Ethereum is making history:

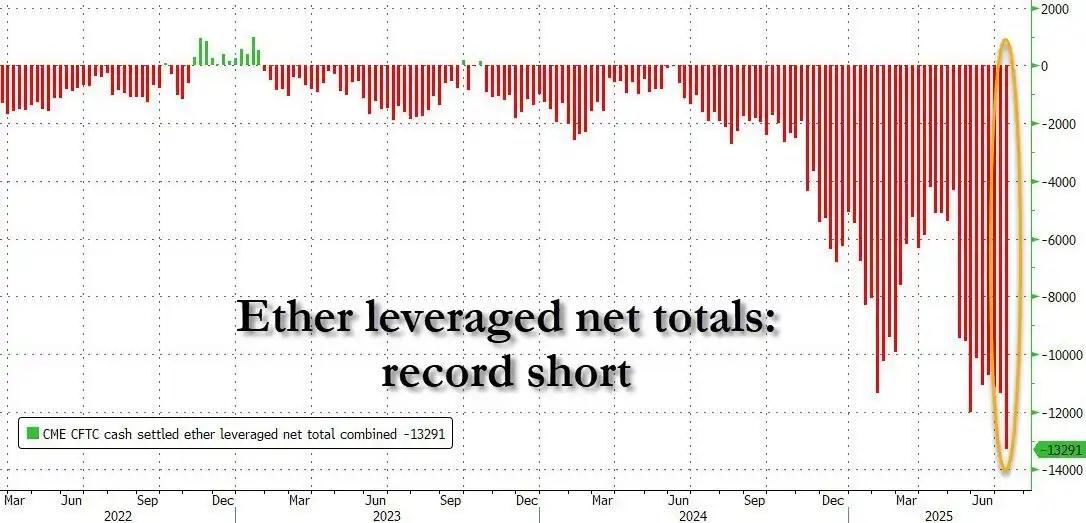

We are witnessing one of the largest short squeezes in cryptocurrency history. Since July 1st, Ethereum's market value has surged by $150 billion—just days after net short positions hit a historic high.

What exactly happened? This article will explain.

