Trump and Congress Pressure Federal Reserve, 10-Year Expected Inflation Rises

Bitcoin Maintains Stability Due to Lack of Small Investors

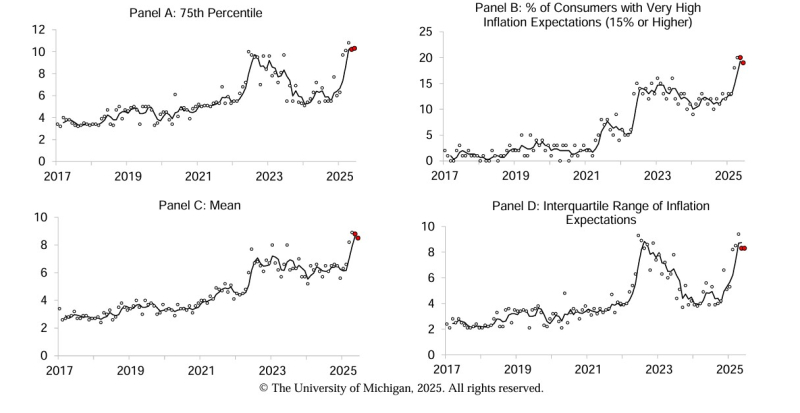

Recently, the 10-year long-term expected inflation in the United States has been recording a steep upward trend. This is considered an exceptional phenomenon, given the stable oil prices and the downward trend of inflation expectation indicators from the University of Michigan and the New York Federal Reserve. Market experts analyze that higher-than-expected tariff levels and pressure from former President Donald Trump and Congress on the Federal Reserve (Fed) are the main causes.

Despite this macroeconomic uncertainty, Bitcoin has shown only limited adjustments. According to the spot CVD (Cumulative Volume Delta) analysis, this is mainly due to the limited participation of small investors in the spot market. Early buyers are holding quantities secured at lower prices, resulting in minimal selling pressure from large investors.

Meanwhile, in the futures market, individual investors continue to engage in high-leverage trading. As a result, the current Bitcoin market is showing a pattern of only limited short-term adjustments to the level of clearing high-leverage positions in the futures market.

Experts are focusing on two scenarios. They predict that Bitcoin may experience one or two strong adjustments if the long position ratio in the futures market increases further or if small investors start entering the spot market, accompanied by a Kimchi Premium. In particular, concerns are raised that market volatility could expand further if inflation control fails in the second half of the year.

Choi Joo-hoon joohoon@blockstreet.co.kr