Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

The long-cooled Non-Fungible Token track seems to have shown signs of recovery after a long absence.

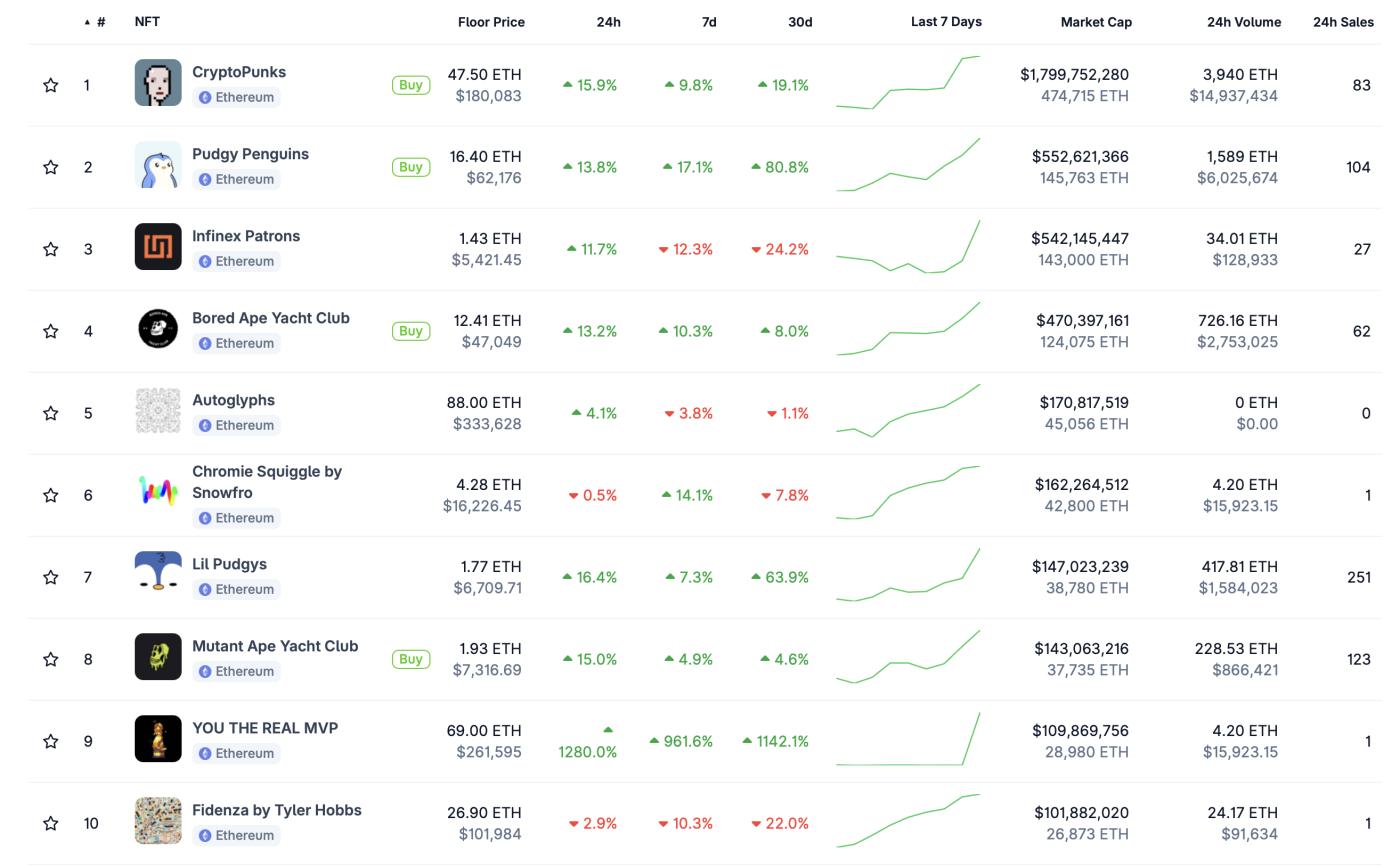

CoinGecko data shows that the total market value of the Non-Fungible Token sector has rebounded to above $6 billion, currently reporting $6.417 billion, with a 24-hour increase of 23.2%; the growth in trading volume is even more dramatic, with a total trading volume of approximately $40 million in the past 24 hours, an increase of about 318.3%.