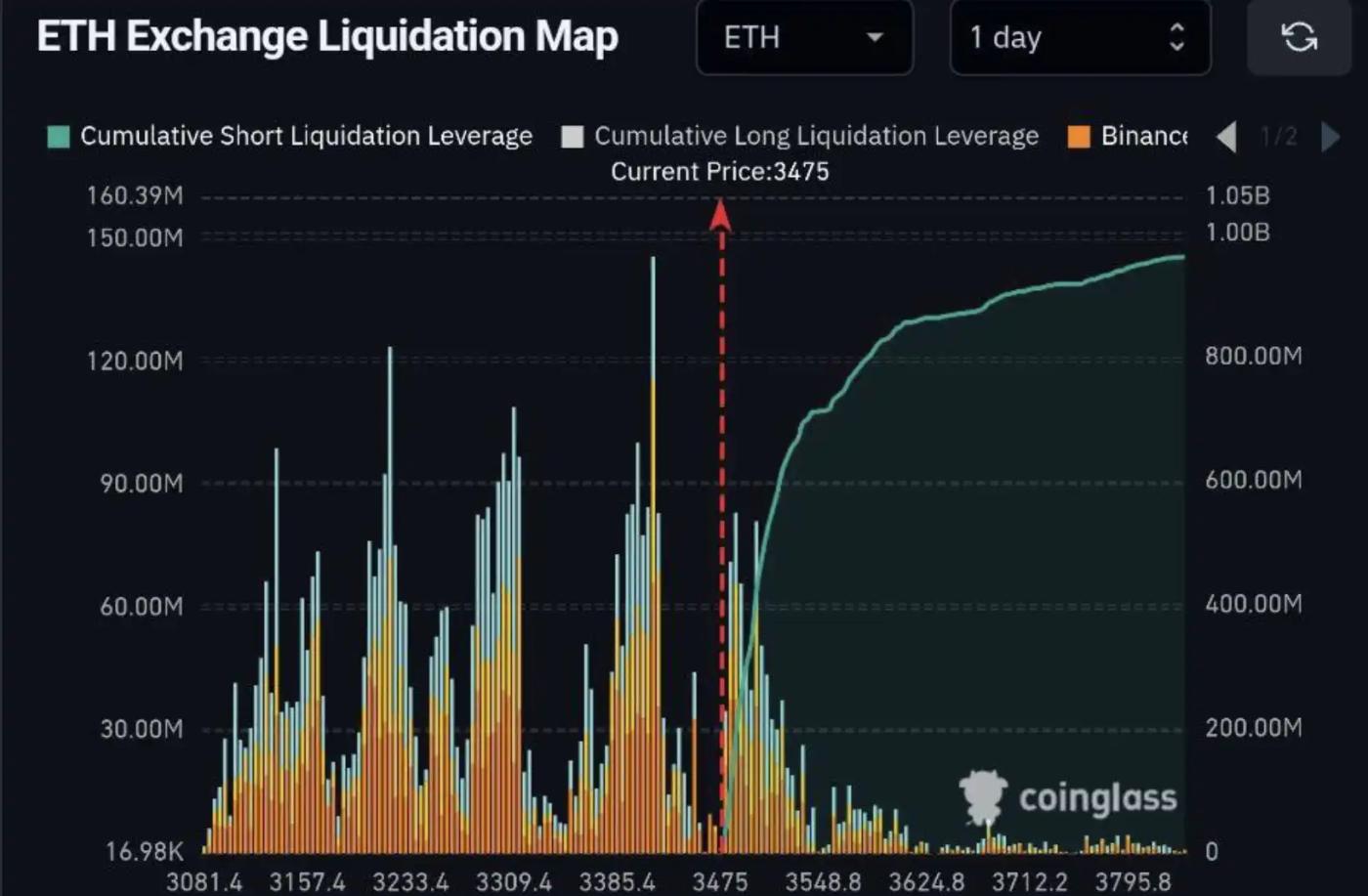

Look at the chart below:

According to Zerohedge data, Ethereum's net leveraged short positions reached a historical peak in July. In fact, the net short exposure is about 25% higher than the level in February 2025. This directly led to Ethereum's 70% surge in less than a month.

But the story is far from over.

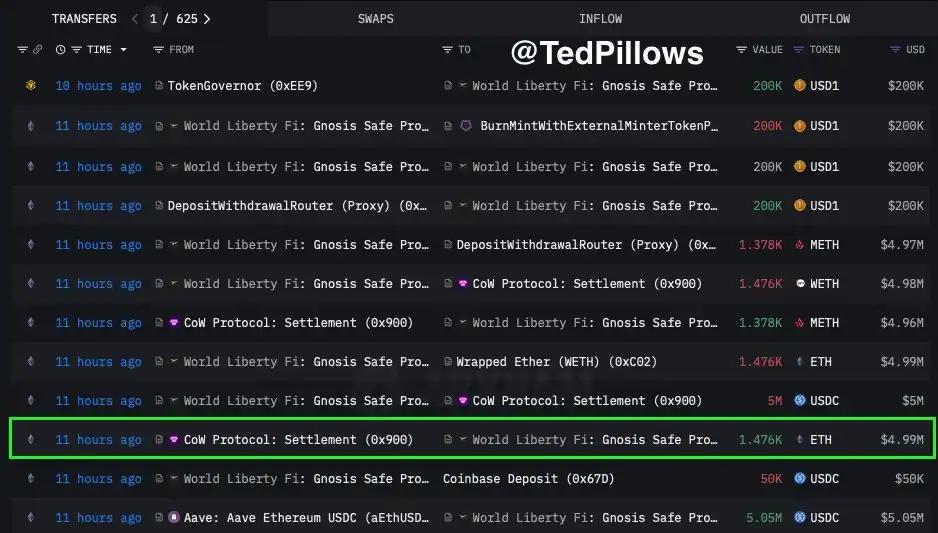

President Trump's World Liberty Financial institution has been accumulating Ethereum. The latest transaction records show that just 24 hours ago, the institution completed a $5 million purchase. This added fuel to the already intense short squeeze.

