This time, the CPI is slightly higher than expected, which is a bit of a cold water, but the core CPI meets expectations, which is relatively neutral. Simply put: not good enough, not bad enough, no big surprises, and it won't directly crash the market, but don't expect a sudden surge. The market still needs to digest it slowly.

BTC surged to $123,000 before the data release, but after the data came out, it fell back to around $116,000, dropping 7,000 points; ETH also dropped from $3,083 to $2,930, but overall still maintains a high-level oscillation.

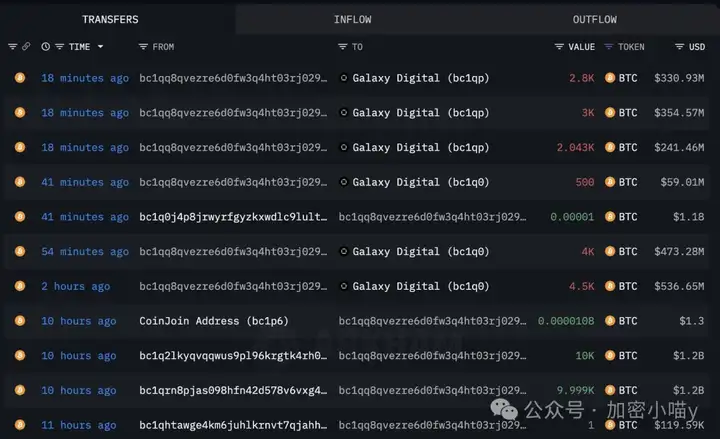

The direct trigger for this pullback was actually a whale who hadn't moved for 14 years suddenly becoming active. On-chain data shows that this OG whale transferred nearly 40,000 BTC (about $5 billion) and sent it to Galaxy's OTC wallet, with some BTC entering exchanges, causing market panic.

To be honest, I was initially worried about a major negative CPI, but now it seems that this whale's "dumping" has released risks in advance, and the opportunity for low-multiple positions has come again!

Technical Analysis: Normal Correction After Upward Movement

For #BTC on the daily line, there was a significant upper shadow yesterday, followed by oscillation and pullback, with the market testing the support of the 7-day moving average. If it doesn't break the position, this pullback is actually to build momentum for the next wave.

For #ETH, it's oscillating horizontally around $3,000, with bulls still dominating the situation. MACD maintains a golden cross, and the overall trend is healthy, which is good as long as it doesn't break position.

Conclusion: This is a healthy adjustment, not a reversal.

As for Altcoins: This Altcoin market is very different from the past. In 2015, Altcoins were truly copycat coins, mostly just modifying Bitcoin parameters; later during the ICO era, everyone was building platforms around Ethereum, competing on performance and security; by 2021, DeFi, stablecoins, and lending protocols were flourishing, with TVL becoming a new indicator - it was an Altcoin bull market where both retail and institutional investors could make money. But now? The narrative has changed - protocol innovation has basically peaked, public chain patterns have stabilized, and new projects find it hard to start from scratch.

Now, market funds are only chasing two extremes:

✅ Either top-tier Meme (#trump, #pump, #bonk, #fartcoin); ✅ Or extreme applications (like #JTO, #ENA, #ONDO, #ETHFI).

Those coins stuck in the middle without distinctive features will be eliminated if they don't transform. The future survival rule is: either bind to US stocks/ETF/institutional narrative, or have a product with a traffic closed loop.

So, the strategy for investing in Altcoins now is: either meme leader or application leader. If you don't want to take risks, just honestly hold BTC, cross margin BTC, and you'll never go wrong.

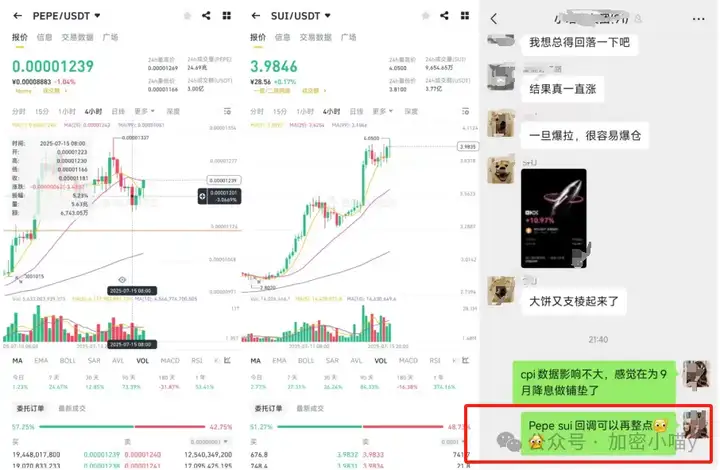

Additional note: I added some #PEPE today. #SUI's trend is also strong, waiting for it to pull back to make a move! According to the bull market rhythm, there might be only three months left for Altcoins to take off. This adjustment must be seized, get on board and prepare to lock positions! Follow closely and charge!

Rhythm Judgment: August is a Good Pullback Opportunity, October is the Golden Breakout Point

Many people are waiting to "buy the dip," but the market never follows emotions. In a bull market, don't short if you don't understand the rise, or you might miss the train. My personal rhythm is: complete positioning by the end of August, focusing on the October market.

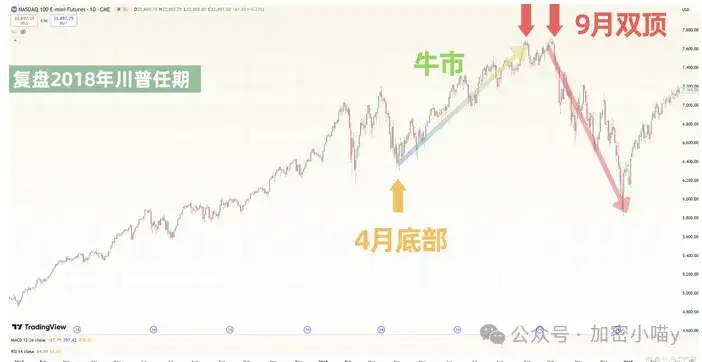

Why choose August? In the past five years, July's average return was close to +10%, but August and September are relatively weak, making them ideal for adding positions; October and November are historically the strongest months in the crypto market, with October known as "Uptober" with an average increase of over 20%.

Let's look at the market trend during Trump's era in 2018, will this time follow a similar pattern?

Market summary:

- BTC/ETH continue low-multiple strategy unchanged, pullback is an opportunity;

- Pay attention to SOL, XRP, DOGE and other Altcoins with ETF narrative;

- Control positioning rhythm, don't chase highs, enter in batches;

- If you don't want to be too complicated, regular BTC investment is always the right choice.

During the bull market, don't be scared by temporary fluctuations. The hardest part is not making a fortune, but holding on. Now is the time to compete on vision and perspective. Let's go!

That's it for the article! If you're feeling lost in the crypto world, consider joining our community to layout and harvest from market makers!