Institutional buying has driven the cryptocurrency market to soar, with Bitcoin breaking through $116,000 this morning and then skyrocketing, surpassing $118,000 at noon, continuing to set new historical highs.

VX: TZ7971

Bitcoin reached a high of $118,254 at noon and has since fallen to $117,838, up 5.9% in the past 24 hours. Bitcoin's new all-time high is a strong signal that a "major bull market is about to run".

The recent stabilization of the overall economic environment, coupled with institutional investors accelerating their layout, is reigniting market enthusiasm for Bitcoin. This capital shift reflects the market's growing confidence in Bitcoin, viewing it as a regulated long-term asset, similar to a digital version of gold.

The only current market risk is that if the U.S. Consumer Price Index (CPI) data to be released on July 15 again triggers inflation concerns, there is a possibility of a profit-taking wave that could suppress Bitcoin's rise.

Nearly $1.2 Billion Inflow in a Single Day, Bitcoin Spot ETF Sees Second-Highest Capital Inflow Ever

Bitcoin spot ETF played a crucial role in this rally. Statistics show that the U.S. Bitcoin spot ETF had a net inflow of $1.18 billion on Thursday, the second-highest record since its listing, with institutional funds fully engaged. This surge in ETF buying reflects the market's renewed expectations of U.S. interest rate cuts and institutional investors' increased appetite for Bitcoin.

Many companies have begun to follow Strategy in incorporating Bitcoin into their asset allocation, and the ETF listing has further lowered the entry barrier. This continuously expanding demand base is the key fuel driving Bitcoin's surge.

Despite short-term uncertainties such as tax risks, the cryptocurrency market still has multiple tailwinds supporting the bullish trend: Looking ahead, even with short-term variables, the expectations of the U.S. initiating an interest rate cut cycle and the institutional adoption trend will provide strong momentum for future market performance.

The demand for Bitcoin spot ETF may remain strong in the medium term, especially as Bitcoin's role in diversified investment portfolios continues to evolve.

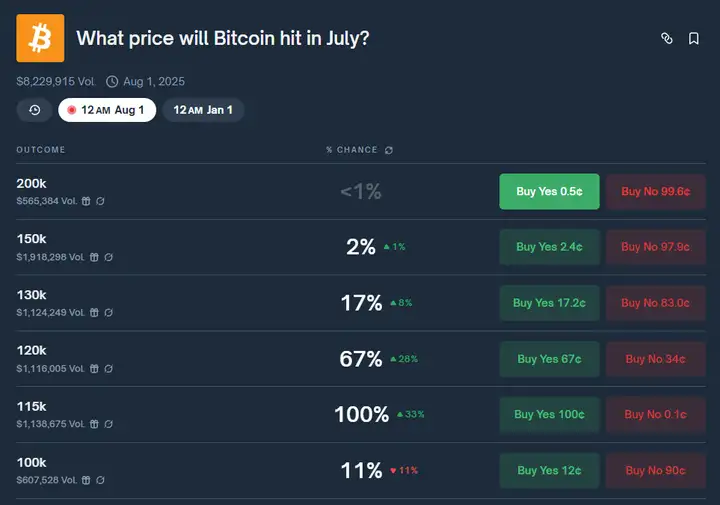

In fact, Bitcoin has returned to an upward trend on the daily chart since yesterday. As long as it doesn't fall below $105,000 in the short term, this new high can be considered an effective breakthrough. If $110,000 transforms from resistance to support, it would be even more favorable for continued price increases. The prediction market Polymarket now gives a 67% chance of Bitcoin breaking $120,000 in July, indicating the market is very optimistic about Bitcoin continuing to set new highs.

Yesterday, the U.S. released unemployment numbers, which were lower than expected. While U.S. stocks were affected and stopped breaking through, the market's expectation of an imminent interest rate cut cycle remained unchanged, so stocks did not show a significant decline. Cryptocurrencies, on the other hand, rose comprehensively. Next week, the U.S. will release the CPI, which is the most important economic data this month, as it directly shows whether Trump's policies have affected inflation. Therefore, market volatility is expected to be significant next week.

This bull market is far from over.

If more institutional-level trading platforms open Bitcoin investments in the future, these potential catalysts could help Bitcoin challenge $150,000 this year. The U.S. M2 money supply is near its historical high, with ample market liquidity. Hold your spot, the altcoin spring is just around the corner.