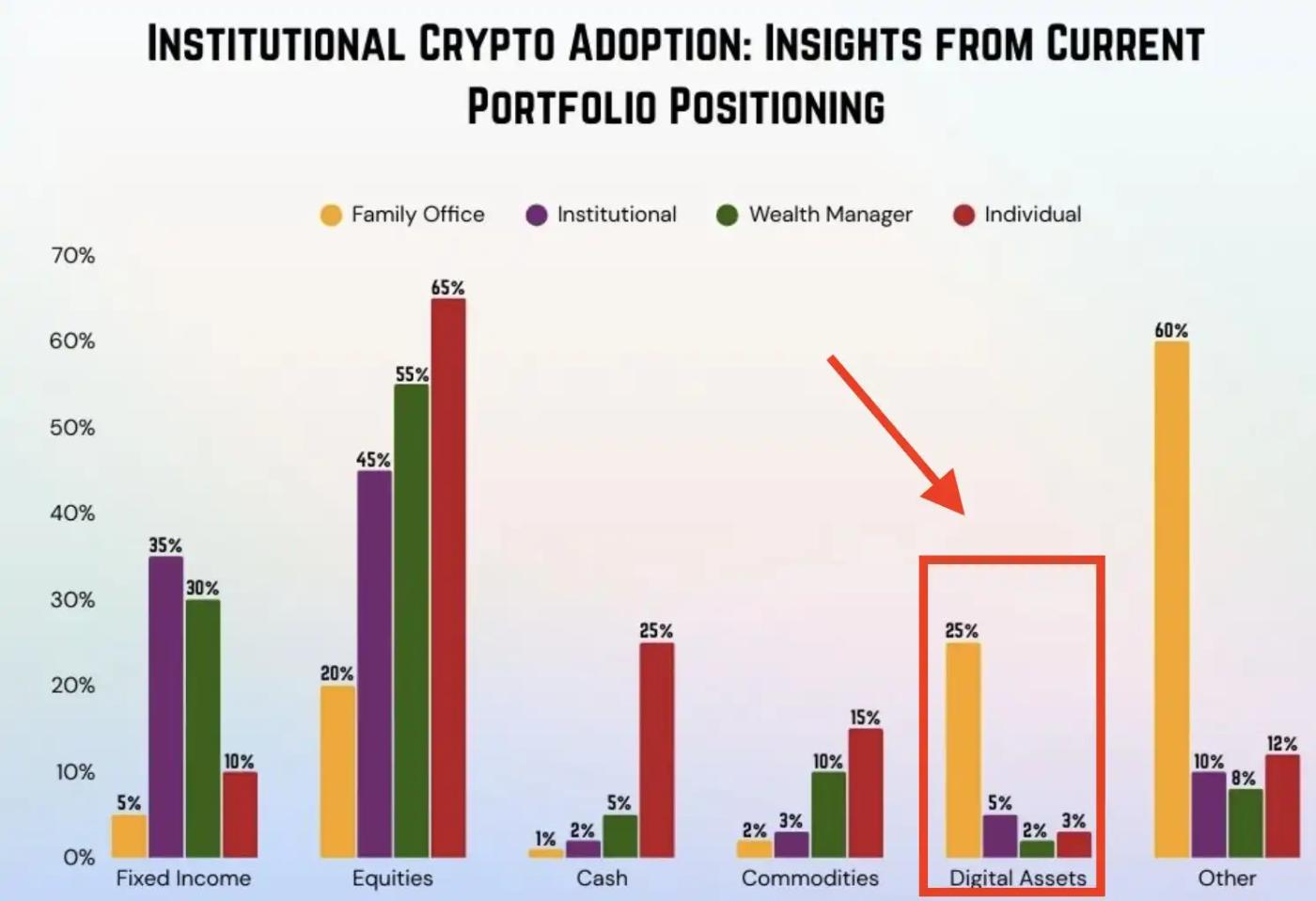

It's worth noting that these short positions mostly come from institutional capital.

