Author: 1912212.eth, Foresight News

On July 12, the PUMP token public offering of $500 million was sold out in just 12 minutes. The pre-market trading price of Binance Perpetual Contract is now $0.006, an increase of nearly $2 billion compared to the initial $4 billion FDV. According to the monitoring of on-chain analyst Ember, judging from the current on-chain holdings of PUMP, the six CEXs participating in the PUMP public offering may have received PUMP. The on-chain addresses of these companies currently hold: Kraken: 7.5 billion, Bitget: 7.5 billion, Gate: 6.4 billion, Bybit: 5 billion, MEXC: 5 billion, Kucoin: 4.1 billion.

Pump.fun has quickly become a phenomenon in the cryptocurrency ecosystem since 2024. The platform allows anyone to create and launch Meme coins with a very low threshold, bringing tokens directly to market through a unique "fair launch" mechanism without complex smart contracts or pre-sale stages.

The scale of this sale is the third largest token sale event in the history of cryptocurrencies, second only to the ICOs of some mainstream public chains. The Pump.fun team said that the funds will be used to expand the platform, including launching its own DEX (PumpSwap) and using PUMP as the base pairing currency for Meme coins.

However, the success of Pump.fun has also sparked too much controversy. Critics see it as a hotbed of "retail gambling," accusing it of siphoning liquidity through an infinitely fragmented market, causing countless retail investors to suffer huge losses after a short-lived rise. The platform's founder and his team were accused of extracting about $800 million through fees without providing any returns to users, such as airdrops or commissions.

The $500 million quota was sold out in 12 minutes

The official release of PUMP is scheduled for July 12. After the public sale officially started at 22:00 Beijing time, it took only 12 minutes to complete the public sale.

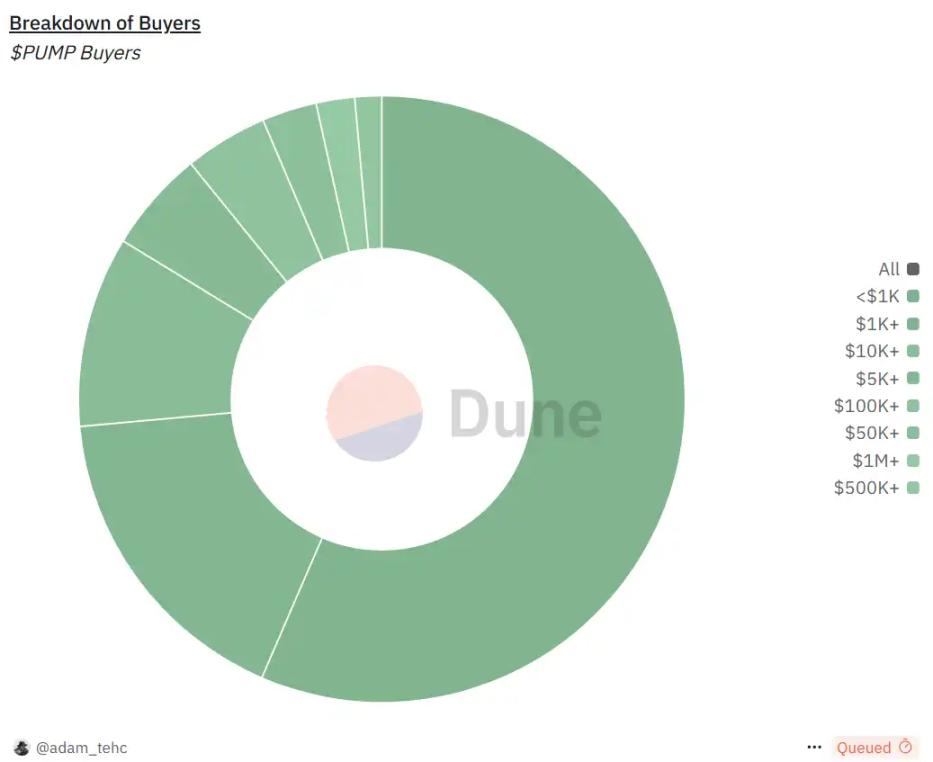

According to @Adam_Tehc's Dune dashboard data, the number of wallet addresses that participated in the Pump.fun official website pre-sale and completed KYC was 23,959, the number of wallet addresses that successfully purchased was 10,145, and the average subscription amount was US$44,209. 89.7% of the PUMP token pre-sale was completed through the official website, and the total sales of various CEXs accounted for only 10.3%.

In the official website pre-sale, there are 202 addresses with a subscription amount of $1 million, 138 with $500,000 to $1 million, 445 with $100,000 to $500,000, and 1,030 with $10,000 to $100,000. The largest number of users subscribed less than $1,000 was 5,758.

Players who participated in the public sale through the official website successfully bought in, but those who bought through exchanges and other channels were wronged. It is not difficult to see from the above data that the total sales of various CEXs accounted for only 10%.

Some users complained that "I couldn't find the entrance to Bitget, the Gate network reported an error, and Bybit was quickly sold out." The pre-sale mechanism seems simple: users submit orders through the API, and the platform allocates them based on timestamps. But the actual process is a mess.

Within seconds of the sale launching, Bybit reported API latency issues that caused orders to pile up. The result was a severe oversale: the system received more orders than the available supply, and some users were successfully allocated, while others were rejected. Bybit officials admitted on X: "Due to unexpected API latency, the sale was oversubscribed, resulting in some users successfully receiving allocations while others were not."

