Spot Market Top Trading Pairs Analysis: MEME Coin PENGU Surges 19%... SPK Draws Attention with 72% Rise

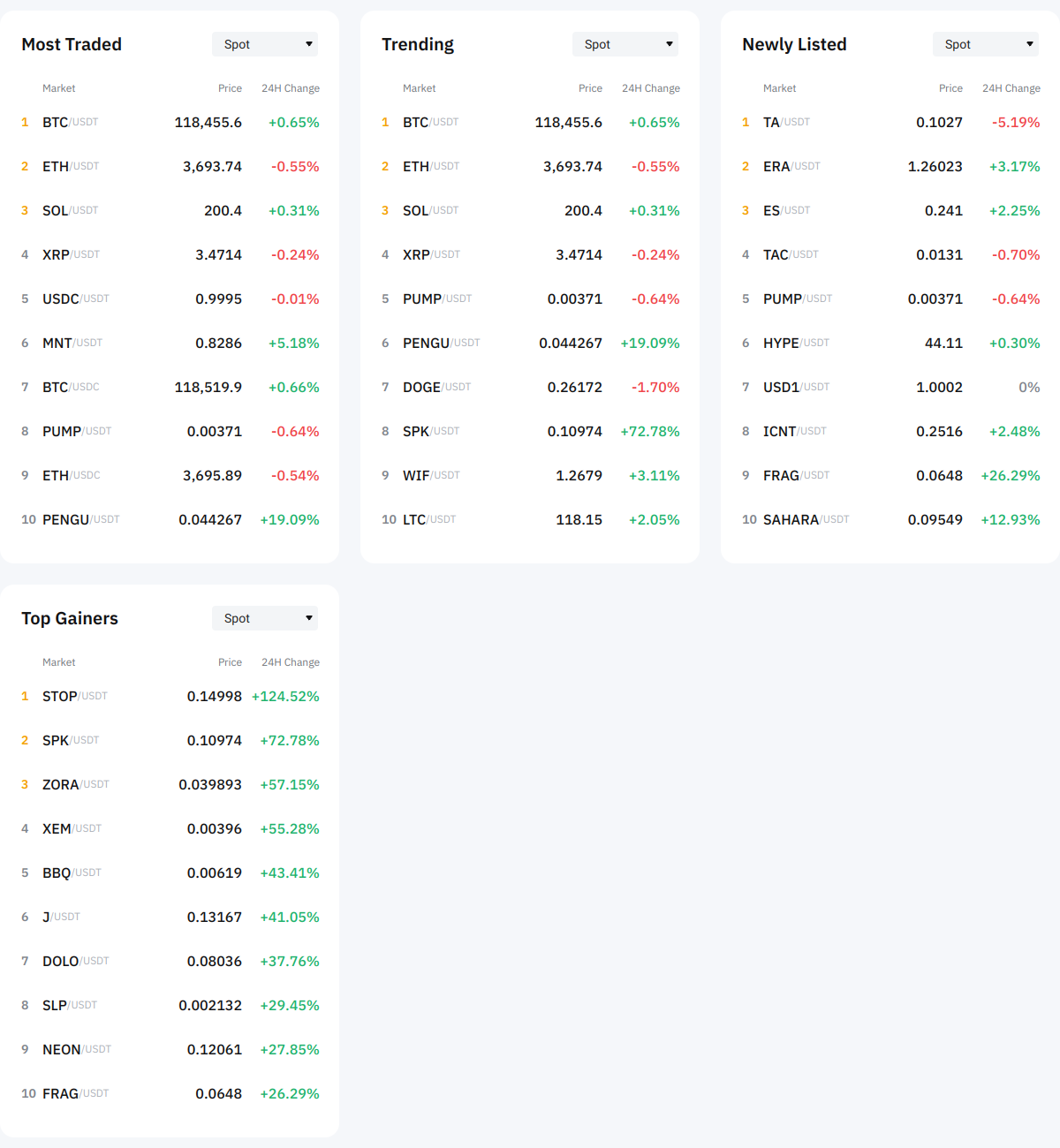

According to Bybit, today's spot market was characterized by altcoin strength. Particularly, the MEME token PENGU (PENGU/USDT) rose 19.09% in 24 hours, trading at $0.044267 and attracting investor attention. Additionally, altcoin SPK (SPK/USDT) led a short-term rally by surging 72.78% in a day. SPK is interpreted as experiencing significant speculative demand based on its low unit price and liquidity.

