HBAR has been steadily rising and showing strength over the recent weeks, recording its highest level in several months.

However, this altcoin is currently located just below a major resistance line. The market is divided, with investors' optimism colliding with concerns about saturation and profit-taking.

HBAR Traders Show Bullish Sentiment

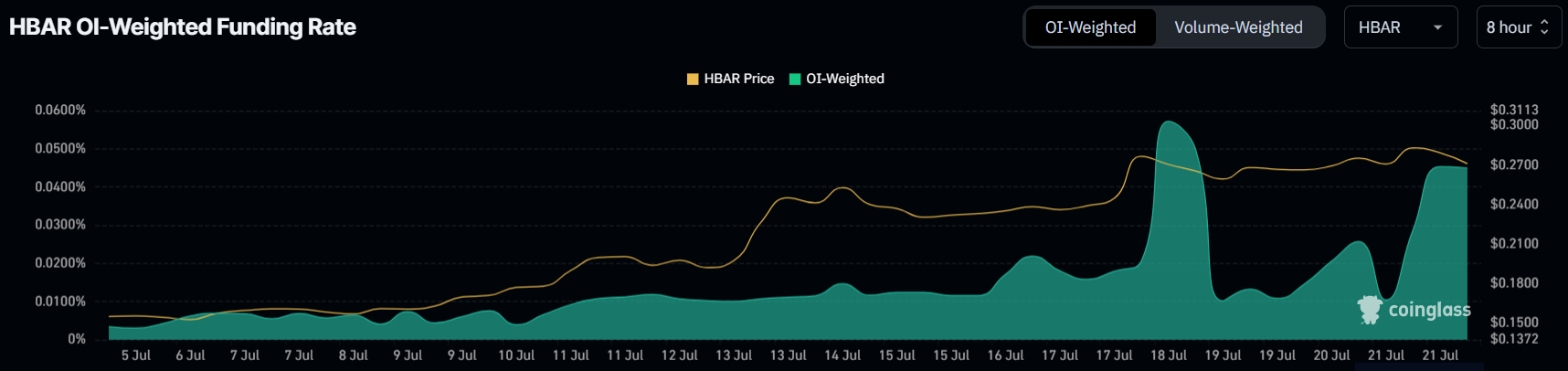

Traders are showing a bullish stance on HBAR, which is reflected in the continuous positive funding rate. This ratio has maintained a positive state for over a month. This week, the funding rate has surged twice, indicating the prevalence of long positions.

This demonstrates that traders are actively opening leveraged long contracts, expecting continued growth.

Such behavior generally aligns with market confidence. These investors anticipate that the HBAR price will rise and are looking to secure profits ahead of a potential breakout. However, high optimism can sometimes indicate the peak of a rally, prompting caution in other market sectors.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

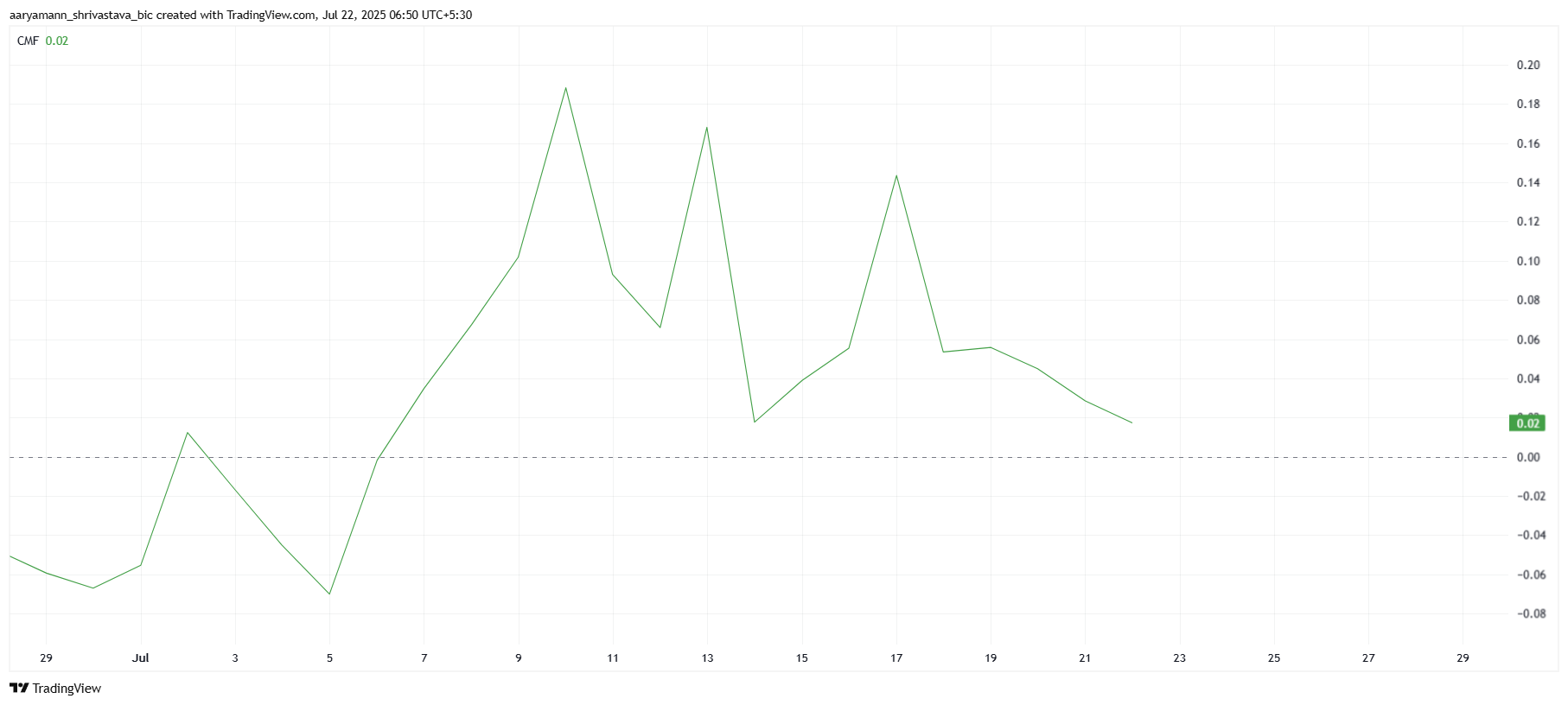

The important technical indicator Chaikin Money Flow (CMF) is painting a more cautious picture. Currently, the CMF shows a macro decline but remains above the neutral zero line. This indicates the presence of inflows but increasing outflows, suggesting some investors are closing their positions.

These changes raise concerns about the rally's sustainability. As HBAR approaches saturation, many holders are choosing to take profits. The conflicting actions of short-term traders and long-term investors are keeping HBAR in a tug-of-war state, limiting momentum in either direction.

Potential HBAR Price Decline

HBAR is currently priced at $0.26, sitting just below a major resistance line at $0.27. The mixed signals from funding rate and CMF suggest that a decisive movement has not yet formed. For now, HBAR is likely to remain range-bound unless one side gains dominance.

If the correction continues and investors regain confidence, this altcoin could break through $0.27. This would open the door to testing $0.30, providing traders with a psychological boost and reinforcing bullish sentiment.

However, if selling intensifies and investors become risk-averse, HBAR could fall back to the support line at $0.24. Breaking below this level would signal further decline, potentially dropping the price to $0.22 and potentially invalidating the short-term bullish case.