulate activity in other areas of the cryptocurrency sector. Issuers hold reserves like government bonds to back stablecoins, but this interest cannot be passed on to holders.

The GENIUS Act isn't directly about DeFi — it regulates centralized stablecoins with full reserves offchain.

— Jake Chervinsky (@jchervinsky) July 18, 2025

But it is very good for DeFi — the more dollars and people there are onchain, the more need there will be for onchain finance of all kinds.

Payments are just a gateway.

This provision presents a notable challenge to institutions and advanced investors with fiduciary duties to seek returns on capital.

Since regulated stablecoins cannot provide passive income, such substantial institutional funds may turn to alternative routes for generating returns.

This scenario allows decentralized finance to become a practical solution for those seeking returns.

Shifting Direction of Return Seeking

For some of today's largest stablecoin issuers, the GENIUS Act's prohibition on interest payments does not have an impact.

"The largest stablecoins like USDT and USDC have never directly provided returns to holders. Therefore, there will be no substantial changes due to the GENIUS Act." – Julio Moreno, Research Head at CryptoQuant

However, the act prevents new entrants from doing so, protecting current offerings. This dynamic indirectly encourages investors to seek returns elsewhere.

"This could reallocate investor capital to decentralized platforms offering more transparent and potentially higher return opportunities. For example, lending protocols, liquidity pools, tokenized real-world assets, etc. Consequently, DeFi could become the preferred destination for return-seeking capital, especially when combined with clear regulatory guidelines." – Juan Pellicer, Research Head at Sentora

The market is already reflecting these changes. Investors are increasingly moving to DeFi versions of stablecoins. For instance, Aave's aUSDT or Ethena's sUSDe can generate returns within decentralized protocols through staking or lending.

Tokenized money market funds (MMF) launched by BlackRock or Franklin Templeton are also emerging as significant pathways for stablecoin returns.

