Original Author: Matt Hougan, Chief Investment Officer of Bitwsie

Original Translation: Luffy, Foresight News

Want to know why Bitcoin hit a new all-time high last week?

There are many reasons, including continued demand from institutional investors and corporate finance departments. But one reason has been underreported: This week is "Crypto Week" in Washington, and you will see a lot of pro-crypto news in the coming days.

This is not something I made up. On July 3rd, the U.S. House of Representatives issued a press release with significant implications, officially announcing the week of July 14th as "Crypto Week" and promising to advance three key crypto bills:

The GENIUS Act: A clear regulatory framework for stablecoins

The CLARITY Act: An overall framework for regulating crypto assets

Anti-CBDC Surveillance State Act: A bill prohibiting the creation of a central bank digital currency in the United States

The GENIUS Act has passed the Senate, so if it passes smoothly in the House, it will be submitted to the President for signature and could become the first major crypto legislation in U.S. history.

The CLARITY Act and the Anti-CBDC Act still need Senate approval, but passing either of these bills in the House would be a significant milestone.

Why This Is So Important for Cryptocurrencies

I firmly believe that the passage of pro-crypto bills in the U.S. will both significantly boost crypto industry growth and reduce risks.

The growth logic is obvious and widely discussed. Clear cryptocurrency legislation will better incentivize large financial institutions to position themselves in the crypto space, bringing billions of dollars in investment to crypto assets and guiding trillions of dollars of traditional assets onto the blockchain. If you've ever wondered what would happen to cryptocurrencies if JPMorgan, Bank of New York Mellon, and Nasdaq could freely develop in the crypto space, you're about to find out.

But I believe the bigger development of this legislation is its impact on risk and how it will change the way crypto assets are traded in the future.

One of the biggest obstacles facing cryptocurrencies is its history of continuous collapses: FTX, Luna, Three Arrows Capital, Genesis, Celsius, QuadrigaCX, BitConnect, Mt.Gox.

Each failure has dealt a massive blow to the crypto industry and reduced investor confidence. And each failure largely occurred because of the lack of clear regulation in cryptocurrencies.

If clear regulations allow safer exchanges to operate domestically in the U.S., offshore exchanges like FTX would never thrive because of their lack of internal controls and rough audits.

If large banks can custody crypto assets, investors won't avoid cryptocurrencies due to custody issues.

If we had bills like the GENIUS Act, Ponzi stablecoins like Luna would never exist.

Of course, examples from traditional finance prove that clear rules cannot prevent all scandals: Bernie Madoff's fraud and Credit Suisse's series of violations were not stopped by rules. But rules can indeed make a big difference.

One challenge that deters investors is that we often witness significant drops in Bitcoin and other crypto assets. Bitcoin has been the best-performing global asset in the past 15 years, but it has also experienced seven drops of over 70%.

For professional investors, buying an asset that could drop 70% due to an unexpected scandal on an unregulated offshore platform is difficult. As Washington D.C. weighs these crypto bills, I believe the likelihood of such scandals will drastically decrease.

Strong crypto legislation won't eliminate market volatility, but I dare say that if the bills pass, cryptocurrencies might never experience drops of over 70% again.

Why I'm Not Worried About the Future of Crypto Policy

People always ask about crypto legislation: Aren't you worried that the next government will reverse these achievements?

My answer is: No.

Contrary to media reports, cryptocurrency is one of the few policy issues with bipartisan support. The GENIUS Act passed the U.S. Senate with 68 votes to 30, with 18 Democratic senators voting in favor. This is one of the most bipartisan bills in the 2025 congressional session.

There are many reasons for bipartisan support, including the widespread popularity of cryptocurrencies among young voters. But perhaps the most important reason is the support of the U.S. financial industry - traditionally a major funding source for the Democratic Party, and they are eager to seize growth opportunities in the crypto space.

This economic motivation makes me believe that Washington's support for cryptocurrencies is sustainable in the long term. As more investors and businesses enter the market, politicians will find it increasingly difficult to oppose cryptocurrencies.