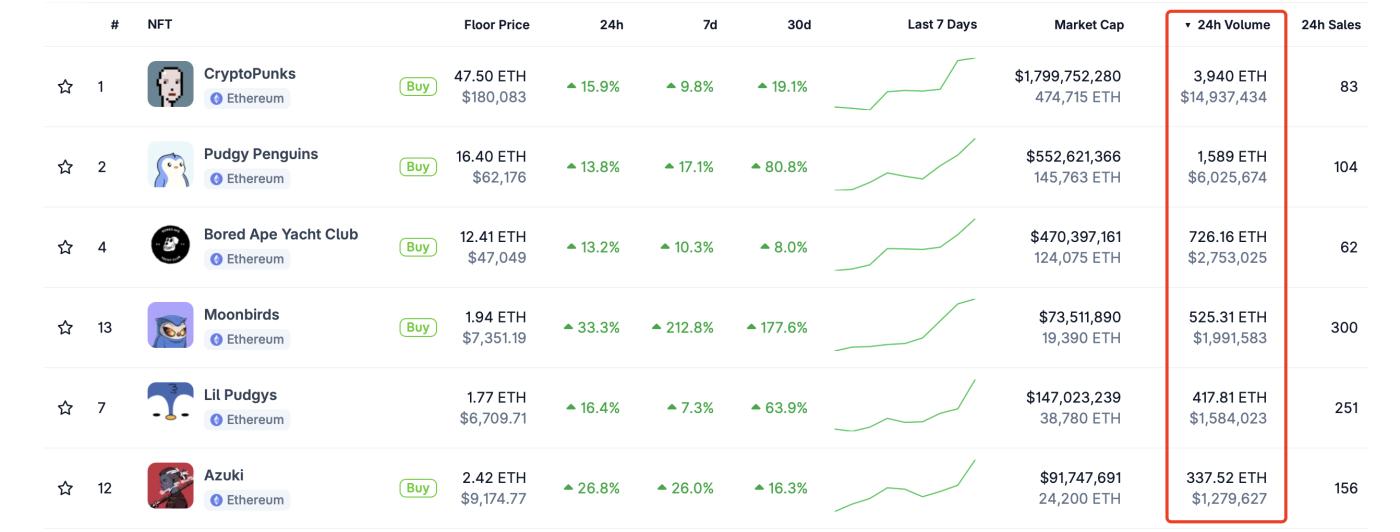

Among mainstream Non-Fungible Token projects,CryptoPunks, Moonbirds,and Pudgy Penguins are particularly outstanding.

CryptoPunks saw a whale spending millions of dollars to buy 45 pieces last night (the whale also bought multiple Chromie Squiggles). Non-Fungible Token artist Jediwolf calculated that in just 5 hours from last night to this morning, a total of 76 CryptoPunks changed hands, the largest sweep operation for this series since 2021. As of the time of writing, the floor price of CryptoPunks is temporarily reported at 47.5 ETH, with a 24-hour increase of 15.9%.

Moonbirds gained momentum because OpenSea briefly changed its official X avatar to Moonbirds series images last night. As of the time of writing, the Moonbirds floor price is temporarily reported at 1.94 ETH, with a 24-hour increase of 33.3%.

Pudgy Penguins, which was considered the "industry's light" during the Non-Fungible Token winter, recently appeared in the second season of the American TV series "Poker Face", capturing some external traffic. As of the time of writing, the Pudgy Penguins floor price is temporarily reported at 16.4 ETH, with a 24-hour increase of 13.8%.

Apart from the above outstanding projects, most Non-Fungible Token projects have seen good increases. As of the time of writing, BAYC has a 24-hour increase of 13.2%, Azuki has a 24-hour increase of 26.8%, and the Bitcoin ecosystem is no exception, with Taproot Wizards showing a 24-hour increase of 30.3%.

Additionally, Non-Fungible Token concept coins have also seen a significant rise. On OKX market, as of the time of writing, BLUR is reported at 0.1176 USDT, with a 24-hour increase of 27.4%, currently ranking third on OKX's gainers list.

Regarding the recovery of the Non-Fungible Token market, although there were people "shilling" in the market earlier, after the long years of the past, the various "milk methods" surrounding Non-Fungible Tokens have appeared too many times, resulting in the track becoming cooler day by day. Retail investors have long been numb to such "shilling" rhetoric.

On July 16, BitMEX co-founder Arthur Hayes predicted on the X platform that "ETH Season has arrived, and the DeFi and Non-Fungible Token markets will benefit and make a comeback", but at the time, most replies under his post were mainly sarcastic.

However, with the gradual emergence of signs of the long-awaited "Altcoin season", discussions about whether the Non-Fungible Token market can recover have also increased.

BitmapPunks founder and well-known Non-Fungible Token collector FreeLunchCapital stated today that institutions have already contacted him to try to acquire inventory - "Since two weeks ago, some institutions have contacted me with interesting offers. Everyone knows I don't sell Non-Fungible Tokens, but that's not entirely true. If the other party has resources that can attract more people's attention to Non-Fungible Tokens and help the industry move to the next level, I would consider an over-the-counter transaction."

Abstract contributor 0xCygaar and other old players who were active in the previous Non-Fungible Token cycle are exclaiming "Non-Fungible Token Season has finally returned".

The sudden recovery of Non-Fungible Tokens is not too difficult to understand logically.

On one hand, with ETH's strong rebound and rapid rise to high levels, follow-up funds will consider related investment targets while focusing on ETH. Since Non-Fungible Tokens originated in the Ethereum ecosystem, and most top projects are still concentrated in the Ethereum ecosystem, the Non-Fungible Token sector can be viewed to some extent as an alternative choice to ETH. From the trading volume perspective, the Non-Fungible Tokens with the largest trading volume are still top projects with relatively abundant liquidity on the Ethereum chain, indicating that the funds in this small recovery mainly come from within the Ethereum ecosystem.

On the other hand, after a long downturn, the entire Non-Fungible Token market has undergone thorough washing out - weak hands have exited, and market makers who intend to control the market may have long completed their target selection and chip layout. Considering the non-standard liquidity characteristics of Non-Fungible Tokens, they might be an easier target to control compared to Altcoins.

The current issue is that since the Non-Fungible Token market was previously so thoroughly cooled, with the track consensus almost collapsing, it remains uncertain whether more retail investors and funds can follow up even with a short-term increase in heat.

In other words, if you say the Altcoin season is coming, perhaps many retail investors would be willing to buy in, but if you say Non-Fungible Tokens are about to surge, it seems less believable than claiming I am Qin Shi Huang...