Even more intriguing:

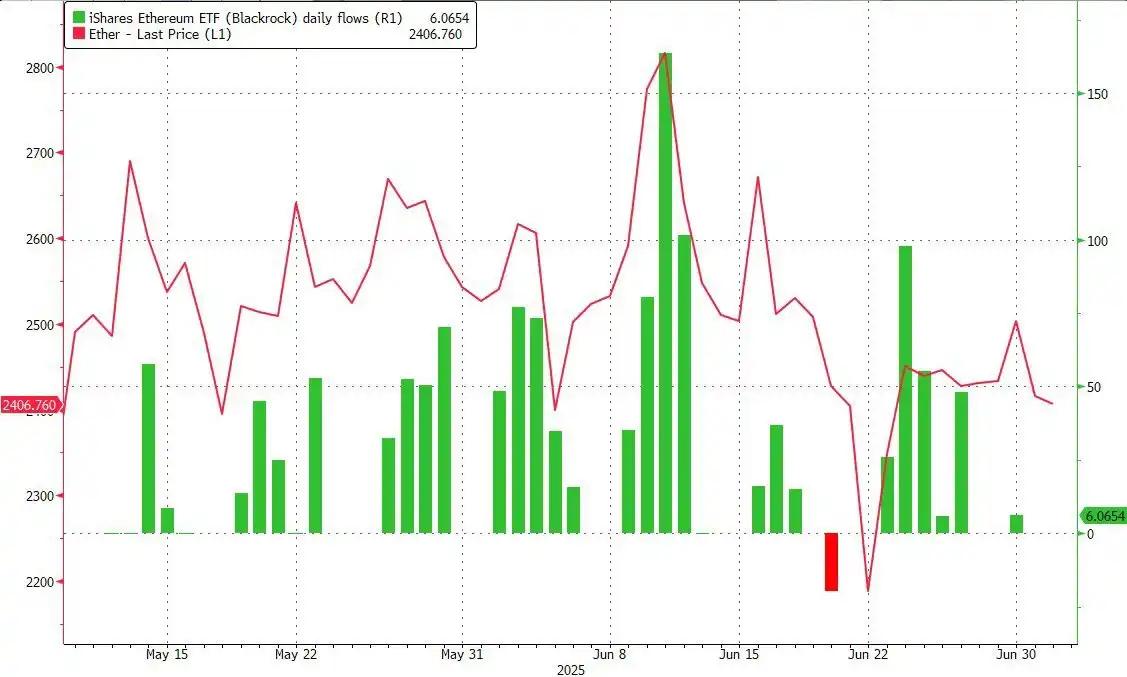

Zerohedge reports that in the 30 days before July 1st, BlackRock's ETF accumulated Ethereum for 29 days. However, as mentioned earlier, due to the sudden surge in leveraged short exposure, prices continued to decline. Clearly, "smart money" predicted this storm.

Now we are witnessing: Billions of dollars in short positions being liquidated. If Ethereum rises another 10%, an additional $1 billion in short positions will be liquidated.

Moreover, since these short positions are mostly leveraged, the market is facing even stronger short-covering pressure.

Ethereum may soon reach $4,000.

