Author: Zz, ChainCatcher

Editor: TB, ChainCatcher

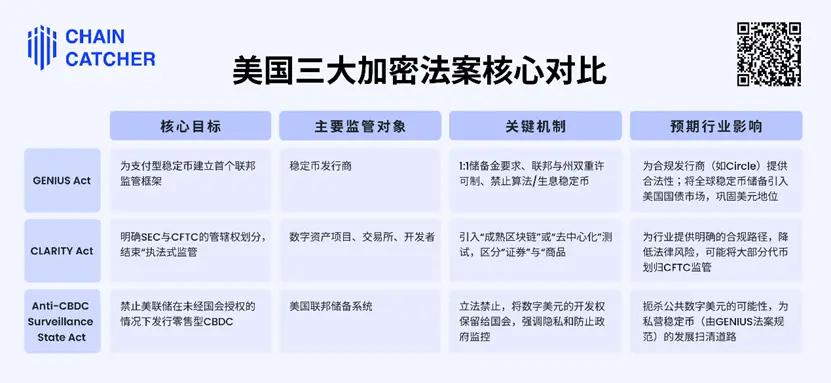

The U.S. Congress is advancing critical crypto regulatory legislation at an unprecedented speed. During the "Crypto Week" in July 2025, the House will hold decisive votes on three core bills. According to the agenda published by House Majority Leader Steve Scalise, the "Guiding and Establishing National Stablecoin Innovation Act" (GENIUS Act), the Digital Asset Market Clarity Act (CLARITY Act), and the Anti-CBDC Surveillance State Act have been reviewed by the Rules Committee on July 14.

The House held a procedural vote to determine debate terms on July 15, with the final vote expected on Wednesday or Thursday (July 16 or 17). The rapid advancement of these three bills will bring long-awaited regulatory certainty to the Web3 industry.

These bills will directly impact daily user experiences: stablecoins will gain clear legal status and stronger security guarantees, digital asset transactions will proceed under clear rules, while ensuring the government cannot forcibly implement potentially privacy-invasive central bank digital currencies.

This article will provide a detailed analysis of how these three bills will reshape the regulatory landscape for stablecoins, digital asset transactions, and central bank digital currencies, as well as their practical impact on the entire Web3 ecosystem.

The changes these three bills will bring:

- Legally prevent the issuance of central bank digital currencies in the United States, protecting the existing crypto market space

- Avoid competitive impact of government digital currencies on the decentralized finance ecosystem

- Create more development space for private sector digital assets

- Provide a clear regulatory framework for U.S. dollar stablecoins, reducing compliance costs

- Make stablecoin issuance more standardized, enhancing user trust

- Provide stronger legal protection for stablecoin use in DeFi protocols

- Provide clear market rules for other digital asset transactions

- Reduce regulatory uncertainty and lower project compliance risks

- Provide more clear legal boundaries for digital asset innovation

GENIUS Act: The Digital New Clothes of U.S. Dollar Hegemony

The GENIUS Act will bring comprehensive regulation to the stablecoin market, directly affecting the digital asset experience of every Web3 user.

The act requires all stablecoin issuers to obtain federal or state licenses and hold U.S. dollars, bank deposits, or short-term U.S. Treasury bonds at a 1:1 ratio as reserves. This means that each stablecoin held by users is backed by an equivalent dollar asset, significantly enhancing fund safety.

For users, the most important changes include: algorithmic stablecoins will be explicitly banned, with a two-year transition period, meaning projects like Terra/Luna will not be able to operate in the United States. Stablecoins will not be able to pay interest to holders, and users will need to seek returns through other DeFi protocols.

The act is essentially a financial strategic layout by the United States. By forcing stablecoin reserves to hold dollar assets, it is expected that by 2028, 1.6 trillion dollars of the global 2 trillion dollar stablecoin market will flow into U.S. short-term Treasury bonds, further consolidating the dollar's dominance in the digital world.

The act will have a profound impact on the industry landscape. Compliant U.S. issuers like Circle will be the biggest winners, with CEO Jeremy Allaire repeatedly expressing support, believing the act will formally incorporate stablecoins into the U.S. financial system as "cash equivalents" on corporate balance sheets, thus opening the door to institutional adoption.

In contrast, small or non-compliant issuers will face enormous compliance costs and survival pressure, potentially leading to further market consolidation. Foreign issuers wanting to enter the U.S. market must also meet strict registration and regulatory requirements. Although the act has broad bipartisan support in the Senate, some Democrats still express concerns about the strength of consumer protection and national security provisions.

CLARITY Act: Defining the "Boundary" Between SEC and CFTC

The U.S. crypto industry has long been plagued by regulatory uncertainty. The jurisdictional dispute between SEC and CFTC, and the SEC's "enforcement-style regulation" strategy, have left the entire industry walking on eggshells. The SEC's insistence on using the 1940s "Howey Test" to determine whether digital tokens are securities not only stifles innovation and hinders industry development but also triggers legal battles like the SEC's lawsuit against Coinbase. The CLARITY Act is precisely aimed at ending this chaos.

