- XRP's current price has broken through a key technical level, showing strong upward momentum

- Whale accumulation and institutional demand are driving XRP to create a new historical high

- If it breaks through the key resistance level, XRP may challenge the target price of 4.80 USDT

XRP Price Prediction

XRP Technical Analysis: Price Trend Prediction After Breaking Key Resistance

According to BTCC financial analyst Emma's technical analysis, XRP's current price is 3.2452 USDT, having broken through the 20-day moving average (2.5000 USDT) and Bollinger Band midline (2.5000 USDT), indicating strong upward momentum. Although the MACD indicator is still in the negative zone, the histogram is converging (-0.1271), suggesting weakening downward momentum. If XRP can stabilize above the Bollinger Band upper rail (3.1720 USDT), the next target price will be 4.80 USDT.

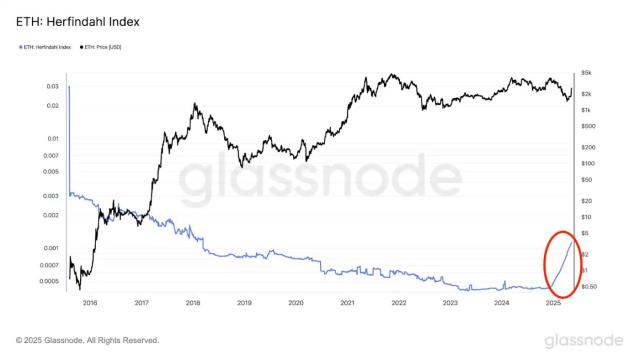

Whale Accumulation Driving XRP to New Historical High, Strong Institutional Demand

BTCC financial analyst Emma points out that the recent surge in XRP price is closely related to whale accumulation and increased institutional demand. CME's XRP futures open interest has reached $235 million, showing strong interest from institutional investors. If XRP breaks through key resistance levels, market sentiment will further turn optimistic, driving the price to challenge the target of 4.80 USDT.

Factors Affecting XRP Price

Whale Accumulation Pushing XRP Towards Historical High

XRP has surged to over $3.16 driven by active whale accumulation, with large holders purchasing 2.2 billion tokens in two weeks. This rally reflects growing institutional interest, boosted by newly approved ETFs and open interest reaching $9.25 billion.

Blockchain tracking systems discovered multiple eight-digit transfers, including a $73.6 million deposit to Coinbase. Analysts now view the $3.30 monthly closing price as a key threshold for breaking historical highs.

Analysts Indicate: XRP Price May Challenge $4.80 If Breaking Key Resistance

Crypto analyst Ali Martinez discovered a key technical pattern suggesting that if XRP's closing price breaks a specific resistance level, the price could surge to $4.80. This analysis is based on a parallel channel pattern observed on the weekly chart—a technical indicator hinting at potential breakthrough momentum.

The parallel channel is characterized by price consolidation between two parallel trend lines, typically signaling a significant market move. Breaking the upper rail often indicates continuation of an upward trend. Martinez's chart shows XRP has been trading within this channel for months, with the $4.80 target price calculated through movement measurement.

While the analysis does not include specific exchange data, it is relevant for all platforms supporting XRP trading. Market participants will closely watch weekly closing prices to confirm the breakthrough scenario.

XRP Futures at CME Reach $235 Million, Showing Strong Institutional Demand

On July 11, CME Group's XRP futures daily trading volume soared to a record $235 million, reflecting accelerating institutional interest in the cryptocurrency. The derivatives giant reported trading 9,100 contracts—equivalent to 82 million XRP tokens—marking a significant milestone since its launch in May 2024.

The total notional trading volume of standard (50,000 XRP) and micro (2,500 XRP) contracts has exceeded $1.6 billion. CME Active Trader attributes this trading activity to "rapidly growing demand", reinforcing the platform's position as the preferred regulated crypto derivatives trading venue. This record follows CME's introduction of Bitcoin and Ethereum futures in 2017 and 2021, respectively.

Is XRP a Good Investment?

According to BTCC financial analyst Emma's analysis, XRP is currently a promising investment target. Here are some key data and analysis:

| Indicator | Value |

|---|---|

| Current Price | 3.2452 USDT |

| 20-day Moving Average | 2.5000 USDT |

| Bollinger Band Upper Rail | 3.1720 USDT |

| MACD Histogram | -0.1271 |

From a technical perspective, XRP has broken through key resistance levels and has strong institutional demand. If market sentiment remains optimistic, XRP has the potential to challenge the target price of 4.80 USDT. However, investors should still be aware of market volatility risks.