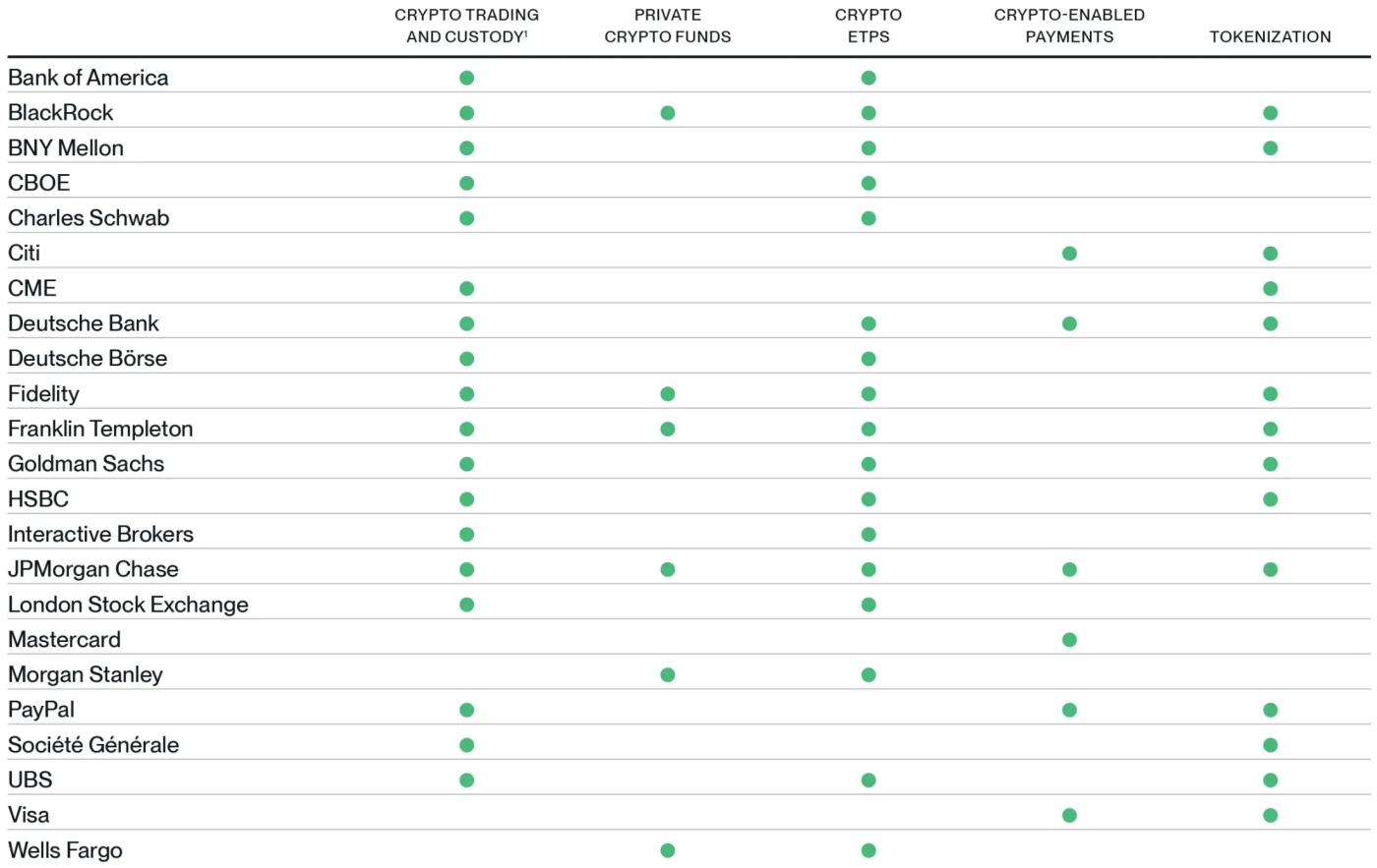

Think about it: Today, almost all major U.S. financial institutions are involved in cryptocurrencies to some extent. If BlackRock, JPMorgan, and Morgan Stanley, along with thousands of U.S. companies and millions of Americans, have made massive investments in cryptocurrencies, it will be hard for politicians to change course.

Institutional Adoption of Cryptocurrencies

Source: Bitwise Asset Management, data as of June 30, 2025. "Crypto Trading and Custody" includes trading of crypto spot, futures, and derivatives.

In other words: Once the bottle is opened, it can never be closed again. If these bills pass Congress during "Crypto Week" and are ultimately signed into law, we will enter a new era.

Cryptocurrencies are going mainstream, risks are continuously reducing, and Wall Street is making a big move.

No wonder Bitcoin is hitting an all-time high.