The act's core innovation is introducing the concept of a "mature blockchain system". The basic logic is: digital assets may be regulated by the SEC as "investment contract assets" during the initial financing stage, but as the network becomes sufficiently decentralized, they can transform into "digital commodities" regulated by the CFTC.

Key criteria for determining whether a blockchain system is "mature" include: no single entity holds more than 20% of tokens, and the project's value primarily comes from actual use rather than speculative trading. This means truly decentralized mature projects will receive a more relaxed regulatory environment. This effectively writes the theory of "full decentralization" into law.

According to the act, the SEC will primarily be responsible for the initial issuance of digital assets and "maturity" certification review, while retaining anti-fraud enforcement rights. The CFTC will gain exclusive jurisdiction over "digital commodities", including spot markets. The CFTC will become the primary regulator of the crypto market, with a regulatory style typically more pragmatic and innovation-friendly than the SEC. This means Web3 projects may gain more development space.

Web3 projects will have a clear "graduation path" - transitioning from securities regulation to commodity regulation, providing legal certainty for long-term development. Users trading mature digital assets will face a more friendly regulatory environment, reducing the risk of suddenly being deemed "unregistered securities".

This framework brings unprecedented certainty to the industry. Giants like Coinbase and a16z have expressed support, believing this is the legal clarity the industry needs. For users, this means more clear compliance guidelines and more stable regulatory expectations when participating in Web3 applications like DeFi and Non-Fungible Tokens.

Anti-CBDC Act: An Ideological Battle About "Financial Freedom"

The Anti-CBDC Surveillance State Act is the most ideologically charged of the three bills. Its content is simple and direct: prohibit the Federal Reserve from issuing retail-facing central bank digital currencies (CBDC) without explicit congressional authorization.

This means the United States will not introduce an official digital currency like China's digital yuan. The bill's proponents fear that CBDC could become a "government-controlled programmable currency" that would allow the government to monitor, censor, or even limit users' every transaction, directly conflicting with Web3's core principles of decentralization and privacy protection.

The bill is actually protecting the Web3 ecosystem from direct government competition. If the Federal Reserve issues CBDC, it could pose a significant threat to Bitcoin, Ethereum, and various DeFi protocols, as users might be more inclined to use the "official" digital dollar.

Democrats oppose the bill, believing it would weaken the United States' financial innovation capabilities, but for web3, the bill's passage means that cryptocurrencies and DeFi protocols will continue to develop in a relatively free environment without worrying about direct competition from official digital currencies.

The bill's passage will ensure that the future of digital dollars is led by the private sector—specifically through stablecoins regulated by the GENIUS Act. This is a double-edged sword for Web3 users: on one hand, it avoids direct government control and maintains decentralization; on the other hand, stablecoins still need to follow strict regulations, which may limit innovation space.

Goodbye to the Wild West, Embrace Regulation

The rapid advancement of this series of bills is the result of years of negotiation and collaboration between the U.S. political world, capital, and the crypto industry. Facing the EU's MiCA Act and proactive layouts in places like Hong Kong, the United States is trying to reclaim its leadership in the digital financial field through a combination of strategies.

Under the push of key figures like Patrick McHenry, the House Financial Services Committee successfully transformed crypto policy from partisan dispute to national consensus. The bill received extensive support from Democrats in the House, showing a fundamental change in the U.S. political world's attitude towards the Web3 industry.

The crypto industry has evolved from tech geeks to a powerful political lobbying force. Companies led by Coinbase have invested heavily in pro-crypto political action committees, with its CEO Brian Armstrong and advocacy organization Stand With Crypto actively lobbying legislators, successfully packaging industry demands as consumer protection and innovation encouragement. Circle has demonstrated to legislators how regulated stablecoins can serve U.S. financial interests through its compliant image.

Meanwhile, top venture capital firms like a16z and think tanks such as Coin Center and the DeFi Education Fund have provided theoretical foundations and specific legal text suggestions for the bill, profoundly influencing its final form. This marks the "professionalization" of the crypto industry's political operations, capable of influencing legislative processes.

The passage of this series of bills signifies the beginning of a new era. The "Wild West" period of the crypto industry is gradually coming to an end. As the cost of obtaining legal certainty and market legitimacy, the entire ecosystem will be formally incorporated into the existing financial regulatory framework. Stablecoin issuers will become U.S. Treasury bond purchasers, and digital asset projects must operate within the frameworks defined by the SEC and CFTC.

This is an important trade-off: the industry surrenders some innovation freedom in exchange for clear development space in the world's largest market. The United States, through standardized management, will transform Web3 technology into a new tool to consolidate its financial dominance. The regulatory "clarity moment" has arrived, meaning higher security but potentially fewer innovation choices and higher compliance costs.

Recommended Reading:

The Rise of Stablecoins: Catalyst of the New Digital Financial Era

Going Public in the U.S.: Ultimate Destination or Expedient for Crypto Companies?

Seven Years of Grudges Hanging: Trump "Forcing" Powell, What Will the Resignation Storm Bring?