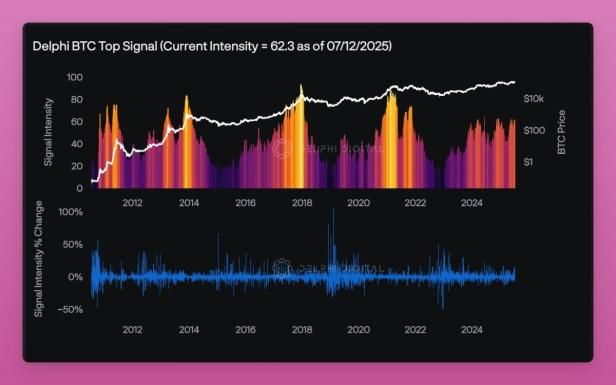

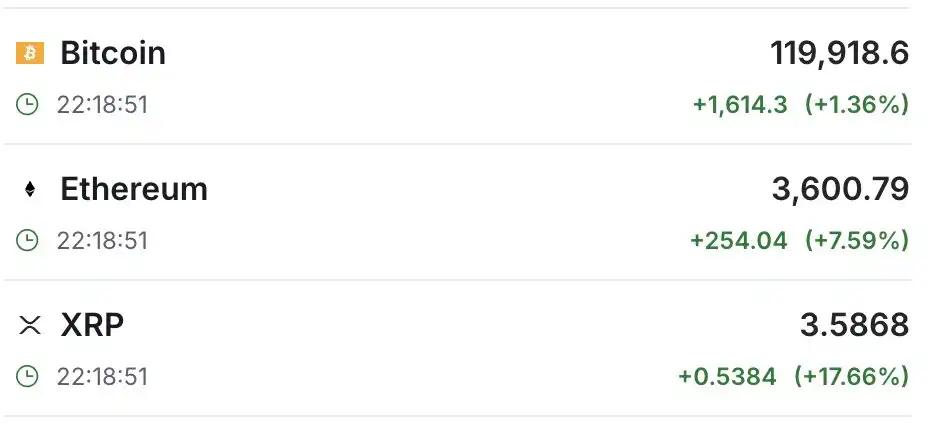

We've observed similar effects in Ripple, while Bitcoin continues to show relative strength. Bitcoin has officially returned to the $120,000 mark, with its market value increasing by $900 billion since the April low. After months of stagnation, Ethereum and Ripple are finally starting to catch up with Bitcoin's gains.

