Under the Bitcoin frenzy, four listed companies are taking a different approach, betting on Ethereum reserve funds. Instead of simply hoarding coins, they are using strategies like staking to generate capital, reshaping the logic of corporate assets.

Written by: Christopher Rosa

Translated by: Saoirse, Foresight News

[The rest of the translation follows the same professional and precise approach, maintaining the technical terminology and specific names as instructed. Would you like me to continue translating the entire text?]After strategic adjustment, Bit Digital significantly expanded its Ethereum reserves through public issuance and Bitcoin sales, increasing total holdings to 100,603 coins. Although the company has not yet disclosed specific staking quantities and expected returns after transformation, based on past operations, it will continue to focus on generating revenue through Ethereum staking.

Key Points

Bit Digital's reserve fund transformation is particularly noteworthy: it combines traditional public equity financing with the unconventional move of liquidating Bitcoin holdings to purchase Ethereum. This strategy sets Bit Digital apart among listed cryptocurrency companies, demonstrating its firm confidence in Ethereum's revenue generation capabilities. Compared to Bitcoin's passive role on the balance sheet, Ethereum's advantages are more prominent.

GameSquare(GAME)

Company Background

GameSquare Holdings (NASDAQ: GAME) is a gaming media group headquartered in Texas, owning brands like FaZe Clan, Stream Hatchet, and GCN, focusing on creator-led marketing content for global advertisers targeting Generation Z players. In July, the company raised approximately $8 million through a subsequent equity offering and partnered with cryptocurrency company Dialectic to launch an Ethereum reserve plan that can allocate up to $100 million in Ethereum, targeting a return rate of 8% to 14%.

