I will share how to achieve financial freedom through meme in this cycle, which is a specific execution strategy, not just an idea.

Written by: NEET

Compiled by: AididiaoJP, Foresight News

I will share how to achieve financial freedom through meme in this cycle, which is a specific execution strategy, not just an idea. Yes, I'm not joking.

Over the past one to two years, I have been accumulating meme coins on Ethereum. I buy at low prices and have no plans to sell short-term. Currently, meme coins account for 80% of my investment portfolio.

At the same time, I am gradually selling my meme holdings on Solana. The liquidity of meme coins in the Solana ecosystem has become increasingly low. With few exceptions, the returns of meme coins have been declining since the launch of TRUMP and MELANIA in January.

The meme coin battlefield on Solana will never disappear, with new meme coins experiencing extreme ups and downs daily. However, we can find safer and more rewarding opportunities on Ethereum.

From a macro perspective, my meme coin strategy is very simple:

Stop making broad-net bets on low-liquidity Solana meme coins chasing 100x returns.

Start pursuing 10-20x returns on high-liquidity Ethereum meme coins and invest more funds.

Part One: Why Choose Ethereum Meme Coins?

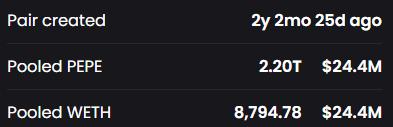

The liquidity of the PEPE/ETH trading pair is as high as $49 million. What happens to PEPE's price when ETH's price doubles or triples?

My view is simple: ETH will rise, and meme coins will rise even more.

Over the past 1-2 years, we have already seen the excess returns of meme coins like PEPE, MOG, and SPX. These coins have outperformed ETH and are likely to continue this trend in the future.

If an Ethereum meme coin meets the following conditions, I will add it to the watchlist and monitor it closely:

- Listed for at least one year

- Liquidity locked or burned exceeds $500,000

- Contract ownership has been renounced

- Official website and social media are still operating

- Holders maintain a certain level of activity on Telegram or Twitter

These coins will significantly outperform ETH in the upcoming altcoin season, which may be closer than imagined.

Additionally, Ethereum meme coins have a hidden advantage: they are compatible with DeFi. This will be explained in detail later.

Next is the part everyone has been waiting for.

Part Two: Price Targets

Everyone cares about price targets.

No one can accurately predict price trends, but reasonable estimates can be made based on multiple indicators. Remember: In a bull market, almost all meme coins will rise, regardless of whether you like a coin or its meme culture.

Let's start with the leading meme coins:

- PEPE

- MOG

- SHIB

- SPX

I define leading meme coins as those that have reached a market cap of $1 billion. At the current price level, their expected returns are 5-10x. Holding these coins allows you to sleep soundly, with a 90% drawdown being almost impossible unless a catastrophic event occurs.

Next are mainstream meme coins:

- APU

- BITCOIN (HarryPotterObamaSonic10Inu)

- BOBO

- JOE

- NPC

- WOJAK

These coins have broken through a $100 million market cap, are typically listed on second-tier exchanges, and have active communities and loyal holders. These mainstream meme coins are expected to have 10-20x upside potential.

Finally, the altcoin meme coins:

- BUSINESS

- KEKEC

- LMI

- SMURFCAT

These are small-cap meme coins with market caps just over $10 million, not listed on exchanges, with low liquidity and trading volume, but higher volatility. Not all small-cap meme coins will surge, but the best performers could yield 20-30x returns.

The investment portfolio should focus on blue-chip meme coins, moderately allocate mid-cap meme coins, and hold a small amount of small-cap meme coins as speculative bets.

Part Three: Spot Leverage

Don't let anyone tell you meme coins are worthless.

After buying meme coins, what's next? Use meme coins in DeFi.

The IMF@intlmemefund protocol allows you to use meme coins as collateral for lending.

Why use IMF to collateralize meme coins? I use it to add spot leverage to my holdings. Now, when meme coins rise $1, I can earn $1.50.

Here's the specific operation:

- Buy $10,000 worth of PEPE

- Deposit PEPE into IMF and borrow $5,000 USDS loan

- Swap USDS for PEPE

- Deposit the remaining $5,000 worth of PEPE to lower the loan-to-value (LTV)

Now your PEPE holdings have increased 1.5x. You would only face liquidation if PEPE's price drops 66% from the current level, and the likelihood of this happening decreases daily.

Moderate leverage can bring huge returns. A 1.5x PEPE exposure allows you to sleep soundly. Additionally, after completing this trade, you can also receive IMF rewards, killing two birds with one stone.

Initially, I did not realize IMF's potential. But now, communities like MOG and JOE are buying more tokens and driving prices up through new buying pressure.

IMF currently supports PEPE, MOG, and JOE, and will support more coins in the future.

As for futures or perpetual contract trading on Binance, Bybit, and Hyperliquid? I recommend caution. Ethereum meme coins are more mature, and their rise will take longer - this is a patient game, and the rise is just a matter of time.

If you want to trade, stick to low leverage, long cycles, and never invest more than you can afford to lose.

Part Four: Exit Strategy

The final step is the simplest.

The position is already built. The next step is not to wait idly, but to wait patiently. The moment for Ethereum meme coins will come. The market is cyclical, and the moment funds rotate back to Ethereum meme coins is approaching.

In any case, setting clear profit targets is crucial. Without a plan to sell a certain percentage or amount of meme coins, your position is like a roller coaster.

When your coins start rising, first repay the IMF loan and reduce spot leverage. Then use protocols like @1inch or @CoWSwap to sell gradually in multiple stages.

Don't try to time the top precisely. You need to take profits in batches during the price rise. Gas fees on the Ethereum mainnet are low, so you can sell multiple times as needed.

After completing these steps, you have successfully captured the bull market and achieved financial freedom through meme coins.

Conclusion

I must admit and execute this trading strategy.

Meme coins will exist long-term.

Although I am also optimistic about other crypto assets (including Non-Fungible Tokens and some Solana meme coins), I firmly believe that Ethereum meme coins are like beach balls underwater, destined to float to the surface.

In the bear market environment, we have already seen the rise of MOG and JOE, rebounding from February's lows. With DeFi protocols like IMF introducing lending and spot leverage functions, a new meme coin season is likely imminent.

This time, I will not aggressively trade new coins but stick to the established, time-tested meme coins.