Global cryptocurrency investment products recorded an all-time high inflow.39 billion last week which is the figure sinceointracking in, surpassing the previous peak of $4.27 billion recorded in December after the US election, as stated by James Butterfill, the research director of the the company on Monday.

According to The Block on the 21st (local time), this surge, which marks the 14th consecutive week of net buying, has brought the year-to-date ininflows to $27 billion, and the assets under management have increased to an all-time high of $220 billion.

Trading activity Exchange Traded Products (ETP) also reached, surge in trading $39.2 billion.

According to Butterfill, while Bitcoin, the market leader, was the main driver of capital flows last week, Ethereumherwas,13allocation. Fundsds associated with the world second-largest cryptocurrency drew in $21.2 million, nearly doublebling the previous week's record of $12 billion, and have already exceeded exceeded last year's entire inflows, bringing them to $6.2 billion. Bitcoin products raised $22 billion, down from $27 billion the, but still sufficient to maintain historical levels of overall capital flowsows.

Geographically, the United States was overwhelmingly dominant with $43..6in flows funds provided by companiesLsuch as BlackRock, Grayscale, and Bitwise, while Switzerland, Hong Kong, and Australia contributed a total of $78.7 million. Brazil and Germany recorded slight outflows of $28.1 million and $15..5 million, respectively.

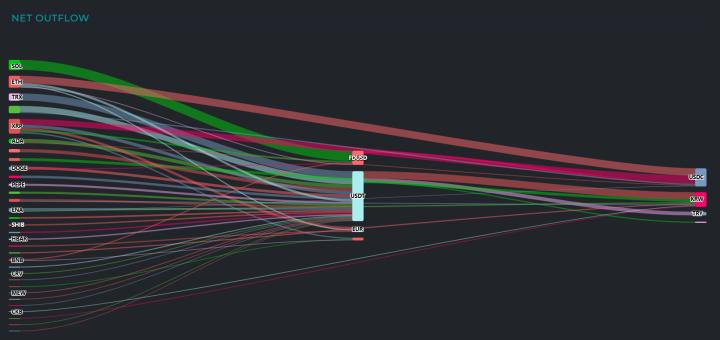

Among other altcoins, Solana, XRP, and Sui products attracted $39 million, $36 million, and $9.3 million respectively, showing a risk appetite that surpassed the two major cryptocurrency companies.

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>