An individual retail investor suffered a loss of $6 million while attempting to front-run Binance's potential listing, which well illustrates the current state of the overheated cryptocurrency market.

Typically, listing and delisting announcements particularly impact prices on popular exchanges. Foresighted traders and investors take advantage of buying on rumors and selling on the event.

PUMP Investor Loses $6 Million…'I Should Have Just Sold'

According to blockchain analyst LookOnChain, an investor identified as "PUMP Top Fund 2" transferred 2 billion PUMP tokens worth $12.79 million to Binance exchange.

Like other investors, this investor expected a profitable exit after a potential spot listing. Listing announcements from exchanges like Binance and Coinbase have triggered sharp price increases for related coins.

However, immediately after the listing event, prices decline as early investors cash out for quick profits.

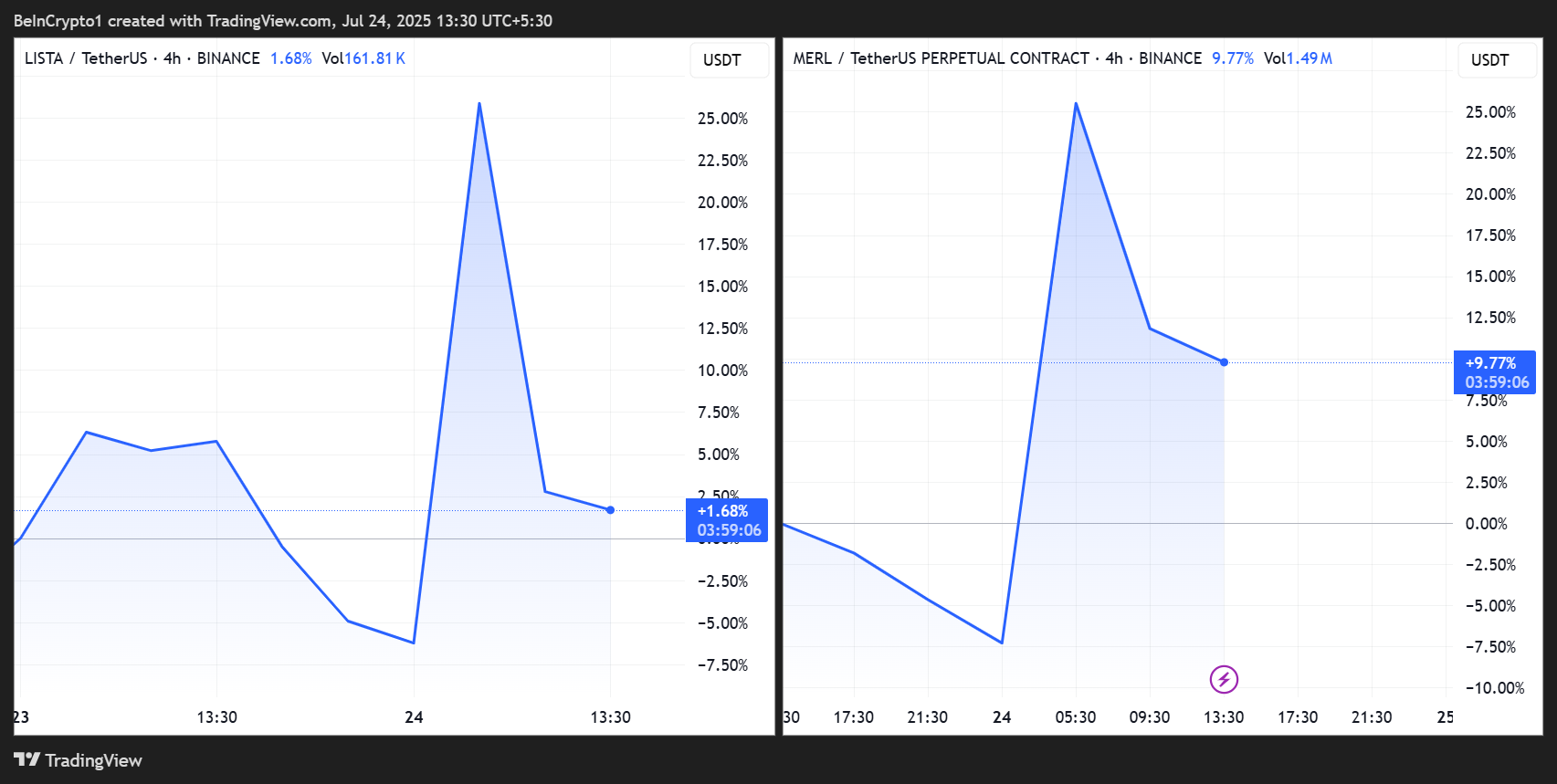

For example, Bithumb's listing announcement promoted LISTA and MERL. But an immediate significant price drop followed.

However, PUMP Top Fund 2's situation reversed because Binance did not list the token. When the investor sent funds back to Bybit exchange, the price had nearly halved.

This mistake cost the investor approximately $5.86 million in unrealized profits. After receiving 2 billion PUMP tokens from Binance, the investor immediately moved assets to Bybit, where PUMP's price dropped from $0.0064 to $0.0035 eight days earlier.