Financing and Ethereum Acquisition

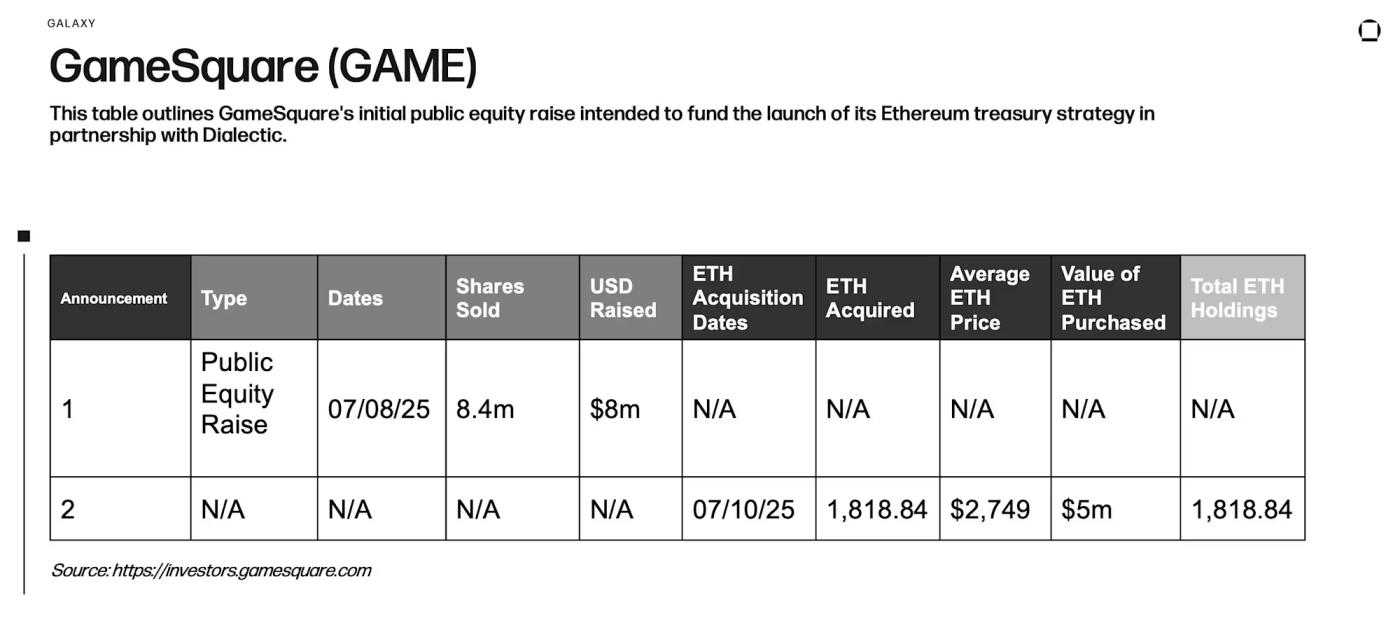

This table outlines GameSquare's initial public equity financing, aimed at supporting its Ethereum reserve strategy in collaboration with Dialectic.

Ethereum Deployment and Staking

As part of a broader digital asset reserve strategy, GameSquare has completed its first Ethereum purchase, acquiring $5 million worth of Ethereum. This move marks the company's formal entry into cryptocurrency reserves, aimed at asset diversification and supporting long-term innovation.

Key Points

GameSquare's shift to an Ethereum reserve strategy represents a bold expansion beyond its core gaming media business. By collaborating with Dialectic and leveraging its Medici platform, GameSquare plans to invest funds in the DeFi sector to achieve returns (8% to 14%) significantly higher than standard Ethereum staking yields (typically 3% to 4%). If successfully implemented, this strategy will directly contribute to the stability and development of the entire Ethereum ecosystem by enhancing liquidity of key DeFi protocols and enriching validator participation structures. Corporate capital's active involvement will further solidify the DeFi infrastructure foundation.

Ethereum Concentration

(Translation continues in the same manner for the rest of the text)Who Will Face the Largest Equity Dilution Risk?

