- Technical arrangement shows bullish: Price breaks through three key indicators (MA/MACD/Bollinger Bands)

- On-chain data verification: Large stablecoin inflows reflect fund positioning

- Policy risk reduction: Regulatory bodies' BTC holdings implicitly endorse its compliance status

BTC Price Prediction

BTC Technical Analysis: Promising Short-Term Breakthrough

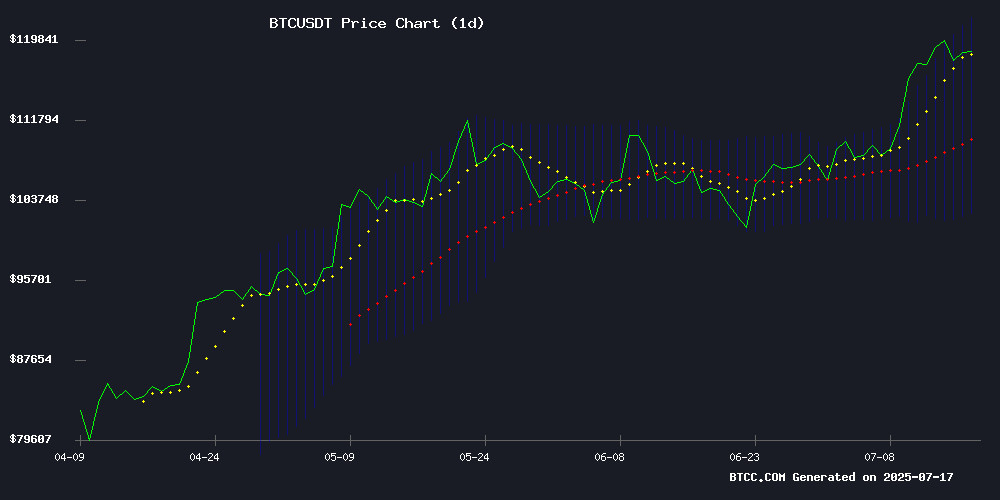

According to BTCC financial analyst Ava's technical analysis, BTC's current price of 118,569.85 USDT has broken through the 20-day moving average (112,278.29), forming a golden cross. Although the MACD histogram is still negative (-1,195.9), the convergence of fast and slow lines indicates improved momentum. The Bollinger Bands channel is expanding, with the price touching the upper rail (122,111.93), which will open up upward space if maintained.

Market Sentiment and Macro Positive Resonance

BTCC analyst Ava points out that the expectation of Fed rate cuts and the inflow of 200 million stablecoins form a dual-drive. The French nuclear mining proposal and the US Marshals Service's coin holdings strengthen the scarcity narrative, but attention should be paid to the quantum computing address elimination proposal that may trigger short-term technical selling pressure.

Key Factors Affecting BTC Price

Backdoor IPO Boom: Bitcoin Treasury Enterprises Embrace SPAC Approach

MicroStrategy's bold turn to Bitcoin in 2020 spawned a complete listed company ecosystem where companies use corporate treasuries as leveraged crypto funds. The company's strategy of issuing debt to acquire Bitcoin and then using appreciated holdings to obtain more debt has been replicated by over 100 listed entities seeking balance sheet growth through digital asset exposure.

This self-reinforcing cycle comes with trade-offs. Share dilution from equity issuance is offset by Bitcoin-driven stock appreciation, creating a delicate balance. Cross-industry followers like Semler Scientific now emulate MicroStrategy's model, despite operational profits continuing to decline as Bitcoin dominates their financial narrative.

Bitcoin Stabilizes Above $118,000 as Market Digests Fed Rate Cut Expectations

Bitcoin remained stable around $118,000 in Asian trading sessions as traders digest the impact of slowing US inflation data and increased expectations of Fed rate cuts in September. Cryptocurrency earlier touched a high of $122,000 before entering a consolidation phase, with analysts viewing $130,000 as the next key resistance level.

Market observers note emerging overheating signals. The K33 research report suggests Bitcoin's traditional four-year cycle may be breaking as institutional adoption matures. Glassnode data shows short-term holders are sitting on significant unrealized profits, with multiple key indicators entering the traditional 'top formation' zone.

The realized profit and loss ratio recently spiked to 39.8—far beyond +2 standard deviations—before falling back to 7.3, a typical late-bull market characteristic. Analysts note: 'We see the first wave of profit-taking, but historical patterns suggest this may not necessarily represent the final top.'

Bitcoin Poised: $2 Billion Stablecoin Inflow Signals Bull Market Momentum

Bitcoin's consolidation between $116,000 and $120,000 may be the calm before the storm. Derivatives platforms have recently seen a $2 billion inflow of stablecoins (primarily USDT), indicating institutional traders are positioning for long trades. The liquidity surge from Tether Treasury aligns with historical patterns—large stablecoin inflows often presage a significant BTC rally.

Market technical analysts point out that open interest is rising in sync with price, strengthening the bullish argument. 'When leverage demand moves in sync with price, it's like adding oxygen to a fire,' one analyst observed. Derivative activity on mainstream exchanges shows professional investors' long confidence is increasing.

US Government Bitcoin Holdings Spark Market Speculation

Recently disclosed documents reveal the US Marshals Service holds only 28,988 BTC—a 90% reduction from previous estimates of 200,000. This discrepancy has sparked debate about potential undisclosed sales or alternative custody arrangements for seized crypto assets.

