HBAR has recently experienced a price increase, reaching a new high. However, this altcoin has encountered a significant resistance level at $0.241, which it is struggling to overcome.

As a result, traders are currently facing increasing pressure, and worsening conditions could trigger significant liquidations.

HBAR Traders Are in Trouble

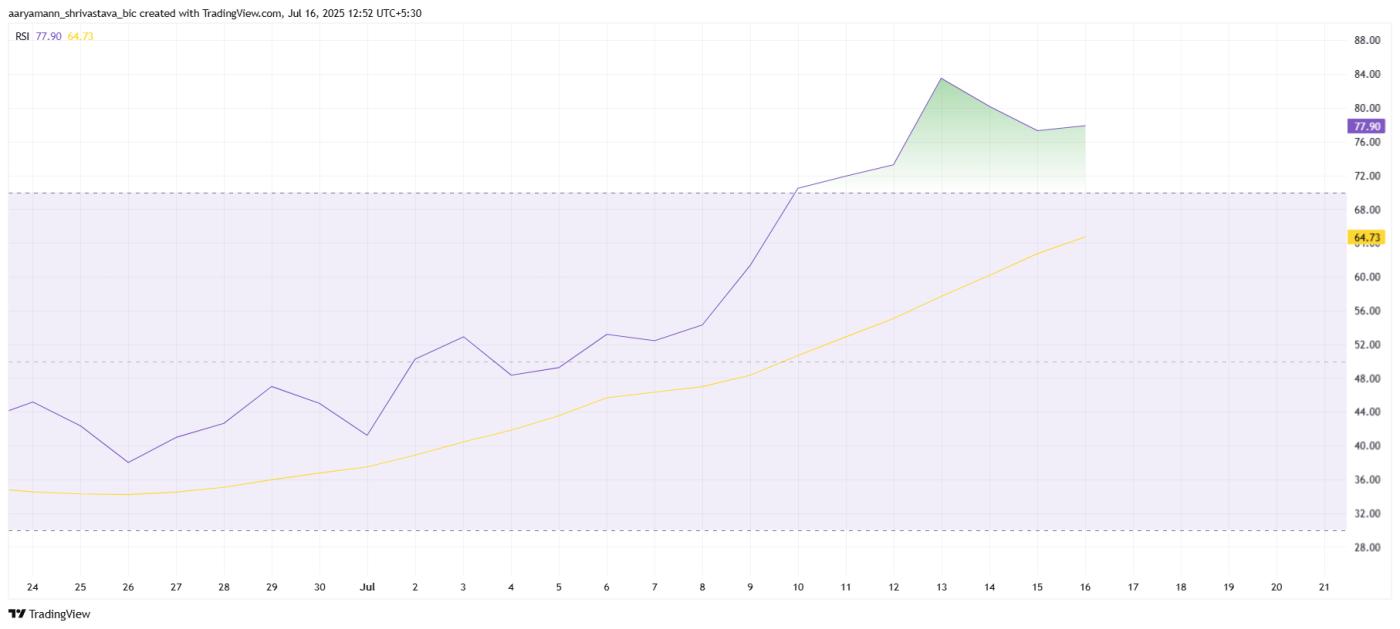

The Relative Strength Index (RSI) shows that HBAR is currently overbought. The index is crossing the 70.0 threshold, which typically signals a potential reversal. When the market is saturated, upward momentum may shift to downward movement. Investors tend to take profits in such situations, which could push prices lower.

With the market cooling down, there is a growing concern about price correction. Investors are currently highly cautious, and selling may increase if the overbought condition continues. As a result, many traders may be looking to liquidate their positions before further price decline risks emerge.

HBAR RSI. Source: TradingView

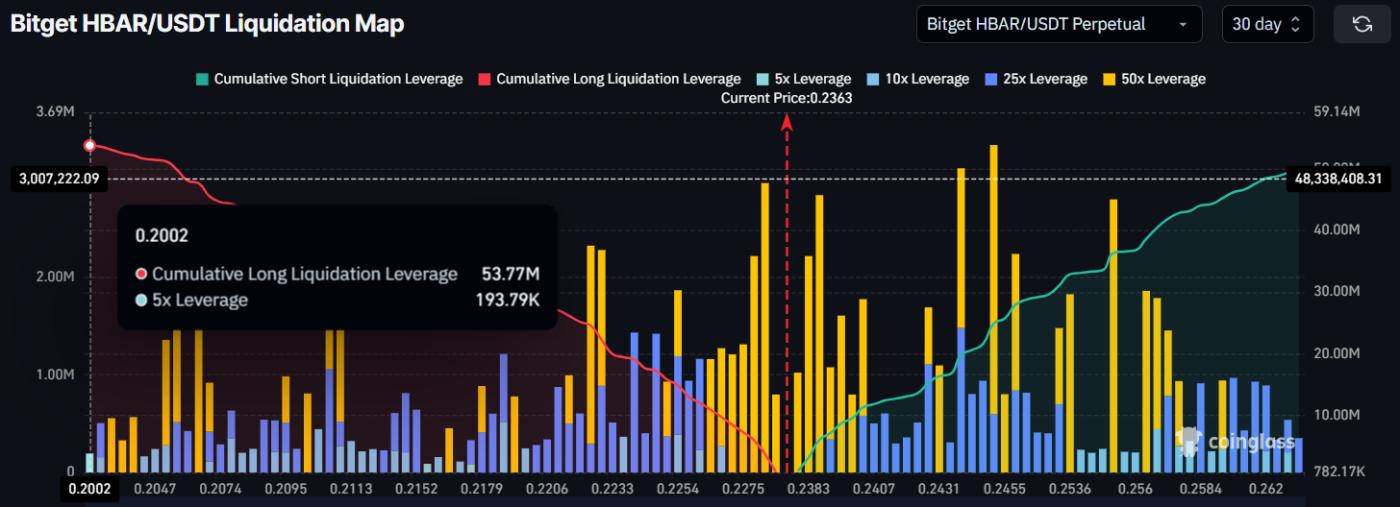

HBAR RSI. Source: TradingViewLooking at the liquidation chart, there is a real possibility of significant losses for HBAR traders. The chart shows that if the price drops to $0.20 or lower, around $53 million in buy positions will be liquidated. This will create selling pressure and potentially push the price even lower.

Traders who bought during the recent price increase are at risk of losing a substantial amount if the market turns against them. The liquidation risk further intensifies the bearish sentiment around HBAR, as a subsequent price decline could trigger additional sell-offs, exacerbating the downturn.

ooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooass

ooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooassHBAR Price Has a Chance to Prevent Losses

HBAR's price is currently at $0.235, with resistance at $0.241. Despite the recent price increase, broader market conditions are pulling it down, with the next key support level at $0.220. If this altcoin fails to hold above this level, it could slide to $0.200.

In the event of increasing bearish sentiment or rising selling pressure, HBAR could drop below $0.220, touching the psychological support at $0.205. Falling below this critical level could trigger $53 million in liquidations, further intensifying the decline.

HBAR Price Analysis. Source: TradingView

HBAR Price Analysis. Source: TradingViewHowever, if HBAR can hold above $0.220 and break through the $0.241 resistance, there could be an opportunity for a price increase. A successful bounce from $0.220 could push HBAR to $0.267, providing some relief for traders and reinforcing its upward price potential.