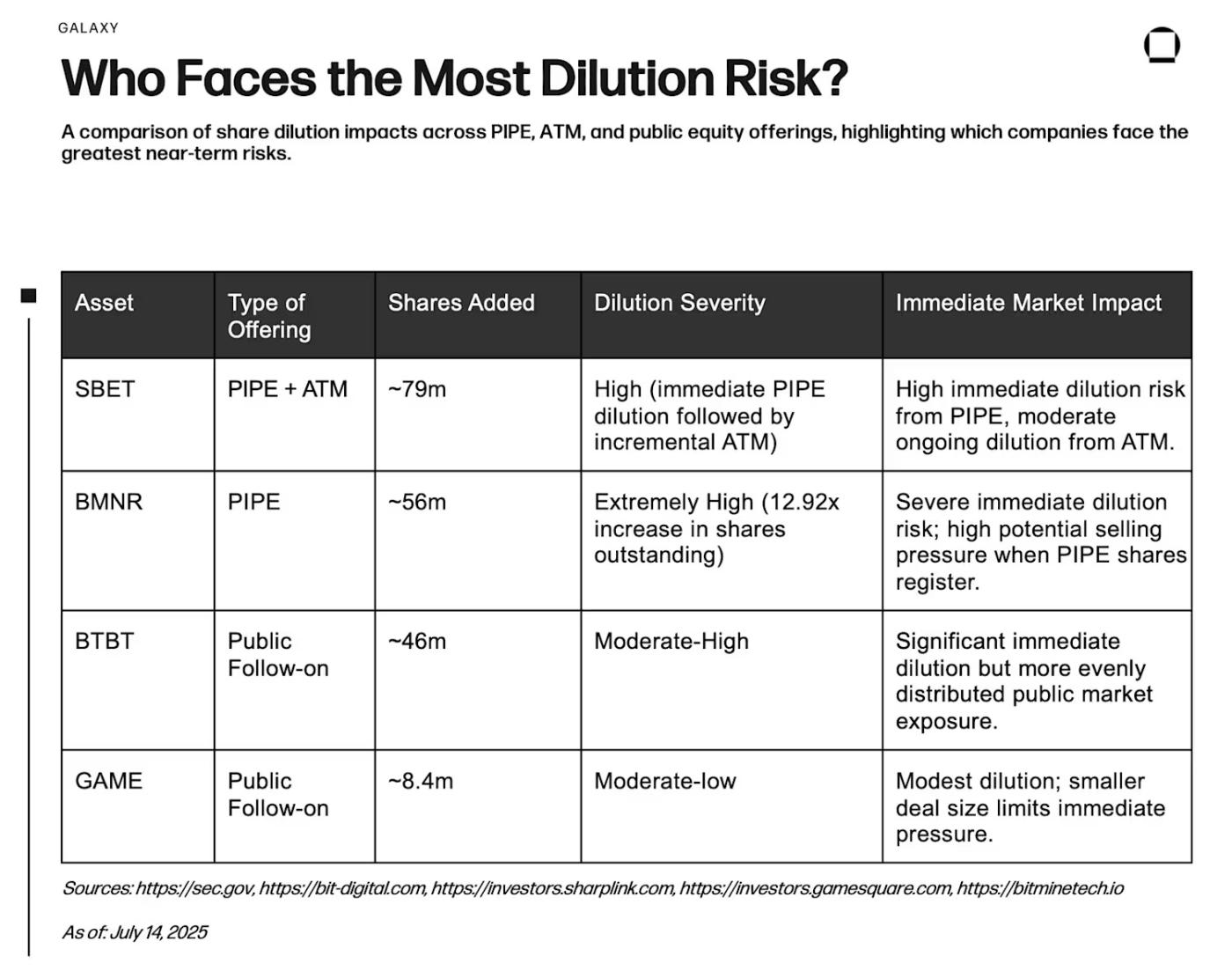

The image compares the impact of private investment in public equity (PIPE), at-the-market (ATM) offerings, and public stock issuance on equity dilution, highlighting which companies face the greatest short-term risks.

Investors need to carefully assess equity financing that adds new shares to the market, especially PIPE transactions, which dilute existing shareholders' interests and put pressure on stock prices. BitMine's large-scale PIPE issuance exposes it to significant dilution risk and stock price volatility in the short term; SharpLink's financing approach combining PIPE and ATM will cause immediate dilution and ongoing incremental pressure. In contrast, Bit Digital and GameSquare adopt a more transparent traditional public offering method, with clearer and more controllable dilution and relatively lower market risks.

Overall, compared to ATM and traditional public offerings, companies choosing the PIPE structure face higher initial market impact risks (especially during market volatility). However, all these equity-based financing strategies avoid the "high-leverage convertible debt" characteristic that Michael Saylor relies on at MicroStrategy.

Conclusion

On the surface, the violent fluctuations in Ethereum reserve-related stocks may resemble the speculative "boom and bust cycles" common to meme coins, but the strategies of the first companies deploying Ethereum reserves differ fundamentally. These companies are not relying on hype or passively holding assets, but positioning Ethereum as a "productive reserve asset" by earning native rewards through staking or implementing more complex DeFi strategies in some cases. This characteristic creates a stark contrast with Bitcoin reserve pioneers who follow a "passive digital gold" model and often finance their positions through high-leverage convertible bonds. In comparison, SharpLink, BitMine, Bit Digital, and GameSquare - these four Ethereum reserve companies - support strategy implementation through equity financing, thereby avoiding structural vulnerabilities from debt pressure and maturity peaks.

Moreover, these capital resources are not idle. By staking Ethereum, enterprises directly contribute to network validator security and protocol layer stability; companies like GameSquare, which plan to deploy native DeFi yield strategies, may also inject vitality into Ethereum infrastructure such as liquidity provision and lending markets.

Despite ongoing challenges like dilution risk, smart contract exposure, and price volatility, investors can comprehensively assess downside risks and upside potential through dilution impact analysis, premium-to-book value ratios, and other tools. Ultimately, this first batch of Ethereum reserve models demonstrates a more deeply engaged, capital-productive operating method. Although it has given birth to a class of on-chain corporate reserves exposed to market fluctuations, this model still has the potential to inject momentum into the Ethereum ecosystem's strengthening.

Disclosure: As of the date of this report, an affiliated entity of Galaxy Digital currently invests in BitMine and SharpLink Gaming.