Written by: TechFlow

In July, the crypto market surged again.

BTC broke historical highs, and ETH spot ETF maintained continuous 9-week net inflows; last week, ETH spot net inflows reached $850 million, setting a record, with capital never stopping, and the market feeling optimistic again.

However, the real catalyst might not be in the price curve, but in the U.S. House of Representatives in Washington, D.C.

From July 14 to 18, the House announced "Crypto Week", focusing on reviewing three milestone bills: the GENIUS Act, CLARITY Act, and Anti-CBDC Act, targeting stablecoins, digital asset classification, and central bank digital currency (CBDC).

This intensive legislative feast is not only a turning point for the U.S. crypto industry but could also influence the entire crypto market's direction and asset changes.

Let's take a look at the progress of these three bills during this week and grasp the market pulse of Crypto Week.

[The rest of the translation follows the same professional and accurate approach, maintaining the original meaning and tone while using the specified translations for specific terms.]Hidden opportunities include institutional fund inflow and startup boom: Financial institutions may accelerate the launch of more cryptocurrency ETFs, while developer protection clauses will generate a blockchain startup wave, attracting venture capital. Compared to the EU's strict regulations, the US's lenient policies will provide investors with extensive cross-border arbitrage opportunities.

Decentralized Assets: Building a "Privacy" Moat

The anti-CBDC bill defends the decentralization concept, will consolidate BTC's status as "digital gold", and open up new tracks for privacy technologies. Bitcoin returns are tied to institutional investment and community faith; the bill's passage will further strengthen its anti-censorship narrative, attracting long-term holders. Privacy coins (Monero, Zcash, etc.) and anonymous technologies will also rise due to increased privacy protection demands.

Distinguishing from other countries' CBDC processes, anti-CBDC bill proponents believe government CBDC launches will become "surveillance tools" for user assets, directly conflicting with Web3's decentralization core principles. The US's pioneering anti-CBDC action will undoubtedly make crypto people and money prefer the US as their "base". If the US becomes a "safe haven" for decentralized assets, it will further consolidate its global crypto market attractiveness.

Crypto Week Sets Industry Future Tone

Since the "crypto president" Trump took office, the US government's attitude towards the cryptocurrency field has undergone a massive transformation.

Behind this, numerous Wall Street institutions and US-listed companies have sensed the government's changing crypto attitude. The government's push for industry compliance undoubtedly breaks these giants' final reservations. An "unregulated" market has limited fund capacity, while a market with "rules" can accommodate massive fund inflows, which will undoubtedly bring substantial funds into mainstream cryptocurrencies like BTC, ETH, and more crypto tracks.

Structural Opportunities for Investors Under Legislative Winds

Under this transformative trend, what opportunities might crypto market investors have?

Note, all following text represents the author's personal thoughts and experiences, not investment advice. The crypto market changes dramatically; although legislation brings positive signals, thorough personal research is still necessary.

GENIUS Bill (Stablecoins)

The GENIUS bill's most critical aspect is injecting compliance momentum into the stablecoin market, promoting its application in payments and DeFi, with market scale expected to grow rapidly.

Compared to the EU's MiCA, the bill's more lenient regulatory environment might further attract global stablecoin issuers to register in the US, creating regulatory arbitrage opportunities.

Not just Circle and Tether, when more companies can issue and compliantly operate their stablecoins, these companies benefiting from crypto narratives might see excellent stock performance.

Simultaneously, as stablecoin usage and front-end carriers, wallet tracks will gain unprecedented opportunities. Integrating KYC/AML functions, compliant wallets will attract more institutional and retail users.