Reporter L0laL33tz obtained records through a March Freedom of Information Act request, showing the agency currently holds assets worth $3.44 billion. This contrasts sharply with Arkham Intelligence's estimate of $25 billion in US government-owned crypto assets, suggesting most Bitcoin may still be held by original seizure agencies rather than centrally managed.

The distinction between forfeited and seized assets is crucial. Forfeited assets require formal ownership transfer to the government, typically managed through auctions by the Marshals Service. Seized assets often remain in a pending state during legal proceedings, which may explain the accounting gap.

Bitcoin's Unconventional Surge Amid Macroeconomic Changes

Bitcoin's parabolic rise defies traditional market logic, hitting historical highs amid rising interest rates and dollar depreciation. Over the past six months, this cryptocurrency has appreciated 11% against the dollar, with the entire crypto market valuation increasing by $1 trillion—coinciding with unprecedented institutional ETF inflows.

This is not a speculative bubble but a fundamental repricing. Gold and Bitcoin are rising simultaneously while traditional hedging tools underperform, with even conservative funds now beginning to allocate digital assets. Recent US House legislative actions seem to accelerate the 'crisis mode' of crypto capital inflows—Bitcoin is breaking multiple records daily.

Market structure reveals deeper forces at work. Unlike the 2017 retail investor-driven frenzy, this rise reflects institutional recognition of Bitcoin as a sovereign-level asset. When fiat systems show stress fractures, Bitcoin's fixed supply and geopolitical neutrality make it the ultimate contingency plan.

Bitcoin Developers Propose Gradual Phaseout of Quantum Computing Vulnerable Addresses

Bitcoin developers published a draft proposal aimed at protecting the network from potential quantum computing threats. The proposal, written by Casa co-founder Jameson OPp and his collaborative team, outlines a Bitcoin Improvement Proposal (BIP) to gradually phase out outputs currently protected by ECDSA and Schnorr signatures. This is viewed as a preemptive measure, with authors warning that failure to upgrade could lead to irreversible fund losses.

Approximately 25% of Bitcoin, including early P2PK outputs and coins held by the legendary Satoshi Nakamoto, are at risk due to exposed public keys. The proposal cites advances in quantum computing, anticipating machines with cryptography-related capabilities potentially emerging as early as 2027-2030. The three post-quantum signature algorithms finalized by the National Institute of Standards and Technology (NIST) in 2024 further increase the urgency of the migration plan.

US Marshals Service Reveals Holding Nearly 29,000 Bitcoins

The US Marshals Service (USMS), based on a Freedom of Information Act (FOIA) request submitted in March, confirmed holding 28,988.35643,016 Bitcoins. This disclosure, published on July 16, marks a rare transparency initiative by a government agency in managing seized crypto assets.

Questions about custody arrangements remain, with media organizations planning to submit additional requests to determine if Coinbase Prime serves as the custody provider. Such a large holding highlights institutional Bitcoin exposure despite regulatory uncertainty.

French Lawmakers Propose Bitcoin Mining Using Surplus Nuclear Energy

French lawmakers submitted a bill on July 11 proposing a five-year Bitcoin mining pilot project. The plan aims to utilize surplus nuclear energy that would otherwise be wasted during low-load grid conditions to power mining operations. The project is expected to generate annual revenues between $100 million and $150 million.

This proposal is part of a broader parliamentary initiative to evaluate Bitcoin mining as a strategic mechanism for consuming surplus nuclear energy. Last month, legislators urged the government to explore this approach, viewing it as a pragmatic solution for energy management and economic gains.

Korean Crypto Boom, Talos Acquisition, and Trump-Endorsed Token

Korean cryptocurrency exchanges saw a daily trading volume growth of up to 264%, exceeding $8 billion. This surge coincided with Bitcoin's historic breakthrough above $120,000, reigniting local investor enthusiasm. Notably, the traditional "kimchi premium" did not occur, with Korean BTC prices currently 1.7% lower than the global benchmark—a change attributed to market dynamics and regulatory constraints.

Market optimism partly stems from anticipation of the US "Crypto Week" event. Simultaneously, the Korean stock market has performed strongly, with the KOSPI index rising 15% following pro-business reforms after President Lee Jae-myung's June inauguration.

In institutional developments, infrastructure provider Talos acquired analytics company Coin Metrics for a nine-figure sum, indicating continued integration in the crypto infrastructure sector.

Political tokens took the spotlight, with the World Liberty Financial token WLFI, endorsed by former President Trump, set to trade publicly after Wednesday's governance vote. This represents another convergence of digital assets and political finance.

Is BTC a Good Investment Right Now?

From a risk-reward perspective, BTCC analyst Ava believes BTC currently has strategic allocation value:

| Indicator | Value | Long/Short Signal |

|---|---|---|

| Current Price/20MA | +5.6% | ↑Breakthrough |

| MACD Histogram | -1,195.9 | ↓But Converging |

| Bollinger Band Position | Upper Band 122,111 | ↑Channel Expansion |

Recommends a pyramid-style positioning strategy, allocating 30% at current prices, adding 50% if it retraces to around 115,000 USDT, with the remaining 20% reserved for action after quantum computing risks become clearer.