The fourth week of July marks a record moment when the total cryptocurrency market capitalization reaches 4 trillion USD. The altcoin market capitalization is also on track to reclaim its All-Time-High (ATH).

In this context, some altcoins favored by short-term traders using large leverage may face significant liquidations.

1. XRP

According to Coinglass, XRP's Open Interest – the total value of open positions in the derivatives market – reached an All-Time-High of 10.9 billion USD in July.

Notably, the Funding Rate has turned positive and reached its highest level since the beginning of the year. A positive Funding Rate occurs when futures prices exceed spot prices. This reflects strong market optimism, with most traders expecting prices to rise and opening buy positions.

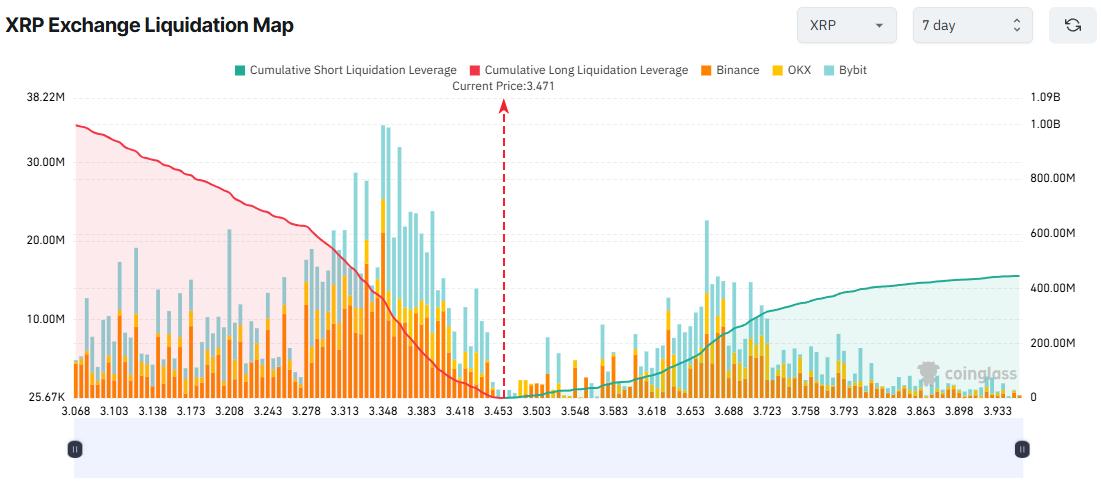

This has caused XRP's liquidation map to become unbalanced between buy and sell positions.

XRP Exchange Liquidation Map. Source: Coinglass

XRP Exchange Liquidation Map. Source: CoinglassAccording to the 7-day liquidation map, the total accumulated liquidation for buy positions far exceeds sell positions. If XRP drops to 3 USD this week, buy liquidations could reach nearly 1 billion USD.

This concern is well-founded. BeInCrypto recently reported warning signs of a potential short-term correction for XRP, including the decline of new investors.