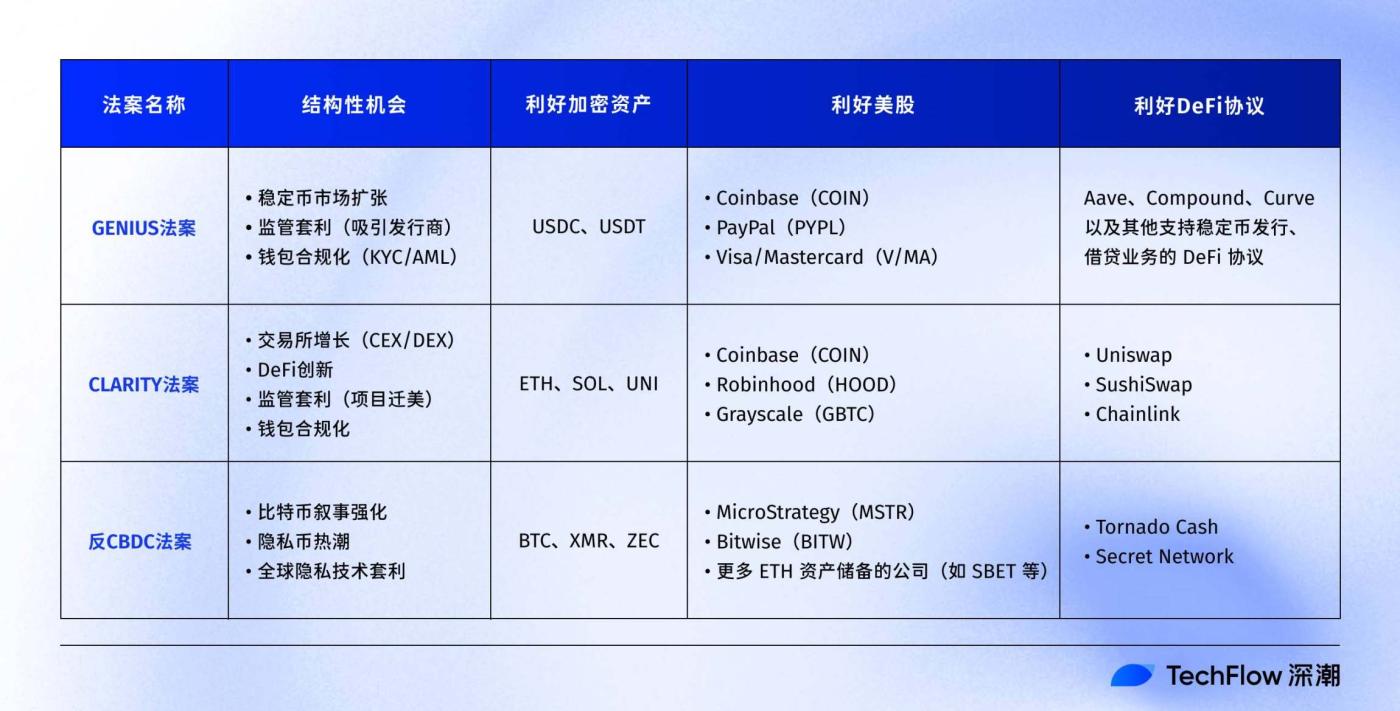

For specific assets, crypto assets like USDC, USDT (expanding market share), DeFi protocols like Aave, Compound (lending), Curve (stablecoin exchange); US stocks like Circle (CRCL), Coinbase (COIN, high stablecoin trading volume), PayPal (PYPL, exploring stablecoin payments), Visa/Mastercard (V/MA, payment integration) are worth further attention.

CLARITY Bill: Exchange and DeFi Growth Potential

The CLARITY bill, by clarifying asset classification and developer protection, reduces compliance costs for exchanges and DeFi projects, driving transaction volume and innovation wave. Centralized and decentralized exchanges will benefit from user growth.

Favorable assets include: crypto assets like ETH (DeFi core), SOL (high-performance blockchain), UNI (Uniswap); US stocks like Coinbase (COIN), Robinhood (HOOD, supporting crypto trading), Grayscale (GBTC, Bitcoin/Ethereum trust); DeFi protocols like Uniswap, SushiSwap, Chainlink (cross-chain).

Anti-CBDC Bill: Long-term Value of Decentralized Assets

The anti-CBDC bill prohibits the Federal Reserve from issuing CBDC, enhancing Bitcoin's attractiveness as a decentralized value storage, attracting long-term holders and institutional funds. Simultaneously, the bill emphasizes privacy protection, creating narrative space for privacy coins (like Monero, Zcash) and anonymous transaction technologies.

Favorable assets include: crypto assets like BTC, ETH, XMR, ZEC; US stocks like MicroStrategy (MSTR), Bitwise (BITW, crypto asset management), and companies with more ETH asset reserves; DeFi protocols like Tornado Cash (anonymous transactions).

Overall, the three bills drive three trends: accelerated institutional fund inflow, crypto and traditional finance integration, and Web3 startup emergence.

If a specific investment strategy is required, short-term focus on stablecoin-related assets and companies, mid-term deployment of DeFi blue-chip assets, long-term BTC holdings, and tracking privacy coins and Web3 startups meeting new regulatory requirements would be a good choice.