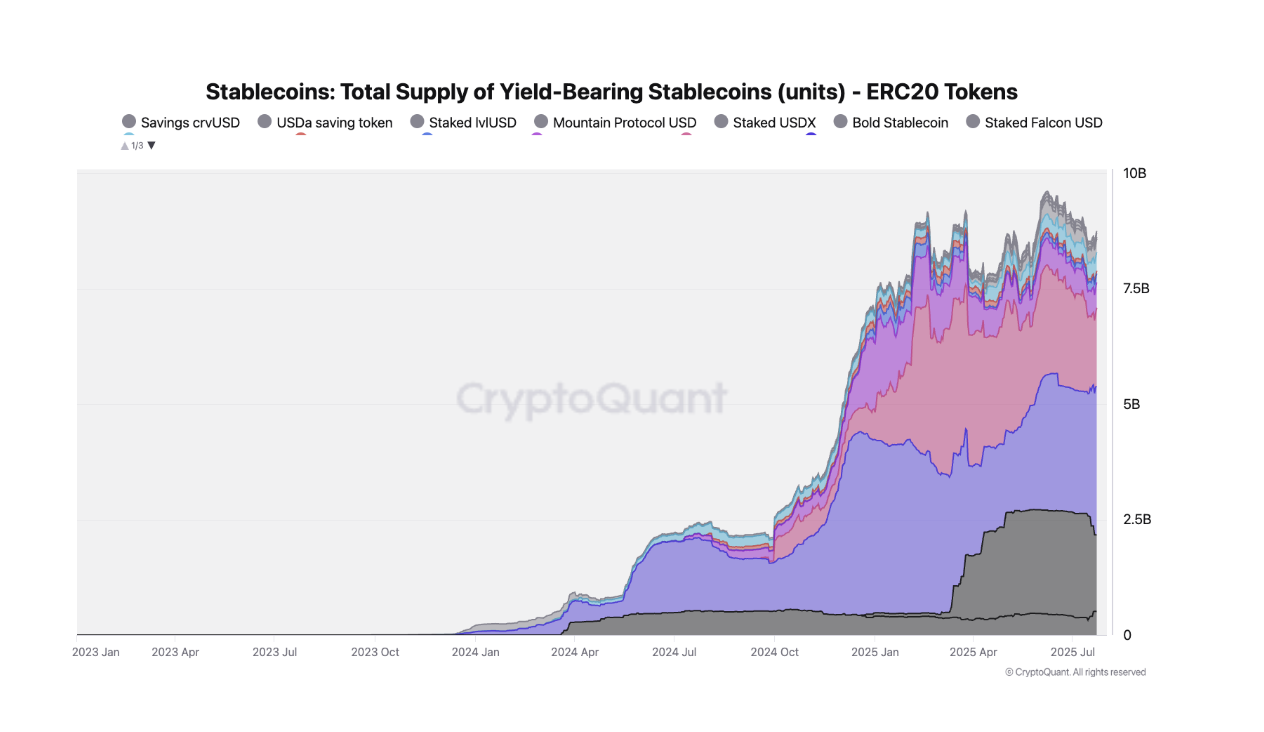

Moreno emphasized that these staked stablecoins and tokenized MMFs have grown significantly, with total market capitalization exceeding $10 billion.

Instead of eliminating yield demand for stable assets, the GENIUS Act relocates this to products other than stablecoins. However, this relocation has drawn attention to specific types of returns increasingly important to institutional investors.

Institutional Investors, DeFi Attraction

As institutional investors explore more paths to find returns in the post-GENIUS Act world, DeFi platforms offer attractive features that meet their requirements.

"DeFi platforms provide institutional investors programmable yields, global liquidity, and access to innovative financial products, backed by transparent smart contracts." – Pellicer "As the GENIUS Act lays the groundwork for regulatory clarity, institutions are increasingly attracted to DeFi's yield potential, especially when combined with robust risk management tools, on-chain audits, and compliance custody solutions."

This attraction focuses particularly on what Pellicer calls "real yields".

"They generate yields from actual economic activity, not token incentives," he explained.

The primary areas where these yield streams occur most are trading fees derived from decentralized exchange activities and interest from over-collateralized lending platforms. DeFi fundamentals have also emerged as another option providing non-traditional yield structures like on-chain insurance.

"These models offer more sustainable yields and clearer risk profiles that better align with institutional risk frameworks," Pellicer added.

However, not all experts agree on the direct impact of the new act on existing DeFi platforms.

Traditional Finance, Will It Compete with DeFi?

Eli Cohen, legal counsel at Centrifuge, suggested that while the GENIUS Act would prohibit stablecoin issuers from paying interest, stablecoin holders would not be prevented from earning returns.

"Only stablecoin issuers are blocked from providing returns, but banks and intermediaries can do so. The GENIUS Act will expand and not limit stablecoin opportunities," Cohen told BeInCrypto.

He also expressed a skeptical view that existing permissionless DeFi platforms would be the primary destination for institutional capital seeking returns. Instead, new products are more likely to emerge.

"I believe traditional financial institutions will create mirror-regulated platforms to compete with DeFi lending protocols like Aave and capture market share," he added.

However, the indirect benefits of the GENIUS Act will provide the most significant upside to DeFi and the broader cryptocurrency industry.

Banks as On-Ramps... A New Adoption Era

DeFi adoption after the GENIUS Act will thrive not because of investors seeking return opportunities, but due to the potential for massive new user inflow.

"This will occur because US retail banks like JPM Chase and Citi will issue stablecoins and provide incentives for depositors to use them. The number of US retail bank account holders is enormous, and drawing even a small portion of this market into the cryptocurrency space will be very significant," Cohen explained.

Beyond new users, Cohen also identified important political advantages. Strong US financial institutions actively participating in the cryptocurrency market as stablecoin issuers will contribute to promoting and expanding this market.

"This will make it very difficult for future US administrations to return to the openly hostile approach of the Biden/Gensler era," he added.

In this context, the future of DeFi and cryptocurrency looks bright.

Growth Certainty

Despite various perspectives on growth mechanisms, experts have a clear consensus that the GENIUS Act will bring substantial expansion to the cryptocurrency ecosystem.

Whether through "real returns" opportunities with greater institutional participation, the emergence of new bridges between traditional finance and DeFi, or massive new user inflow through bank-issued stablecoins, DeFi's future appears prepared for significant, and perhaps unexpected, expansion.