Regardless of the problems in the public offering, this public offering still shows that the community has strong funds willing to pursue popular projects. Crypto KOL Miles Deutscher expressed his opinion on PUMP selling $500 million in 12 minutes, saying that this shows that when there is a suitable opportunity, there is still a large amount of liquidity willing to participate. Altcoin are not "dead", they just need the right narrative.

Exchanges are oversold, and whale are playing games on the chain

Subsequently, Bybit conducted a comprehensive review of the order status of all users. To ensure fairness and transparency, token distribution strictly follows the "first come, first served" principle. Within 10 minutes after Bybit confirmed the final status of the PUMP token sale, all oversubscribed funds were fully refunded. After the sale ended, Bybit confirmed on July 13 that all oversold funds had been refunded, and users can check the status through the platform.

Bitget also responded to the question. Xie Jiayin issued a statement in response to the PUMP public offering distribution issue, saying that a total of 10,144 users participated in the public offering through Bitget in this round. In addition, the Bitget team finally decided to distribute PUMP tokens in proportion.

"Today, several sources said that Pump Fun cancelled the fund-raising of the exchange, which led to the failure of 6 exchanges. Currently, some of these exchanges plan to compensate users through OTC shares, while others are still negotiating." said Twitter KOLAB.

The pre-sale price is based on the FDV of 4 billion US dollars, and a single PUMP is about 0.004 US dollars. On the first day after the sale, many players chose to hedge. For example, the well-known trader 0xSun tweeted that he hedged 1 million US dollars at a price of 0.0054 US dollars.

According to the latest Binance contract data, on July 12, the PUMP contract price once fell to around $0.004589, and then on July 13, it once rushed to $0.007189, and now fell back to around $0.006. According to Lookonchain monitoring, a trader made more than $1.5 million by long on PUMP that day. Trader 0x6b78 opened a 3x leveraged long position on PUMP a day ago and began to take profits when the price broke through $0.007.

Pump.fun users have long suffered on the platform. Historical data shows that more than 90% of Meme coins on the platform collapsed after the binding curve, and snipers made millions of profits by bundling (8-12 SOL supply) at the last minute and selling on Raydium. This PUMP sale is seen as a continuation: the team sells tokens after extracting fees, and retail investors become "exit liquidity." X user @beaniemaxi said: "Pump.fun extracted $500 million in fees, and billions of SOL were locked in the dead pool forever. This is the biggest extraction scam in the history of crypto."

Buyers' losses also involve opportunity costs: Solana's price fell by 10% due to the $PUMP basic matching mechanism, affecting the entire ecosystem. Some analysts predict that PUMP may have short-term upside like TRUMP, but will be weak in the long run.

Pre-release: Community attitudes polarized

The pre-launch preparation phase began in early June 2025, when Pump.fun announced the PUMP token plan through official channels. PUMP is the utility token of the Pump.fun token launch platform and exchange platform, and utility mechanisms such as fee refunds, token buybacks or other incentives will also be considered in the future. The maximum supply of PUMP is 1 trillion, and the specific distribution is as follows:

- 33% will be sold in the ICO

- 24% allocated to community and ecosystem initiatives

- 20% allocated to the team

- 2.4% for the ecosystem fund

- 2% for the Foundation

- 13% to existing investors

- 3% allocated to live streaming

- 2.6% for liquidity + exchanges

According to the PUMP release schedule, the tokens allocated to the team (20%) and existing investors (13%) will be gradually unlocked starting from July 2026; the portion allocated to the community and ecosystem plan (24%) will be gradually unlocked from the first day of token issuance and will be fully allocated in July 2026; other token shares allocated to ICO, liquidity + exchange, and foundation will be fully unlocked on the first day of token issuance.

The market reaction is polarized. On the one hand, Pump.fun's loyal users and Meme coin enthusiasts see it as the "Max Extraction Event" and look forward to sharing the platform's future earnings by purchasing. The platform has proven its profitability: $50 million in fees in May 2025 alone, and cumulative fees of $800 million.

Meme trader Ansem publicly shill on Twitter that he would buy more PUMP tokens.

On the other hand, there are waves of doubts.

Well-known crypto analysts and KOLs (such as @hodl_strong and @RuneCrypto_) publicly criticized the sale as an "exit scam." They pointed out that Pump.fun has extracted more than $1 billion in fees from the market, but chose not to give back to users through airdrops, but to sell tokens directly. This is seen as a betrayal of the community, especially after the precedents of OpenSea (OpenSea failed to launch tokens in time, causing revenue to plummet by 90%). In addition, the anonymity and lack of transparency of the team have exacerbated concerns: the purpose of the funds is unclear, whether it is used for development or personal cashing out? IOSG's founding partner bluntly stated that Pump.fun's public offering is more like the team seeking exit liquidity, and the project and market fundamentals cannot support the inflated valuation.

Trader Eugene also posted in his personal community, "My opinion on pump.fun is simple: just forget about it. It has been over-analyzed to the point where there is nothing new about it, and no matter what price it starts trading at, the market value of $4 billion is like a heavy anchor that holds down the price of the coin. There are too many opportunities in the market with greater potential and more nonlinear returns that are far more worthy of attention than it. Stop wasting brain cells on something that everyone is thinking about."