"This mistake cost him a major selling opportunity, and selling PUMP today could have resulted in about $6 million in losses," LookOnChain wrote.

This incident highlights how the interest cycle for meme coins is accelerating and collapsing faster than ever. It also reflects the complexity of Binance's listing procedures. The recent listing of the lesser-known NEIRO meme coin led to a price decline of the more well-known NEIROETH.

Oversubscription Due to High Interest…Unstable Launch

Earlier this year, Binance Wallet's TGE recorded a 247-fold oversubscription for PUMP, indicating enormous speculative demand. However, BeInCrypto noted that the interest might have been more driven by the meme coin frenzy and the platform's brand.

PUMP functions as the governance token for PumpBTC, but critics argue that its tokenomics and use cases do not demonstrate sufficient long-term value to justify sustained demand.

$PUMP has been going through peak fud

— ߷DK64Trades߷ (@DK64Trades) July 24, 2025

*typically when i like to bid*

Everyone who's wanted out should be long out by now

Fundamentally speaking with ~ 2 Billion dollars in cash this would technically be presented as a buying opportunity if no insider manipulation shorting is… pic.twitter.com/d14tyfdJfc

PUMP's 60% drop within 24 hours of launch is one of the most dramatic declines among Binance-related TGEs this year.

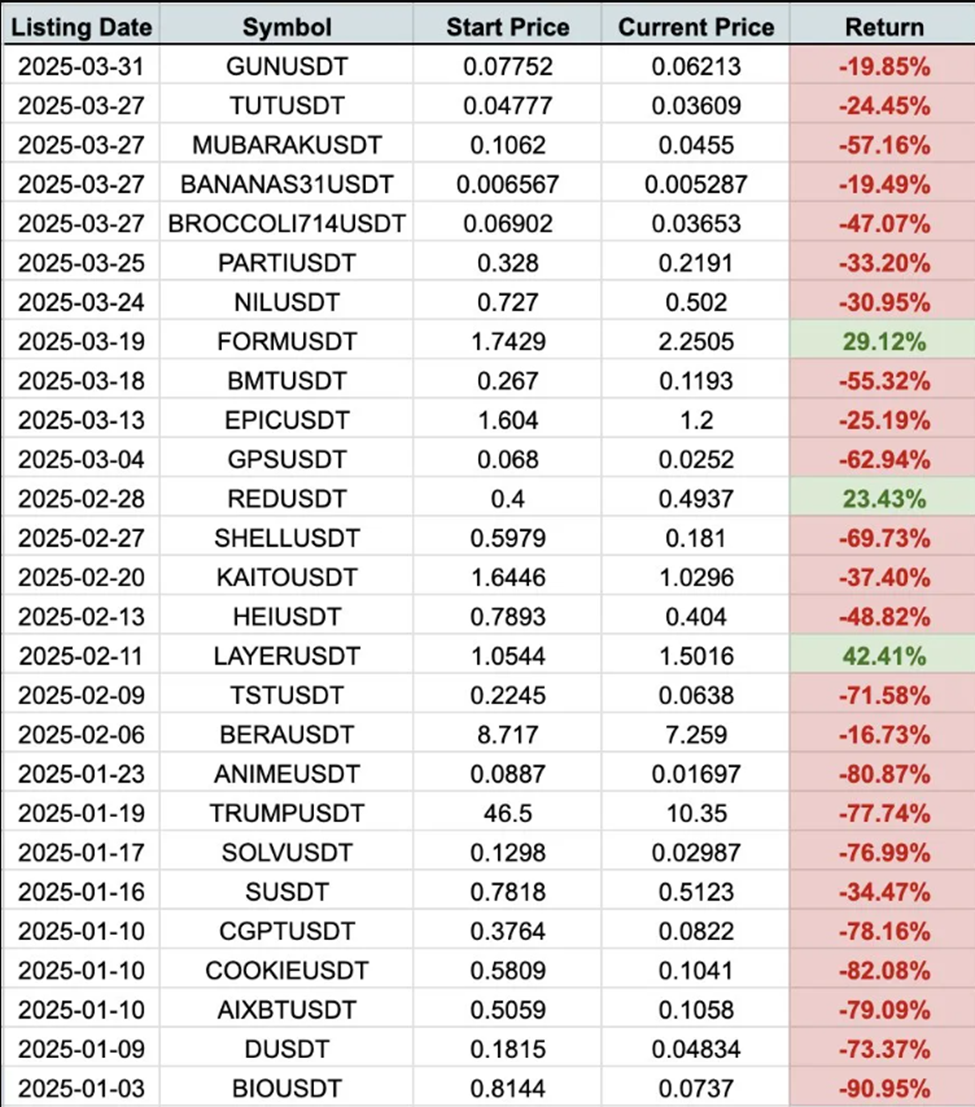

Meanwhile, Binance listings have historically been market-moving events, often triggering short-term price surges. However, recent data paints a different picture. Many tokens listed on Binance have experienced sharp declines post-listing.

This suggests that support from major exchanges does not always guarantee price performance or investor confidence.

In the case of PUMP, the expectation of a Binance listing prompted individual retail investors to take early positions, but when the listing did not materialize, the consequences were swift.