Puji Penguin (PENGU), a Solana-based meme coin, is the only top 10 Solana meme asset that maintained profits last week. However, recent data suggests the party is coming to an end.

This token rose 31% over 7 days but dropped about 11% in the last 24 hours. Meanwhile, exchange flows, whale behavior, and momentum indicators all point to a potential decline. So will the PENGU price undergo a larger correction? Or is this just a temporary adjustment before another rally?

Selling Pressure Remains

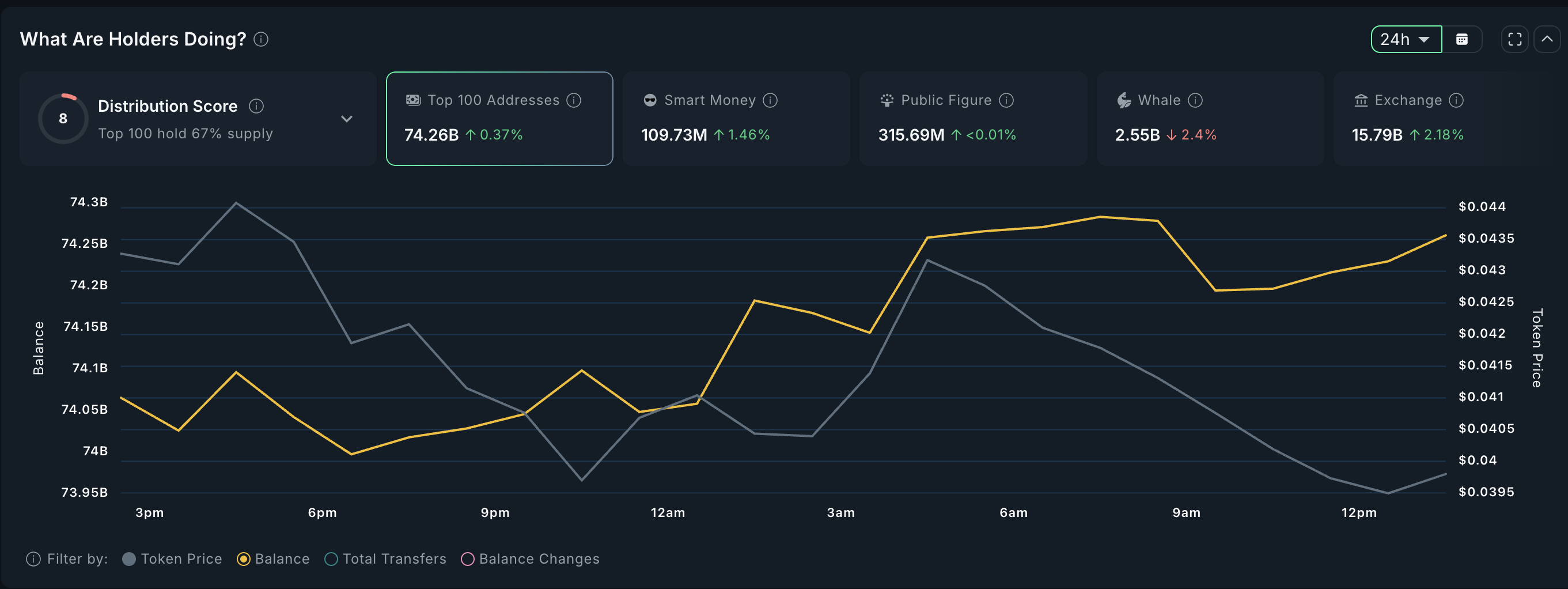

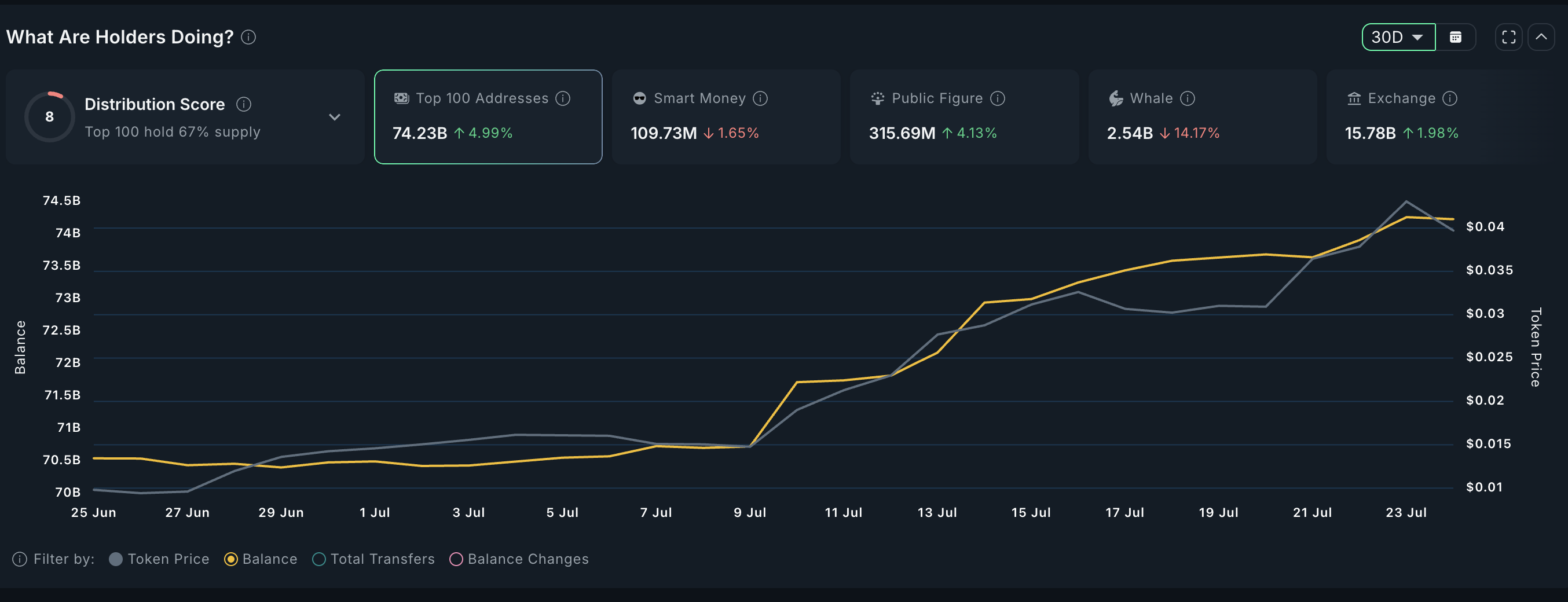

Whale activity continues to show weakness. Over the past 24 hours, whales reduced the circulating supply of PENGU by 2.4%. At the current price of $0.04, this represents approximately 152 million PENGU tokens, worth over $6 million. The selling rate has slowed compared to 30-day and 7-day trends, but the overall direction remains downward.

Token Technical Analysis and Market Update: Want more such token insights? Subscribe to editor Harshi Notariya's daily crypto newsletter here.

This indicates a trend continuing for several weeks. Over the past month, whales have sold more than 14% of their holdings. This pressure has clearly impacted the price and while it has eased, it has not reversed. And that's not all!

Exchange inflows increased by 2.18% in the last 24 hours, bringing total exchange-held PENGU to 15.79 billion. This means approximately 336 million tokens, worth about $1.34 million, moved to exchanges in a single day. Such a surge typically indicates increasing selling pressure and suggests traders are preparing to sell their holdings.

Chaikin Money Flow, Momentum Weakening

The Chaikin Money Flow (CMF), an indicator measuring accumulation and distribution, is showing a bearish divergence. While PENGU's price recorded higher highs earlier this month, the CMF is now forming consecutive lower highs. This pattern, appearing for the first time since May, indicates diminishing buying pressure while the price attempts to rise.

With the price already under pressure and exchange inflows increasing, it could move lower. The Chaikin Money Flow (CMF) is a volume-weighted indicator that tracks an asset's money flow to measure buying or selling pressure.

PENGU Price Precarious at $0.037

Technically, the PENGU price is just above a key support level of $0.037, which coincides with the 0.236 level of the Fibonacci retracement. This was drawn from the low of $0.0077 to the all-time high of $0.46. The $0.037 level has previously shown rebounds but if it fails, the next solid support is at $0.031, near the 0.382 Fibonacci level.

Buyers are trying to defend this zone, but increasing selling pressure and momentum loss suggest a tilt towards decline. If the $0.037 level is definitively broken, a drop to $0.031 becomes highly probable.

However, if the PENGU price rebounds and surpasses the recently formed all-time high, with CMF improving and exchange inflows decreasing, the bearish hypothesis will disappear.