Litecoin is gaining attention again. It is trading at $116 with a 14% price increase. This aligns with several days of continuous rise, a broader cryptocurrency market rally, and signs of an upcoming altcoin season.

However, despite the optimism, whale activity could weaken this upward trend. Large holders are securing profits, which could challenge Litecoin's ability to maintain its momentum.

Potential Weakening of Litecoin Support

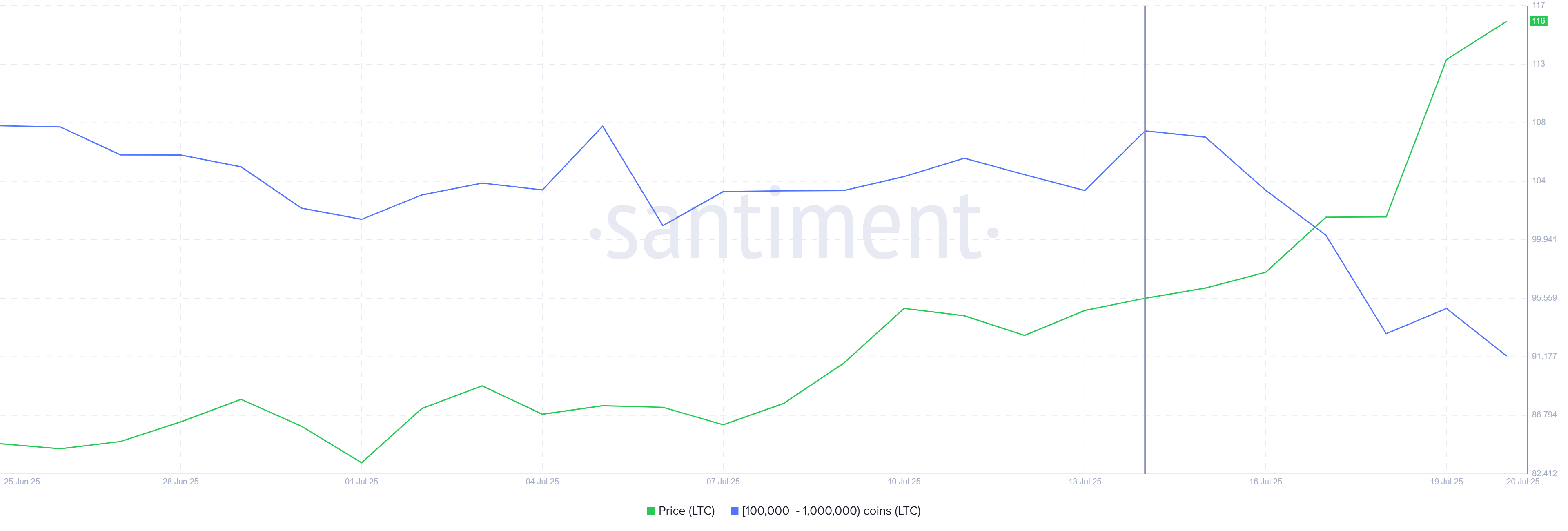

Over the past 5 days, whale wallets holding between 100,000 and 1 million LTC have sold over 500,000 coins. This large-scale sale amounts to approximately $58 million and suggests a cautious sentiment among major investors. Their actions imply that the sustainability of the current rally could be questioned.

The increase in sudden selling pressure indicates potential instability. Such large-volume trades can impact liquidity and influence market direction.

If these sales continue, retail investors' sentiment could turn bearish. This could add pressure to Litecoin's short-term performance.

Despite whale sales, on-chain data from the Mean Coin Age (MCA) indicator tells a different story. Long-term holders (LTH) are not participating in the sell-off. These are confident wallets continuing to hold, which is a positive signal for price stability.

LTHs typically drive medium to long-term trends and have shown minimal participation in recent sales. This demonstrates confidence in Litecoin's prospects. This counterforce can provide the necessary support for Litecoin to withstand additional downward pressure and stabilize prices at current levels.

LTC Price Needs to Break Major Resistance

At the time of writing, Litecoin is trading at $116, approaching the $117 resistance level. While the price has risen 14% in the last 24 hours, whale sales could create friction.

A strong upward momentum is needed. This is crucial to overcome the upper barrier and maintain the upward trend.

If bearish sentiment driven by whale activity is reinforced, Litecoin could retract to $105. This level will serve as the next major support line and could form the basis for a sideways correction if selling continues.

Conversely, continued support from retail buyers and LTHs could help Litecoin break through $117. Surpassing this resistance would indicate strength and could open movement towards $124, establishing a new four-month high and confirming the upward trend.