Bitcoin reached its All-Time-High consecutively in July, but two important indicators show that this price increase was primarily led by the US.

The growing difference between US and Korean trading activities raises questions about global participation — and market risks.

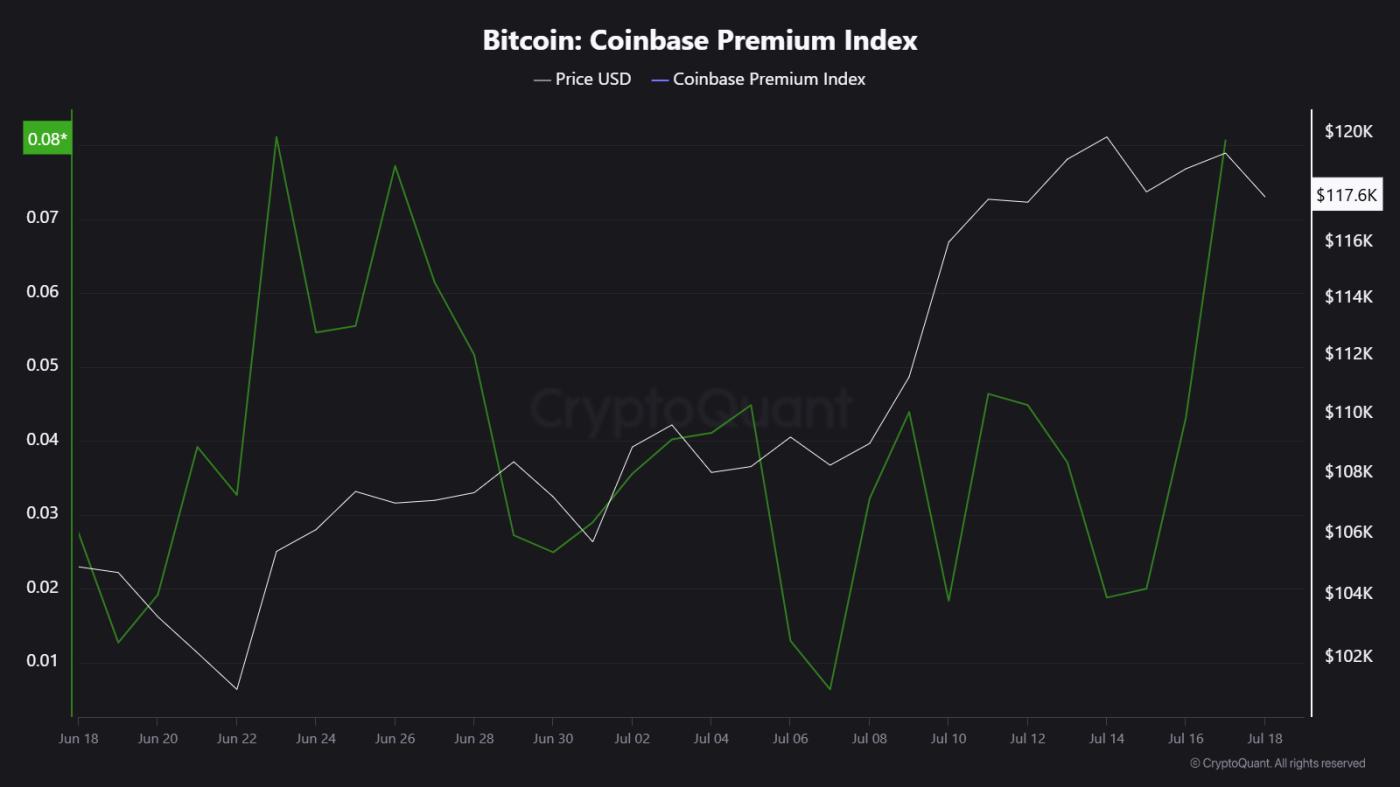

Coinbase Premium Increases Along with Bitcoin ETF Inflows in the US

The Coinbase Premium Index, tracking the price difference between Bitcoin on Coinbase (USD) and Binance (USDT), has strongly increased throughout July. This difference has risen to a maximum of 0.08%, indicating strong buying pressure from the US.

Coinbase serves institutional and retail investors in the US. The increased difference typically reflects strong accumulation by US "whales", ETF providers, or corporations.

Bitcoin Coinbase Premium over the past month. Source: CryptoQuant

Bitcoin Coinbase Premium over the past month. Source: CryptoQuantThis aligns with over $14.8 billion in inflows to US spot Bitcoin ETFs, pushing BTC to an All-Time-High near $123,000.

These movements confirm that US institutions are leading the current cycle, supported by favorable regulations and capital access.

