Get the best data-driven crypto insights and analysis every week:

Circle (USDC) Analyst Report

By: Cooper Duschang & The Coin Metrics Team

Introduction

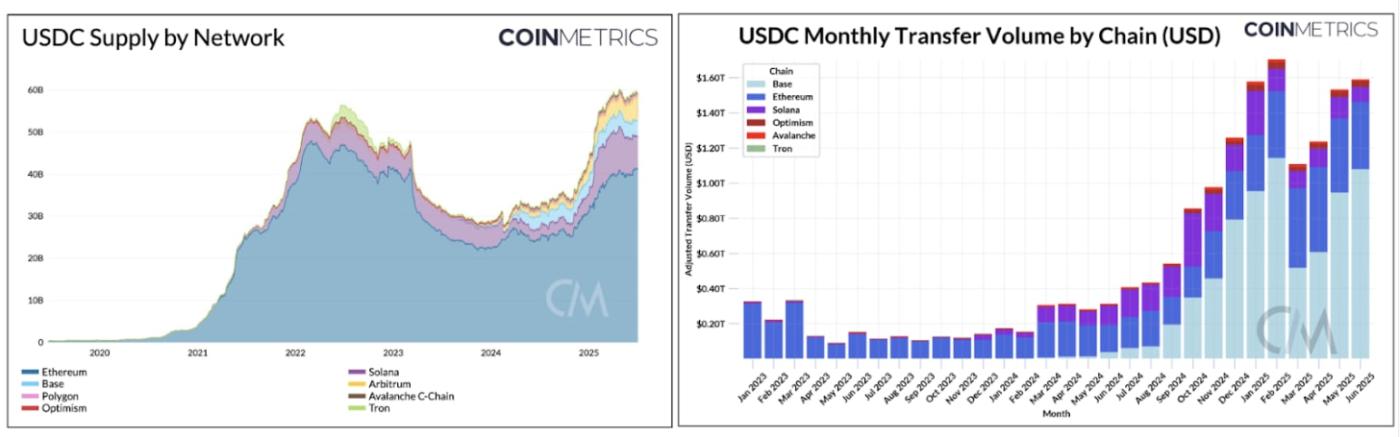

As the second-largest digital dollar with a $61B market cap, Circle’s USDC is among the most trusted and widely adopted stablecoins. It benefits from strong alignment with regulatory frameworks, robust banking relationships, and strategic distribution through both exchanges and on-chain ecosystems.

In this issue of Coin Metrics’ State of the Network, we unpack key findings from our latest report on USDC, examining the economic, regulatory, and technical factors driving its adoption across the market.

Source: USDC Overview Report, Coin Metrics Network Data Pro

Key Takeaways from the Report:

Strategic Distribution Through Coinbase

Coinbase plays a key role in USDC’s adoption as a major holder and distribution channel. Integration of USDC across various exchanges and products incentivizes usage and creates opportunities for USDC to be issued and bridged on-chain for new use-cases.

Bridging the Gap Between Financial Networks

Circle’s supportive mint and redeem policies encourage the adoption of USDC as a bridge between traditional financial systems and blockchain networks. Approved users can seamlessly redeem even small amounts of USDC for fiat currency, enabling interaction with individuals and businesses who do not yet accept stablecoin payments.

Consistent Regulatory Alignment

Management of USDC reserves aligns with global regulatory frameworks, including the European Union’s MiCA regulations. Circle’s proactive approach sets a precedent for USDC as a cross-jurisdictional stablecoin, encouraging merchants and institutions to adopt USDC as the stablecoin of choice.

