As traders withdraw tokens from Binance, the world's largest cryptocurrency exchange, an increasing number of Altcoins are signaling bullish trends, with the market describing it as a "massive accumulation phase".

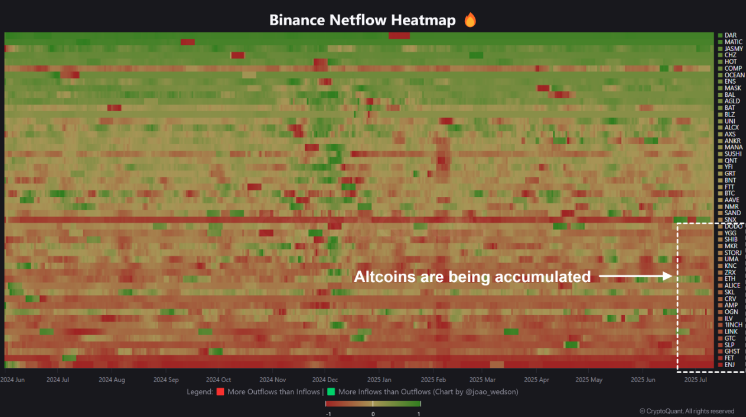

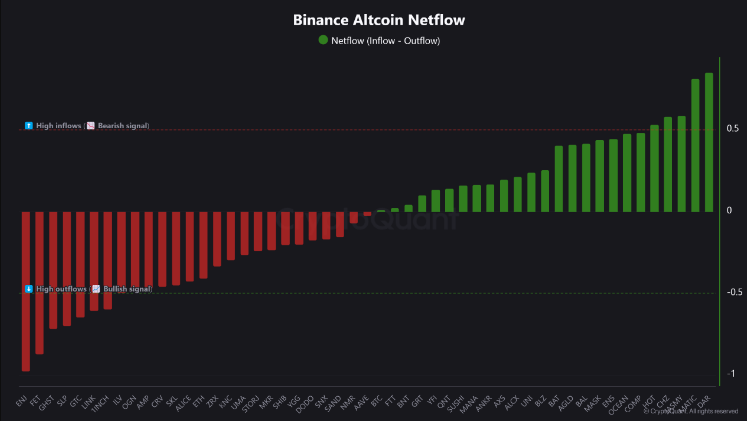

According to blockchain analysis platform CryptoQuant's data, Binance's latest net inflow heatmap shows a series of Altcoins experiencing strong withdrawals, especially ETH, Chainlink, SHIB, Doge, Aave, and many other tokens.

VX:TZ7971

By the time of writing, over a dozen tokens have entered the deep red zone on the heatmap - indicating withdrawal volumes exceeding deposit volumes.

Typically, assets withdrawn from exchanges are a sign of long-term investment confidence, as investors choose to store assets in personal wallets rather than sell them on the market.

Binance's net flow heatmap presents an extremely bullish pattern. Many Altcoins have turned red - indicating outflows greater than inflows - which is a typical sign of experienced investors accumulating.

More and more Altcoins are being extracted from hot wallets

Net flow data reflects the difference in token quantities deposited and withdrawn from exchanges. When withdrawals exceed deposits, it usually indicates investors are buying tokens and moving them to private wallets for storage, suggesting long-term confidence in the tokens. Conversely, if deposits exceed withdrawals, it may signal increasing selling pressure.

The heatmap is a visualization tool that helps quickly identify where accumulation is occurring. In the latest snapshot, many tokens show prominent red bars, such as ENJ, Fetchai, Aavegotchi, Smooth Love Potion, Gitcoin, Illuvium, CRV, 1INCH, and so on.

Notably, ETH and popular meme coins like Doge and SHIB are also on this list, indicating the accumulation trend is spreading across many market segments.

On Binance's heatmap, tokens turning deep red signify withdrawal speeds exceeding deposit speeds - a typical consolidation sign. Conversely, tokens turning green indicate increased inflows, possibly preparing for short-term trading or profit-taking.

What does Binance fund outflow mean?

This signal is particularly noteworthy as the exchange's trends often closely reflect overall market sentiment, especially among institutional investors and "whales" who can influence price trends.

When an accumulation pattern emerges here, it typically reflects the silent yet strategic actions of the most professional and well-informed investors in the market.

Binance's excellent liquidity, global influence, good reputation, and growing attraction to institutional capital are key factors making its net flow data a highly reliable market indicator - a "thermometer" of investor expectations and sentiment.

Large token withdrawals from exchanges like Binance are seen as signs of an accumulation cycle - preparing for the next bull market. The current fund flow pattern is sending a clear signal: reduced selling pressure, tightening supply, and restoration of institutional investor confidence.

It's worth noting that this is not the first time early accumulation signs have appeared. Similar patterns occurred before strong Altcoin rallies in 2023 and early 2024, later confirmed by market movements.

However, despite the optimistic current situation, caution is still needed. Net flows only provide trend direction, not precise timing of price increases. Additionally, a few large withdrawals (especially from low-liquidity tokens) can also influence the data.

From the current situation, the market is showing many promising signs for the future period.

Today's fear index is 74, shifting to a greedy state.

Currently, most cryptocurrencies are not near their historical peak ranges, in contrast to when Bitcoin set new records in February and November 2024, with approximately 75% and 40% of cryptocurrencies within 5% of their 252-day highs, respectively.

Historically, Bitcoin tends to retreat when a large number of cryptocurrencies are trading close to their historical peaks. The current divergence suggests Bitcoin might have more room to rise.

On the other hand, tariffs are about to be implemented, and after negative factors are exhausted, the next step is to patiently wait for interest rate cuts.