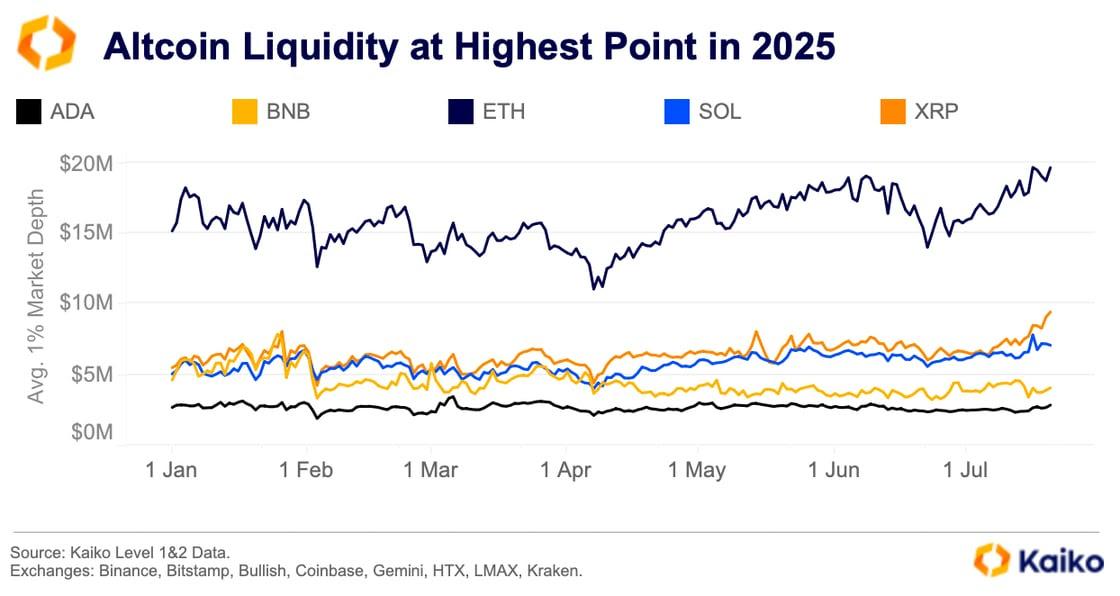

However, the latest report from Kaiko shows that XRP's 1% market depth has reached a new yearly high of nearly 10 million USD in the spot market. This places it above SOL, BNB, and ADA, second only to ETH.

Altcoin Liquidity at Highest Point in 2025. Source: Kaiko

Altcoin Liquidity at Highest Point in 2025. Source: KaikoThis increased market depth and liquidity suggest that XRP could recover quickly if the price drops. However, rapid and unexpected price fluctuations could put both derivative buy and sell traders at significant risk.

2. DOGE

DOGE has attracted high expectations from investors in July, especially with Bit Origin planning to raise 500 million USD to establish a Dogecoin Treasury. Additionally, some indicators suggest the potential return of a meme coin season along with the ongoing altcoin season.

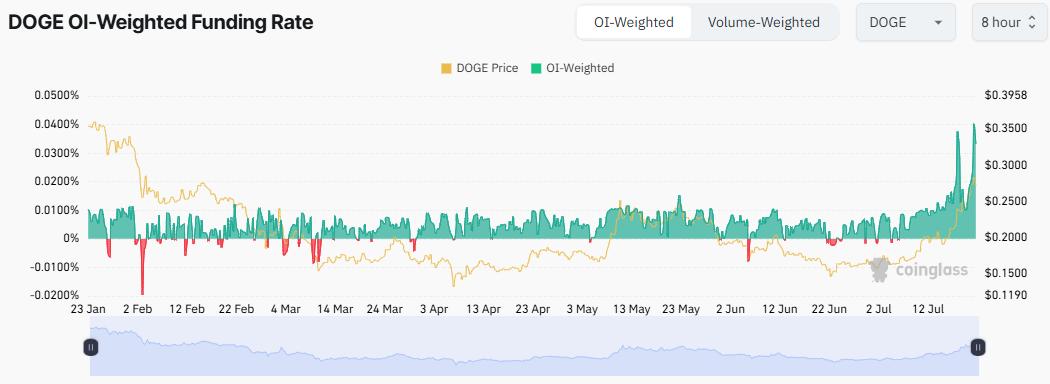

Data from Coinglass shows DOGE's Funding Rate reached its highest level this year on 21/07, when the price returned to 0.28 USD. Many short-term traders opened buy positions, hoping DOGE would continue to rise.

DOGE Funding Rate: Coinglass

DOGE Funding Rate: CoinglassLiquidation risk increases as many traders use leverage to bet on DOGE's price increase.

Recently, Lookonchain reported that famous Hyperliquid trader James Wynn partially liquidated his position, with 4.45 million DOGE (1.15 million USD) after closing his buy trade.