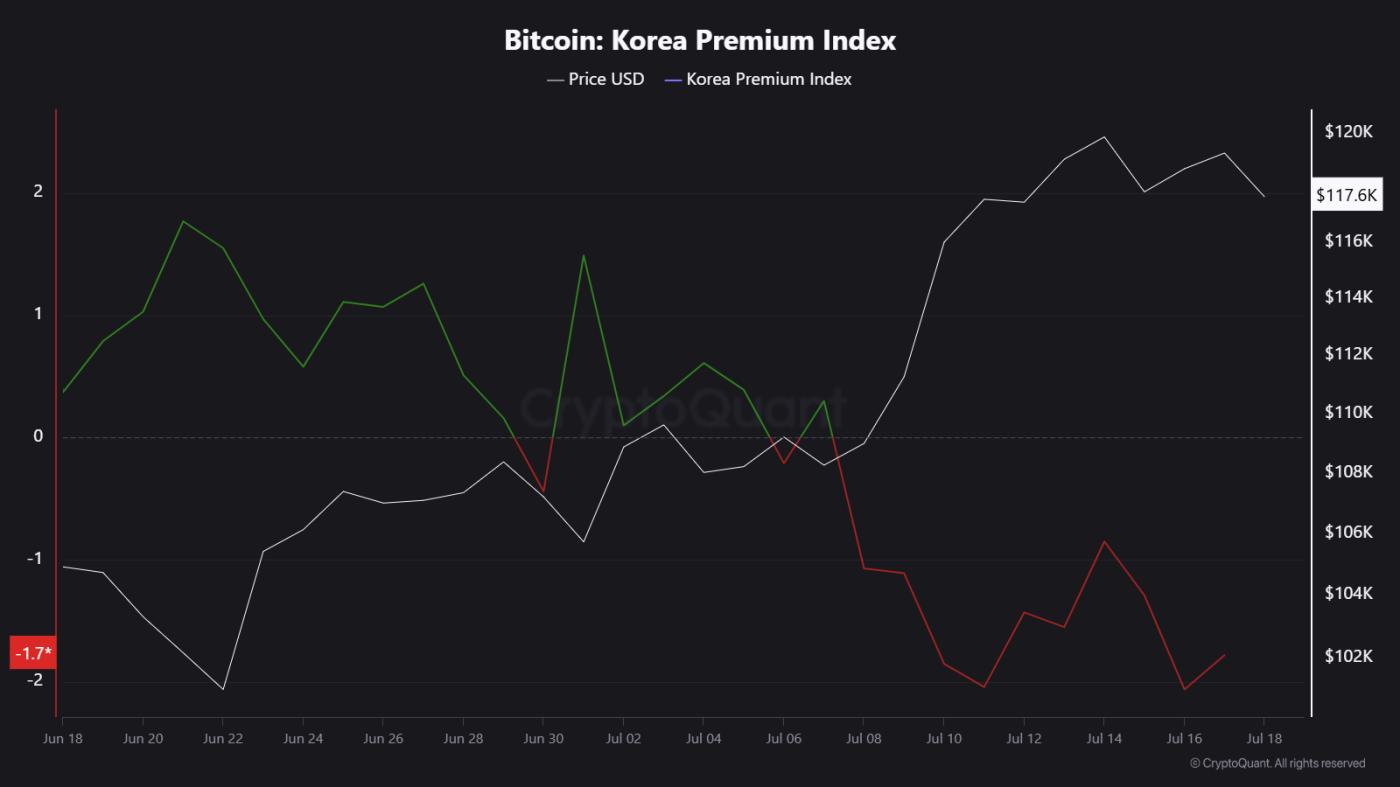

The Korean Bitcoin Market Tells a Different Story

In contrast, the Korea Premium Index — often called "Kimchi Premium" — has dropped below 0. This index tracks the price difference between Bitcoin on Korean exchanges (e.g., Upbit, Bithumb) and global platforms.

In mid-July, the difference remained around -1.7%, indicating Bitcoin trading cheaper in Korea. A negative Korea Premium suggests weak demand from Korean retail investors, with few new market participants.

Bitcoin Coinbase Premium over the past month. Source: CryptoQuant

Bitcoin Coinbase Premium over the past month. Source: CryptoQuantIn previous price increases (2017, 2021), Korea typically saw +10% or higher differences due to speculative enthusiasm from retail investors. That momentum is no longer present.

Why This Divergence Matters

The separation in premium indices shows that the current Bitcoin price increase is not globally balanced. It is concentrated in the US, with limited enthusiasm from one of Asia's most active markets.

History shows that widespread retail investor participation has sustained and prolonged bull markets. Without that, there's a risk of the price increase becoming too heavy, relying solely on institutional capital.

Social post from a Korean crypto influencer. Source: X/Crypto Dan

Social post from a Korean crypto influencer. Source: X/Crypto DanThis could also affect altcoin momentum, which typically relies on liquidation from Korean exchanges and narratives driven by retail investors.

Overall, Coinbase Premium should remain positive if US demand remains strong. But if it decreases while Korea remains negative, it could signal weakening momentum.

A reversal of Korea Premium to positive would indicate re-entry of retail investors and could potentially drive the next Bitcoin price increase.

Until then, Bitcoin's price action is likely to remain focused on the US, led by ETFs, corporations, and asset managers — not global retail investors.