Research firm Artemis reports that while Bitcoin has successfully overcome decades of suspicion and gradually established its title of "digital gold", Ethereum (ETH) is heading in another direction, becoming a scarce, producible and trustworthy reserve asset in the on-chain economy. With the embrace of traditional institutions and the rise of reserve companies, the value of ETH is no longer limited to gas fees, but an indispensable energy source for on-chain finance.

Table of Contents

ToggleProgrammable Gold: ETH’s Monetary Policy and Deflationary Potential

The biggest criticism of ETH has always been that it does not have a fixed supply cap like Bitcoin. However, ETH adopts a more flexible inflation model: "dynamically adjusting the issuance amount based on the staked amount and destroying transaction fees through EIP-1559" to achieve a substantial net inflation reduction.

According to the inflation model of ETH staking, even if 100% of ETH is staked in the future, the annual inflation limit is still only about 1.52%, and will decrease to 0.89% year by year over time. At the same time, ETH's actual inflation has turned negative many times, and its supply curve is even better than that of gold.

For an asset that plays a global clearing role, such inflation control capabilities make ETH an extremely attractive option to combat the depreciation of fiat currencies.

Financial giants participate in blockchain: transparency and composability become the basis of institutional trust

From JPMorgan launching the on-chain deposit token JPMD to BlackRock launching a tokenized U.S. bond fund on Ethereum, global financial institutions are accelerating the transfer of assets to the chain. Companies such as Robinhood and Coinbase have also deployed their crypto businesses on Ethereum or its L2, forming a clearing base layer with ETH as the underlying technology.

This trend stems from the settlement efficiency, transparency and composability of blockchain. Compared with traditional finance, which relies on several days of clearing and intermediary reconciliation, Ethereum can complete the task in seconds and provide a traceable and verifiable transparent annotation mechanism for physical assets.

Today, institutions are starting to buy and stake ETH, not only to earn returns, but also to ensure the security and settlement reliability of the network they rely on.

Staking Economy: How ETH Binds Security and Price Increase

As of June 2025, more than 35.53 million ETH have been staked, showing an annual high correlation of more than 88% with the total amount of assets on the chain (stablecoins and RWA). In other words: "The more assets are on the chain, the higher the security and demand of ETH will be, and the higher the stake will be."

More importantly, ETH staking itself will remove liquidity and create actual supply compression. Research shows that the annual correlation between ETH price and staking amount is 90.9%. This makes ETH's security model not only a technical level, but also a real financial driving force to push up the price of the currency.

As the SEC confirmed in May 2025 that "self-pledge or custodial pledge" does not constitute securities behavior, more and more institutions have begun to apply for staking functions for their Ethereum spot ETFs, taking into account security, returns and regulatory compliance.

Unlike BTC, why is ETH a reserve asset for the on-chain economy?

Unlike "non-productive assets" such as gold or Bitcoin, ETH is a "productive reserve asset" that can actively participate in economic activities, create income and liquidity. The uses of ETH on Ethereum include:

As a pledge and re-pledge asset (such as EigenLayer)

Collateral for decentralized lending (such as Maker, Aave)

AMM liquidity core (such as Uniswap, Curve)

As the native gas fee token for most L2

As a cross-chain circulating asset (such as Solana, Cosmos)

This composability and high applicability make ETH not only a settlement tool for the on-chain economic foundation, but also an indispensable energy unit. As more protocols and assets are developed or issued on Ethereum, the network effect will become stronger.

The wave of ETH reserve companies: the flourishing of micro-strategies in the Ethereum world

In May of this year, Sharplink Gaming ($SBET) became the first listed company to announce that it would include ETH in its corporate reserves, with Ethereum founder Joseph Lubin as a director. This " ETH reserve company " operation is exactly the same as the scene in 2020 where Bitcoin and MicroStrategy interacted to push up prices.

As of now, more than 2 million ETH are held by public enterprises, reflecting the trust foundation of ETH as an enterprise-level asset. This has also led to the ETH price outperforming BTC in recent weeks.

A critical moment for Ethereum: Let narrative guide price

Today, ETH should no longer be seen as a simple gas token, but a "digital reserve asset" with scarcity, manufacturability, institutional trust, and institutional acceptance. If Bitcoin is decentralized digital gold, then ETH is more like " dollars + oil " in the on-chain financial system, representing the value of both currency and energy, and can drive the operation of the entire on-chain economy:

Just as Bitcoin overcame early skepticism to win public recognition as “digital gold,” ETH is also building its own unique identity—not by mimicking Bitcoin’s narrative, but by maturing into a more general economic asset.