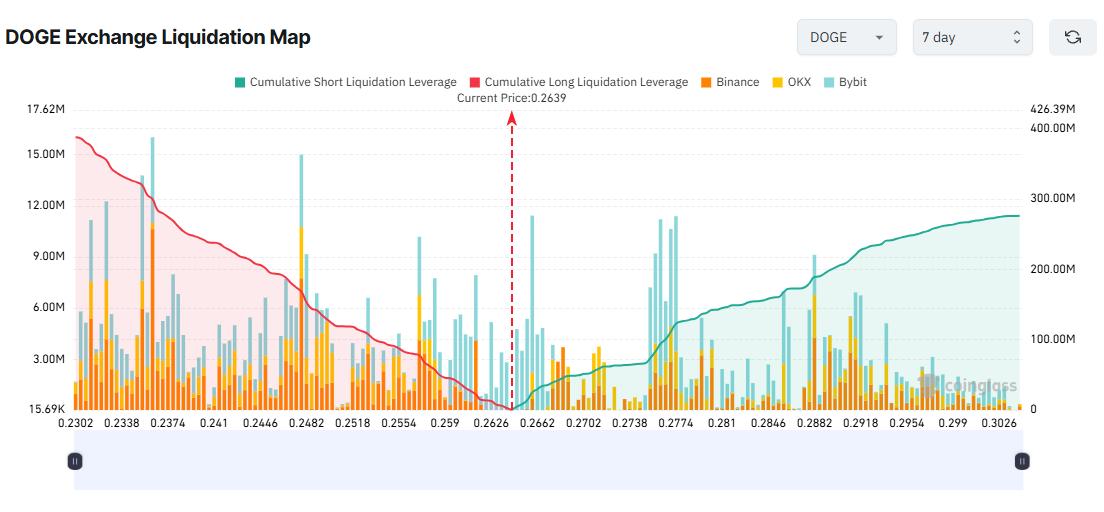

DOGE Exchange Liquidation Map. Source: Coinglass

DOGE Exchange Liquidation Map. Source: CoinglassAt the time of writing, DOGE has dropped from July's high of 0.28 USD to 0.266 USD. The 7-day liquidation map shows that if DOGE drops to 0.236 USD this week, the total accumulated liquidation for buy positions could reach 300 million USD.

A recent BeInCrypto report notes that long-term DOGE investors are quietly withdrawing funds, signaling a potential profit-taking opportunity.

3. ADA

Cardano (ADA) reached a new All-Time-High in open interest in July, at 1.74 billion USD. This occurs as ADA enters its fifth consecutive week of price increase.

Many analysts remain optimistic, predicting that ADA could soon reach 1 USD. On-chain metrics like Age Consumed and MVRV Ratio suggest that the price could continue to rise in July.

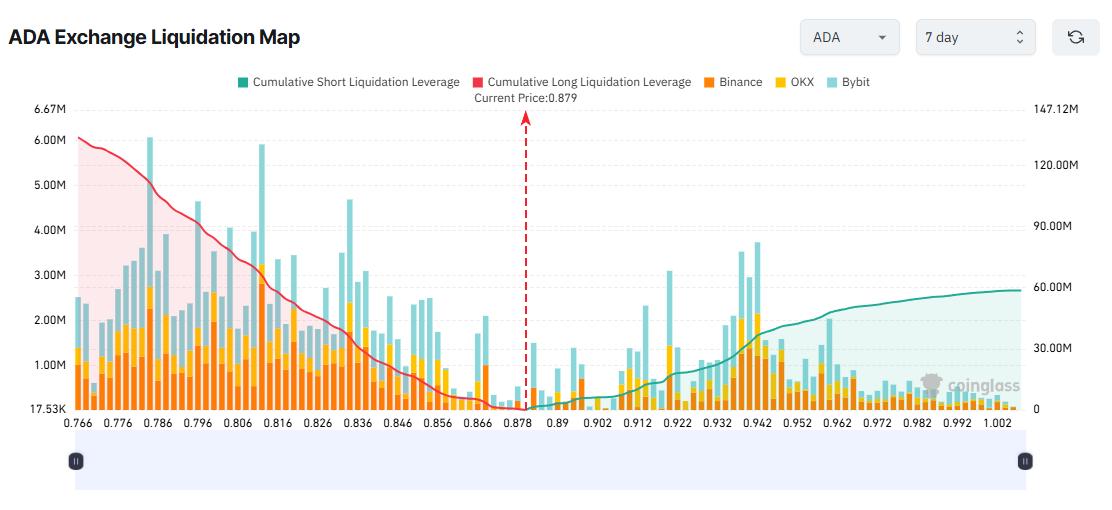

ADA Exchange Liquidation Map. Source: Coinglass

ADA Exchange Liquidation Map. Source: CoinglassAccording to the 7-day liquidation map, if ADA reaches 1 USD, short sell positions could face accumulated liquidations up to 58 million USD. However, the downside risk is even greater. If ADA drops to 0.78 USD this week, accumulated liquidation from buy positions could reach 120 million USD.

Are there any concerning reasons that could negatively impact ADA's price? Possibly. News has emerged that Cardano co-founder Charles Hoskinson is preparing to release an audit report, which could affect trader sentiment.

At the time of writing, the total Open Interest in the market continues to increase, surpassing 213 billion USD. The cryptocurrency derivatives market has never been hotter.

"In the past 24 hours, 152,419 traders have been liquidated, with total liquidations reaching 553.68 million USD," Coinglass reports.

Of the over half a billion USD liquidated in the past 24 hours, more than 370 million USD came from buy positions. This raises concerns that this trend could continue into the fourth week of July.