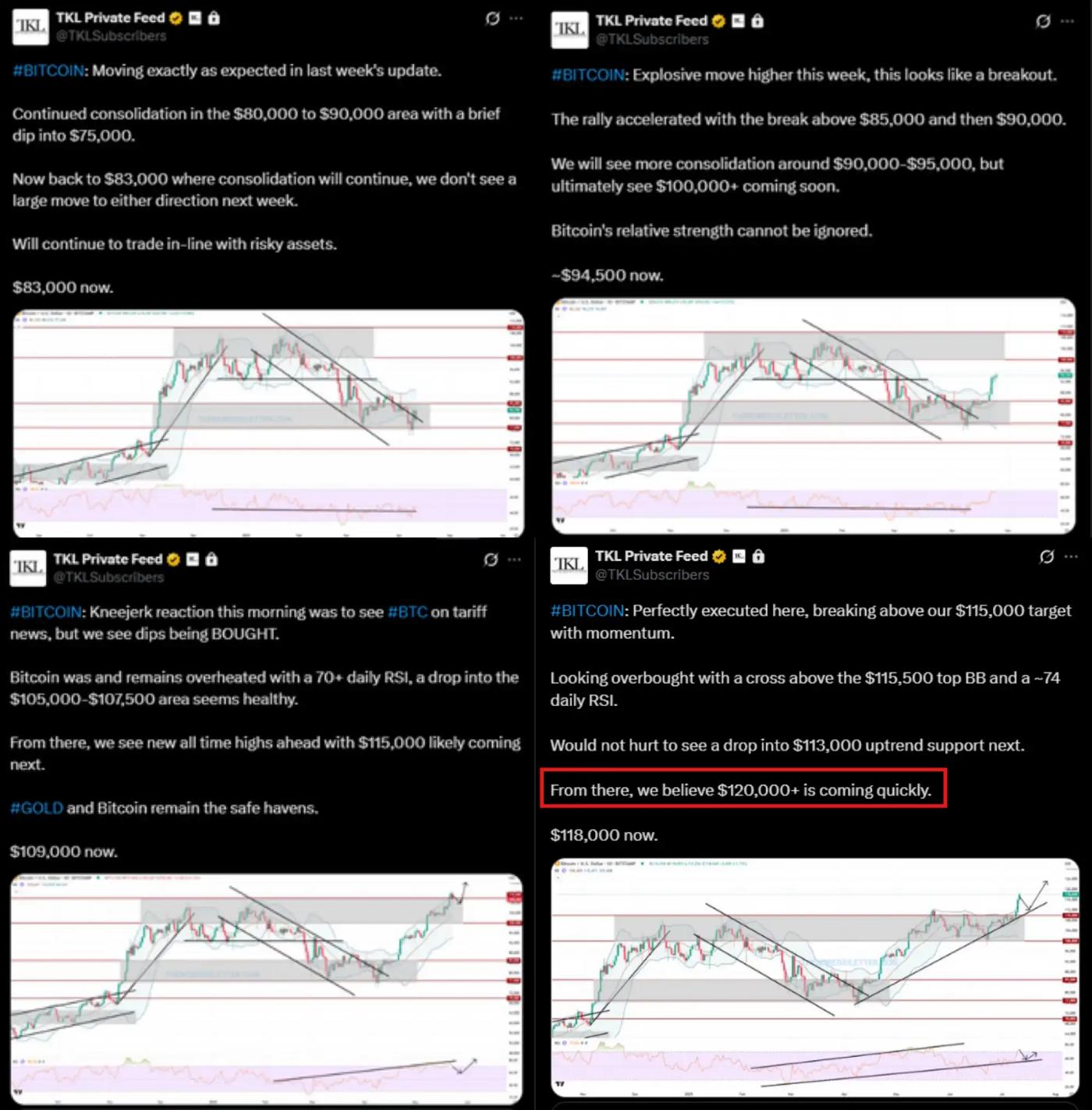

We predicted this trend in advance. Here are some warning signs we provided to premium members: We bought the dips in batches at $80,000, $90,000, and $100,000, and precisely predicted the $115,000 target. Last week, we raised the target to $120,000+, and this target has just been achieved.

