Pepe (PEPE) price has been showing new strength, rising almost 57% last month.

Although the market cooled down in the past 24 hours, PEPE remains one of the few tokens close to major technical breakthrough levels. Despite the recent rally, the meme coin is still trading more than 51% below its all-time high, suggesting potential for further rise if market momentum is maintained.

Large Exchange Outflow... Holder Confidence Remains High

Nearly 17.9 trillion PEPE tokens have been withdrawn from exchanges since July 16th, reflecting an outflow pattern that has continued for a week. This movement indicates that holders are moving tokens to personal wallets, which is interpreted as a positive signal that reduces short-term selling pressure.

Token Technical Analysis and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

Interestingly, token outflow continues even as PEPE price surged over 12% during the same period, which may suggest selling is not a priority at the moment.

Exchange outflows are a useful indicator that measures the net movement of tokens on trading platforms. More tokens going out generally means fewer traders are preparing to sell.

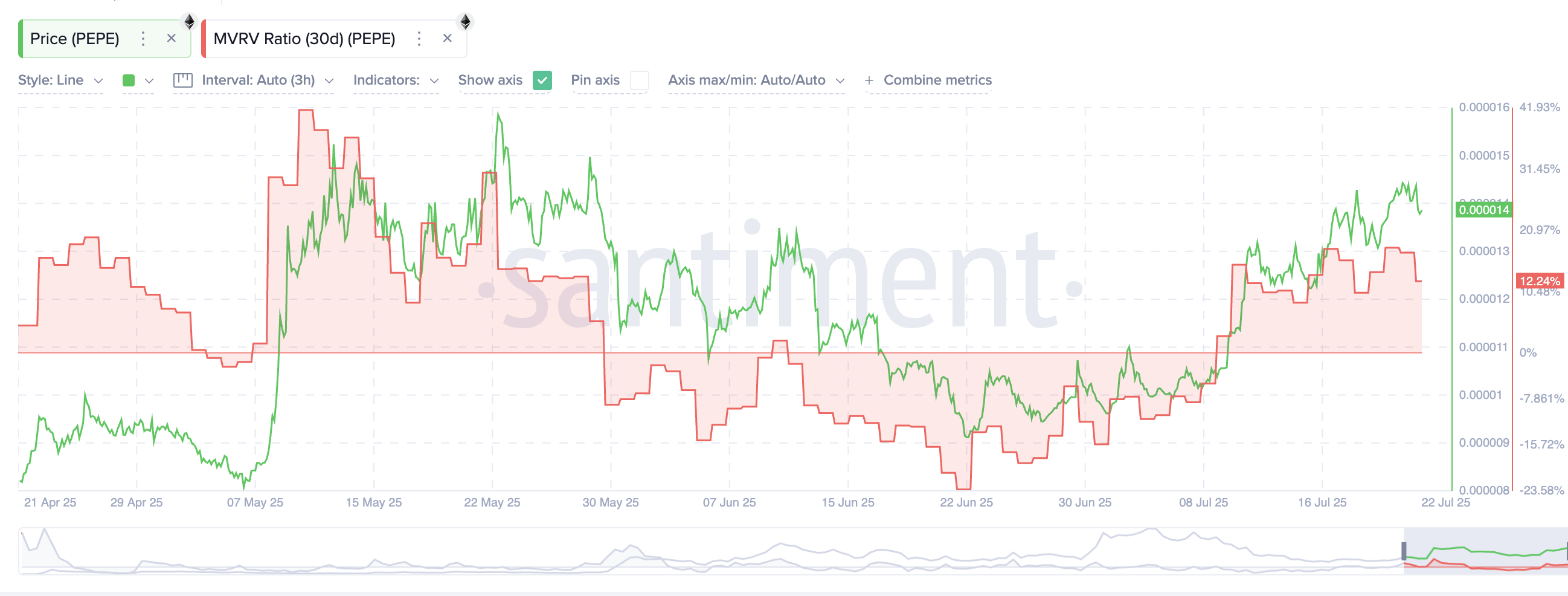

MVRV Data Suggests Low Selling Risk Despite Recent Surge

PEPE's 30-day Market Value to Realized Value (MVRV) ratio has entered positive territory but remains modest at +12.24%. Historically, when this indicator exceeds 20-30%, short-term holders begin selling. The current level leaves room for further increase.

This observation aligns with aggressive exchange outflows despite positive price movements. The combination of these two indicators suggests better returns can be expected from PEPE.

The MVRV ratio compares the price at which tokens were last moved with their current value. A low but positive MVRV suggests holders are seeing slight profits but not enough to trigger massive selling. Combined with continuous outflows, this supports the potential for PEPE's recent price strength to continue.

PEPE Price Near Wedge Breakthrough, But...

PEPE is currently trading at the upper boundary of a wedge pattern, often associated with bullish breakthrough settings. Final confirmation depends on whether PEPE can close above the $0.00001497 level, which coincides with the 0.382 Fibonacci extension.

While a breakthrough could be a trading signal for many, a clear movement above the key resistance level of $0.00001497 could serve as an additional verification layer. If this trend-based Fibonacci resistance level is breached, PEPE price could potentially move to $0.000017 or higher.

However, if PEPE fails to maintain momentum and falls below $0.00001200, this could signal the start of a broader correction and likely invalidate the current bullish setup.