Risk Warning

Cryptocurrency investment carries a high degree of risk. Its price may fluctuate drastically and you may lose all your capital. Please assess the risk carefully.

Ethereum has risen 150% since its April low. Matt Hougan, founder of ETF issuer Bitwise, pointed out that the demand from exchange-traded commodities (ETFs) and Ethereum reserve strategy companies is too huge, resulting in a serious imbalance between supply and demand. He believes that this situation will continue in the future and ETH is still bullish in the future!

Table of Contents

ToggleFunds continue to flow in, and the imbalance between supply and demand causes ETH to rise sharply

Matt Hougan explains the recent rise in ETH prices.

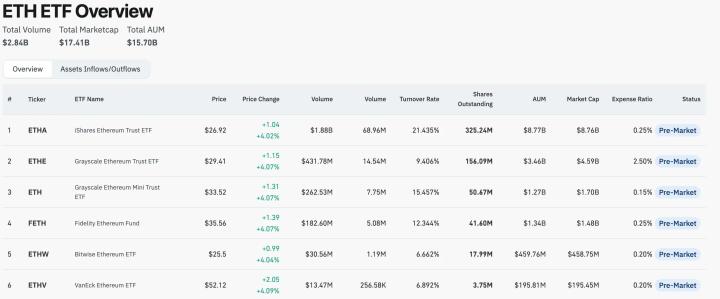

Since mid-May, funds have flowed into Ethereum ETFs, with more than $5 billion in inflows, and Ethereum reserve strategy companies such as Bitmine and SharpLink have also entered the market to buy coins. According to Bitwise estimates, during this period, ETFs and Ethereum reserve strategy companies bought a total of 2.83 million Ethereum, worth more than $10 billion, which is 32 times the increase in ETH supply during the same period. No wonder Ethereum's increase is so amazing!

Ethereum Reserve Strategy Company will accelerate the purchase of ETH

And Hougan predicts that this situation will continue in the future!

Ethereum’s market cap is currently 20% of Bitcoin’s, but Ethereum ETFs are still less than 12% of the size of Bitcoin ETFs. As demand for tokenization and stablecoins grows (primarily based on Ethereum), Hougan believes this will change, with billions of dollars flowing into Ethereum ETFs in the coming months.

Meanwhile, all signs point to the “Ethereum Reserve Strategy” trend accelerating. The key to the growth of a cryptocurrency fund manager is whether its public shares trade at a higher price than the value of the crypto assets it holds, and this is currently the case for ETH fund managers. For example, BMNR and SBET trade at almost double the value of their ETH holdings. As long as this continues, it’s a safe bet that Wall Street firms will invest more money in buying ETH.

ETFs and Ethereum Reserve Strategy Firms Will Buy More Than 5 Million ETH by 2025

Looking ahead, Bitwise predicts that ETFs and Ethereum reserve strategy companies will purchase $20 billion worth of ETH next year, which is equivalent to 5.33 million ETH at current prices. During the same period, the Ethereum network will produce about 800,000 ETH. This is equivalent to demand being about 7 times the supply.

ETH is certainly different from BTC. Its price is not determined purely by supply and demand, nor does it have a long-term issuance cap like BTC. But Hougan doesn’t think this matters at the moment.

In the short term, the price of all commodities is determined by supply and demand. Currently, the demand for ETH is far greater than the new supply.

Risk Warning

Cryptocurrency investment carries a high degree of risk. Its price may fluctuate drastically and you may lose all your capital. Please assess the risk carefully.

Many people think that Musk is just a willful billionaire who spends money recklessly to start companies. However, The Wolf of Wall Street believes that behind every company and crazy adventure Musk has started, he is actually preparing to realize the most daring colonization plan in human history: building an infrastructure for human migration to Mars. Musk really wants to send humans to live on Mars. His friend Cathie Wood has mentioned this many times in interviews. This is Musk's ultimate dream. This article is excerpted from Jordan Belfort's e-newsletter. He is the prototype of the character played by Leonardo DiCaprio in the movie "The Wolf of Wall Street". He is now a writer and educator. After Musk and Trump fell out, there was a lot of bad news, but the most greedy representative of Wall Street explained why Musk is serious. He revealed in detail that Musk's seemingly scattered and random company openings are actually a set of meticulous strategic plans. Even entrepreneurs can use Musk's strategic ambitions as an example to emulate. The following is a compilation and report.