Among major coins, Bitcoin (BTC/USDT) rose 0.65% around $118,400, and Solana (SOL/USDT) also showed a stable trend with a slight 0.31% increase. In contrast, Ethereum (ETH/USDT) declined 0.55% to $3,693.74, recording a limited short-term adjustment, while XRP also dropped 0.24% to $3.4714.

The mixed performance of MEME coins was evident with Doge (DOGE/USDT) declining 1.70%, showing selling pressure in some tokens. Simultaneously, PUMP (PUMP/USDT) dropped 0.64%, while newly listed coins SAHARA (SAHARA/USDT) rose 12.93% and FRAG (FRAG/USDT) surged 26.29%, reflecting high volatility across altcoins.

Price Trend Distribution Analysis: 245 Tokens Rise... Maintaining Strength with Over Half Declining

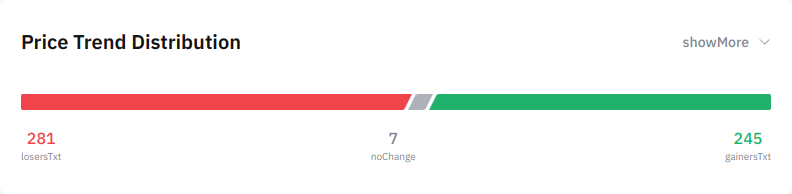

While the overall market showed weak strength, the high proportion of declining tokens suggests a potential correction phase. Out of 533 tokens, 245 rose, while 281 declined, with more than half recording a downward trend. Only 7 tokens remained unchanged.

Examining the distribution of tokens in profit zones, most tokens were located within a 0-10% price range, indicating predominantly short-term trading seeking realizable gains. Tokens like SPK and FRAG, which rose over 20%, were exceptional cases reflecting the market's speculative energy. Conversely, declining tokens often showed drops over -5%, warning of persistent risk factors in the altcoin market.

Overall, while the market maintains balance amid short-term weak and strong trends, the predominance of declining tokens suggests caution regarding the sustainability of upward momentum.

Trending Sector Analysis: NFT and Gaming Sectors Show Strength... SLP Rises 29%

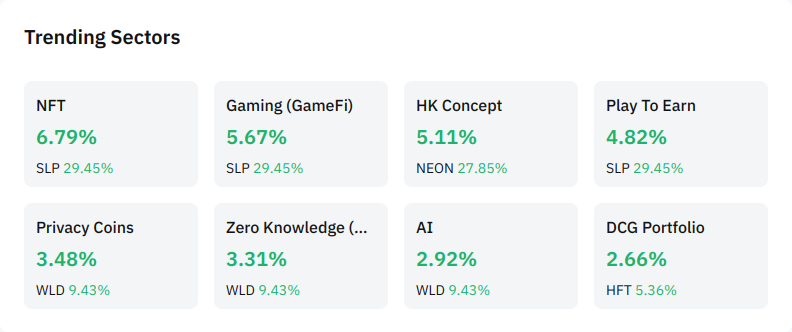

Sector-wise trends were led by NFT and gaming-related themes. The NFT sector averaged a 6.79% increase, with its representative token Smooth Love Potion (SLP) surging 29.45% and emerging as the top performer in both NFT and GameFi sectors. SLP demonstrated a technical recovery by simultaneously contributing to rises in NFT, Gaming, and P2E sectors.

The GameFi sector also rose an average of 5.67%, showing strength comparable to NFT, with SLP driving the sector's growth. The P2E sector increased by an average of 4.82%, with SLP's contribution being decisive.

Distinct upward trends were also seen in Hong Kong Concept stocks. The sector averaged a 5.11% rise, with NEON rising 27.85% and drawing attention. This reflects the recent trend of capital inflow into region-based theme stocks, coinciding with changes in digital asset regulatory environments in the Asian market.

Privacy coins, Zero Knowledge, and AI-related sectors each recorded around 3% increases. Worldcoin (WLD) consistently showed the highest rise at 9.43%, suggesting continued interest in technology-based tokens. The DCG portfolio sector rose a relatively modest 2.66% centered on HFT.

Today's market data indicates a short-term strong buying trend centered on NFT and GameFi legacy sub-sectors, showing continued capital circulation towards speculative and growth-story tokens. The market is driven by thematic sectors, necessitating a review of short-term risk factors from a structural perspective.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>