To explore more data on USDC, check out our Circle (USDC) Overview Dashboard

Market Data Highlights

Source: Coin Metrics Market Data Pro

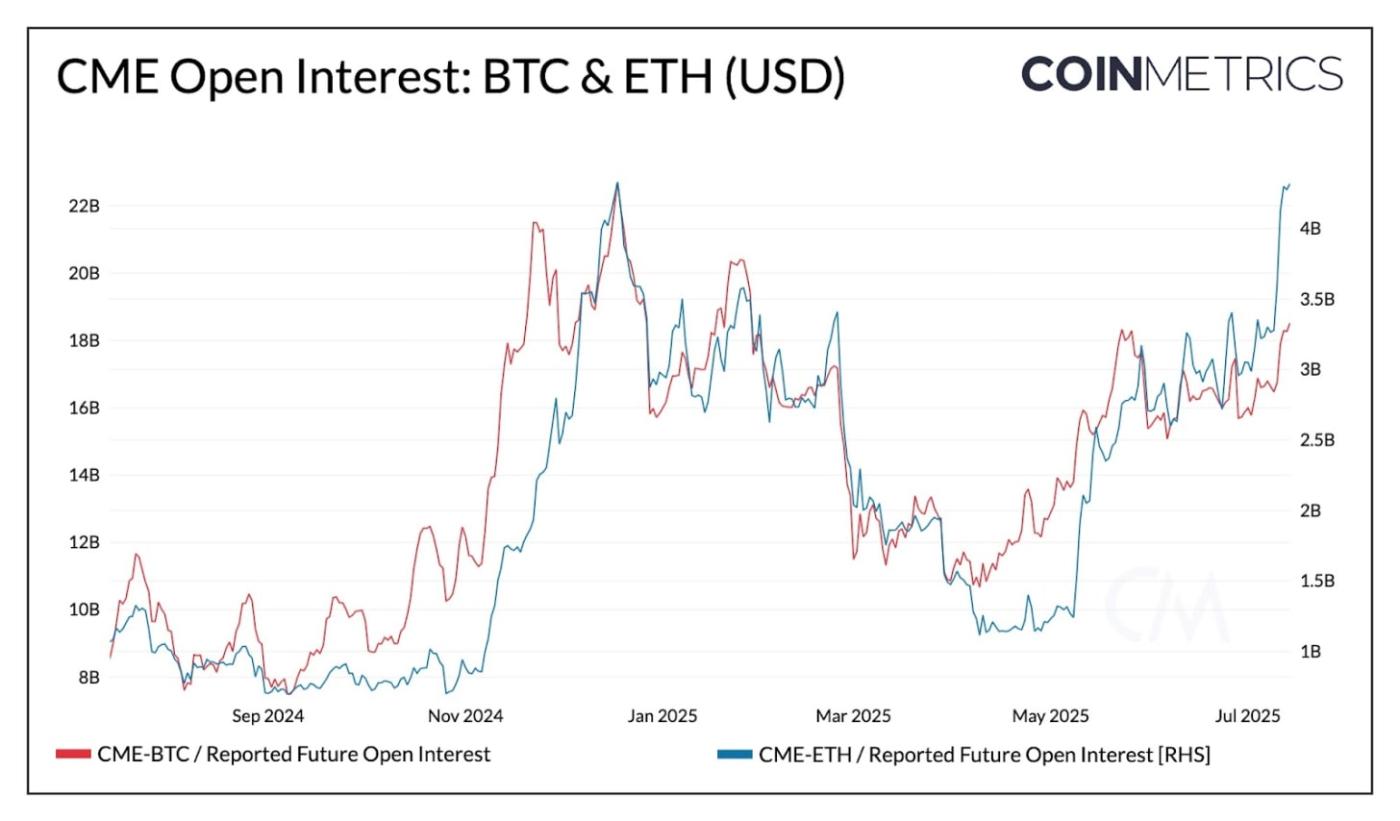

Ether (ETH) futures open interest on the CME recently reached a record-high of $4.3B. This appears to be driven by growth in market-neutral strategies like the basis trade, where participants go long ETH through spot or ETFs, while shorting CME futures.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

We released new features to our Dashboard v2 application, including value boxes.

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.