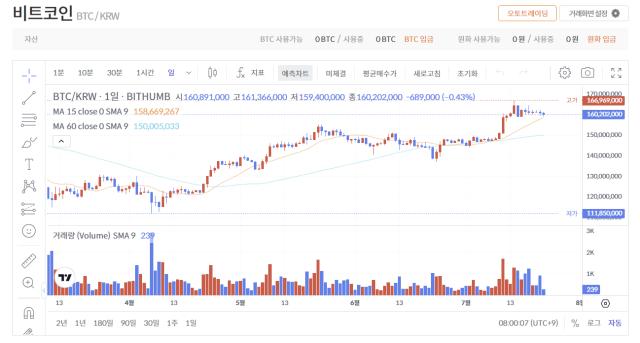

Bitcoin (BTC) is experiencing selling pressure near $120,000 (approximately 166.8 million won). However, it has not fallen below $115,000 (approximately 160 million won), which shows that buying sentiment is still dominant. Despite minor declines in recent days, buyers continue to steadily accumulate at low prices, supporting market sentiment.

After 12 consecutive days of net inflows into spot Bitcoin ETFs, a small net outflow of $13.135 million (approximately 182.5 billion won) occurred early this week. The cryptocurrency analysis platform SoSoValue revealed that funds flowing into spot Bitcoin ETFs over the past 12 days amounted to approximately $6.6 billion (approximately 9.174 trillion won). This suggests that investors are maintaining expectations for further price increases rather than realizing immediate profits.

Along with ETF supply and demand trends, strong buying pressure is recurring in some major altcoins, and expectations for an 'altcoin season' are emerging in the market. Particularly, the fact that major altcoins continue to rise despite Bitcoin's high point resistance shows that investment sentiment in the cryptocurrency market is not limited to Bitcoin.

Overall, as Bitcoin maintains its support, signals are being detected that market expansion could be fully activated. As investors focus on medium to long-term trends rather than short-term prices, future capital flows and policy variables are expected to more clearly define market direction.

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>