Table of Contents

ToggleTesla: The transportation and energy storage lifeline for Mars

On Mars, where there are no internal combustion engines and energy is extremely scarce, Tesla plays a core role in transportation and energy. In addition to electric vehicles, Tesla's battery technology and energy storage system are what really pave the way for Mars. The sunlight on Mars is only 43% of that on Earth, and there may be sandstorms that last for months. For this reason, Tesla is building Megapack energy storage equipment that can cope with extreme environments to power the entire colonial society.

The Boring Company: Building an underground city on Mars for humans

The surface of Mars is not habitable, the atmosphere is thin, and it is bombarded with deadly radiation all year round. It is impossible for humans to live on the surface of such a planet. Musk's Boring Company is not developing a subway on Earth, but an underground city on Mars.

The Boring Company is not just digging holes in Las Vegas and Los Angeles. It is accelerating the improvement of its technology for digging and building underground cities. The underground tunnels connecting the two major cities will become a reference facility for building underground cities on Mars.

SpaceX: The only option to send humans to Mars

To colonize Mars, you must first be able to get there. SpaceX is currently the only company that has reusable rockets that can be produced quickly. This is not just a transportation issue, but the key to establishing a direct route from Earth to Mars.

When you combine SpaceX, Tesla and The Boring Company, a complete "trinity" transportation system emerges, with electric cars moving on the surface, tunnels underground, and rockets connecting the stars.

Tesla robots: the first inhabitants of Mars

Sending 5 million people to Mars is too expensive and too dangerous, but sending millions of robots is feasible. Musk built robots to test operations in the harsh environment of Mars without the need for food, oxygen or shelter. From building habitats, mining resources to building infrastructure, these humanoid robots are the outposts on Mars.

Energy Blueprint for Mars: Tesla Energy / SolarCity

Mars has no power grid, no coal-fired or nuclear power facilities, but there are large tracts of uninhabited land. Solar City and Tesla Energy's solar panels and energy storage systems will be most effective in such an environment. Here, energy supply is no longer at the city level, but at the "planetary level".

xAI: The Central Nervous System of Mars

You can’t manage an entire Martian colony the same way you manage a city. The real purpose of xAI is not a search engine or a chatbot, but an AI system that can coordinate resources and tasks across the entire planet. It will handle remote work, robotic force management, life support, supply chain, and ultimately Martian landforms.

Neuralink: A backup plan for human consciousness

When colonizing Mars becomes a gamble, human consciousness also needs to be backed up. The ultimate goal of Neuralink's brain-computer interface technology is to allow human consciousness to be digitally stored and transferred. Even if colonization fails, Musk still hopes that human intelligence can continue.

Putting all this together, what Musk is building is not seven unrelated companies, but a vertically integrated system on a planetary scale:

- SpaceX puts humans on Mars

- Tesla robots build a base on Mars

- The Boring Company builds underground cities

- Tesla Energy provides energy

- Tesla is responsible for transportation

- xAI Operations Command Center

- Neuralink preserves human consciousness

Learning how to start a business from the Mars project: inspiration for entrepreneurs on Earth

Jordan Belfort concluded at the end of the newsletter that Musk's entrepreneurial thinking is not a science fiction movie, but a profound inspiration for entrepreneurs. Musk not only started a company, but also built a mutually supportive ecosystem, including the following key points:

- Solve future problems: Instead of targeting the current market, plan ahead for challenges in the next 20 years.

- Make limitations your advantage: The harsh environment of Mars is where innovation comes from.

- Extreme testing drives product evolution: Technology designed for Mars will be invincible on Earth.

- Control core technologies and avoid platform dependence: From rockets to chips, every key technology must be mastered in our own hands.

- Side jobs drive main business: Every "seemingly distracting" project is actually paving the way for the main task.

- Build backup routes: Even if one route fails, there are other ways to reach your destination.

Write your "Mission to Mars"

Every entrepreneur and start-up can write down your "Mars Mission", a seemingly impossible ultimate goal, and then start building the technology and resources you can build today. "Ordinary companies compete for the market, and great companies create the market." Musk's dream is not only to migrate to Mars, but also an exercise to stimulate human potential.

Risk Warning

Cryptocurrency investment carries a high degree of risk. Its price may fluctuate drastically and you may lose all your capital. Please assess the risk carefully.