Western Union has made the decision to "join if you can't beat it." There are reports that the 175-year-old remittance company is adopting stablecoins.

Stablecoin-fiat currency conversion remains a hot topic. Stablecoins are gaining an advantage in speed and liquidity.

Western Union Responds to Stablecoin Surge... Plans to Integrate Digital Wallet

Western Union CEO Devin McGranahan appeared on Bloomberg's 'The Close' interview on Monday. He said the company plans to integrate stablecoins into its global payment system.

McGranahan also revealed plans to explore partnerships to allow customers to buy and sell stablecoins through their platform.

"Stablecoins are another opportunity for innovation... We are exploring other partnerships with people who want on-ramps and off-ramps in various regions of the world, and looking for ways to support people buying and selling stablecoins through Western Union's funds." – Devin McGranahan, Western Union CEO said in the interview.

They are already implementing new payment processes across South America and Africa. According to McGranahan, their goal is to facilitate faster remittances and local currency conversion.

Western Union's management also highlighted three key opportunities: fast cross-border transfers, converting stablecoins to fiat currency, and providing customers with a stable value store.

"What we see is that stablecoins are an opportunity, not a threat," he added.

This change in sentiment comes as stablecoins increasingly pressure traditional remittance and cross-border payment companies.

Matthew Sigel, Digital Assets Research Head at Van Eck, posted on X (Twitter) in January that remittance giant app downloads have significantly decreased. He noted Western Union dropped by 22% and Moneygram by 27%.

Remittance App Downloads Falling Sharply as Western Union (-22%) & Moneygram (-27%) Lose Share to Stablecoins pic.twitter.com/5hX5l4XvmR

— matthew sigel, recovering CFA (@matthew_sigel) January 6, 2025

Last quarter's report emphasizes the outlook, showing declining revenues amid intensifying competition.

"The company's first-quarter revenue was reported at $984 million, a 6% decrease on a reporting basis." – Excerpt from the Q1 2025 report read.

Western Union appears to be taking measures to rescue its business.

Western Union Joins In... Stablecoin Remittance Innovation

The competitiveness of dollar-denominated cryptocurrencies lies in speed, cost, and accessibility. BVNK co-founder and executive director Chris Harmse recently confirmed this perspective in a LinkedIn post.

According to his view, stablecoins gain long-term cost advantages through increased liquidity, reduced spreads, and smart routing.

As adoption increases, existing players must adapt or risk losing their foothold. In the past, only a few providers, including Western Union and Moneygram, dominated global remittances.

However, new entrants like Wise and Remitly have disrupted the market by integrating digital-first alternatives.

Now, the landscape is further changing as stablecoin-based services challenge both new entrants and early players like Western Union.

"Wise wins on cost with deep liquidity. Remitly wins on reach. They are where cards and wallets can't go. Cash, rural, mobile wallets. They've built for the edges. Stablecoins offer what neither covers: the logic of money," a user commented.

Notably, Moneygram adopted this strategy earlier than Western Union, introducing stablecoin remittances. Specifically, they launched the Moneygram Wallet in 2024, allowing users to send remittances in USDC stablecoin, which can be collected in cash at 180 country agencies.

Liz Bazurto, Ecosystem Engagement Manager at MetaMask, observing this wave, mentioned that traditional remittance giants could accept stablecoin payments to facilitate operations.

"I can see WU and Moneygram enabling paths to stable. Moneygram has enabled Stellar (USDC) for on and off ramps." – Liz Bazurto, MetaMask Ecosystem Engagement Manager wrote in a post.

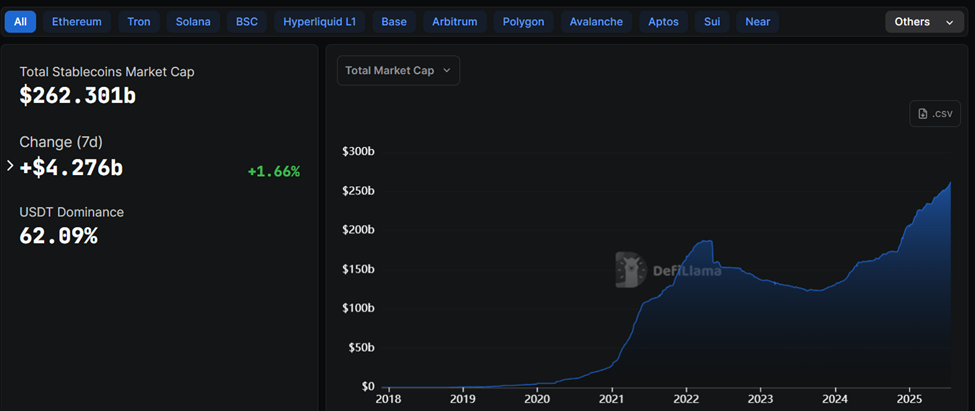

According to data from DeFi on-chain data site defillama, the total stablecoin market cap is at an all-time high of $262.31 billion.