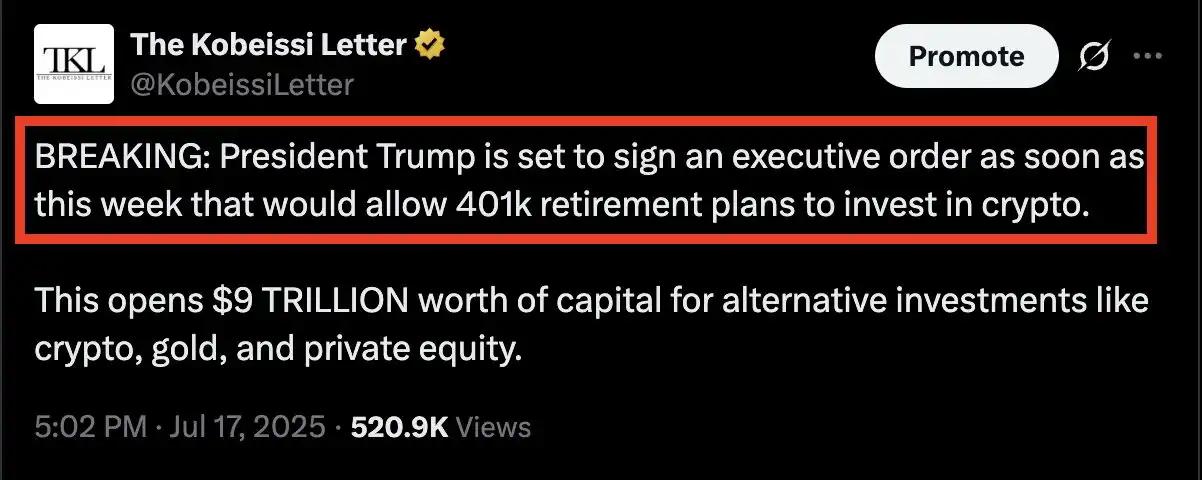

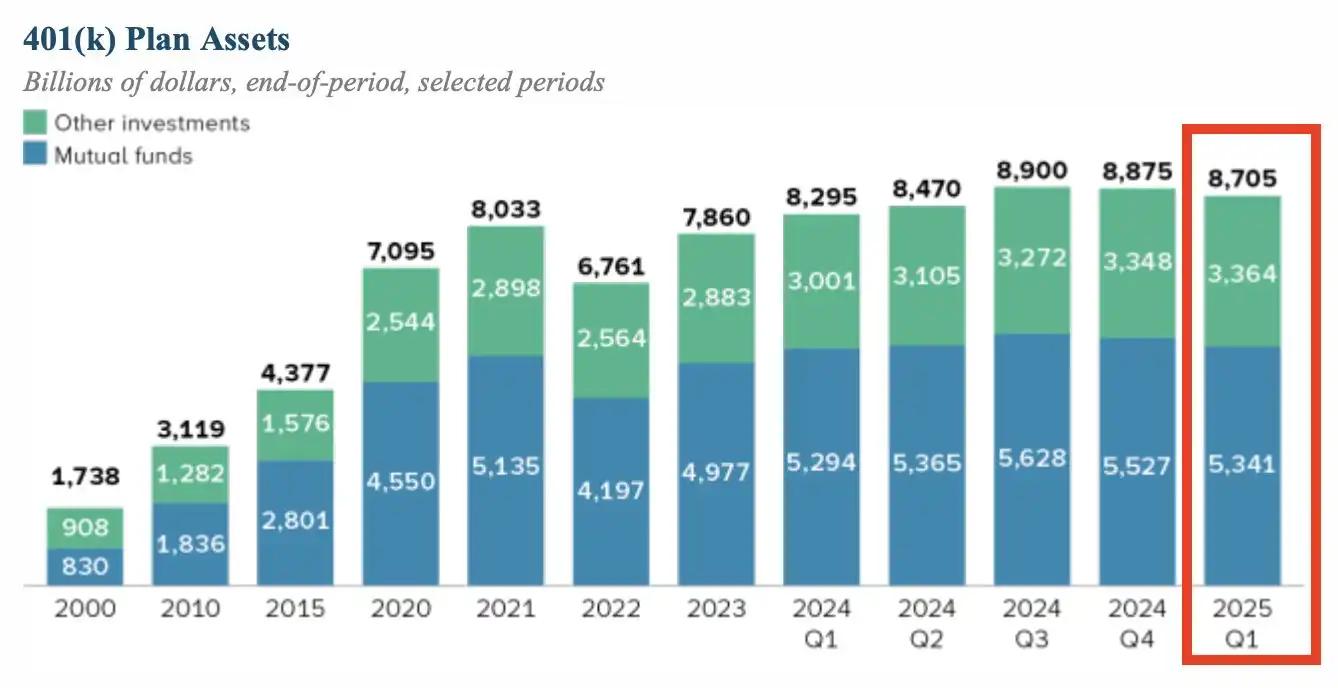

More importantly, the market is digesting the heavyweight report published by FT today. President Trump may sign an executive order as early as this week, allowing 401k retirement plans to invest in cryptocurrencies. This will be one of the most milestone-defining positive developments in crypto history.

As of the first quarter of 2025, the scale of US 401k retirement funds is $8.7 trillion. The current total cryptocurrency market value is only $3.8 trillion. This means funds equivalent to 2.3 times the entire crypto market will soon have an entry channel. This is epoch-making.

Even more significantly, the US House of Representatives has passed three important Bitcoin and cryptocurrency bills: the Clarity Act, the Genius Act, and the Anti-CBDC Act.

The cryptocurrency industry's biggest victory is gaining bipartisan support. Candidates who refuse to accept cryptocurrencies can no longer win elections.

As we have always emphasized: Institutional capital can no longer ignore cryptocurrencies. Over the past 13 years, Bitcoin's compound annual growth rate has been +90%, outperforming almost all global assets.

We continue to receive feedback from institutional investors that their AUM is gradually allocating to crypto assets.

Looking ahead, the core logic driving cryptocurrency increases will trigger significant macroeconomic changes. This is redefining the operating paradigm of financial markets.

Finally, don't forget the strongest bull market engine for cryptocurrencies—the US deficit spending crisis. Not only has Bitcoin risen 55% since April, but the US dollar index has also fallen 10% this year. The US dollar has fallen into an eternal bear market.