Author:Mason Nystrom

Translated by: TechFlow

Providing insights for founders about the current state of cryptocurrency financing and some personal predictions about the future of crypto VC.

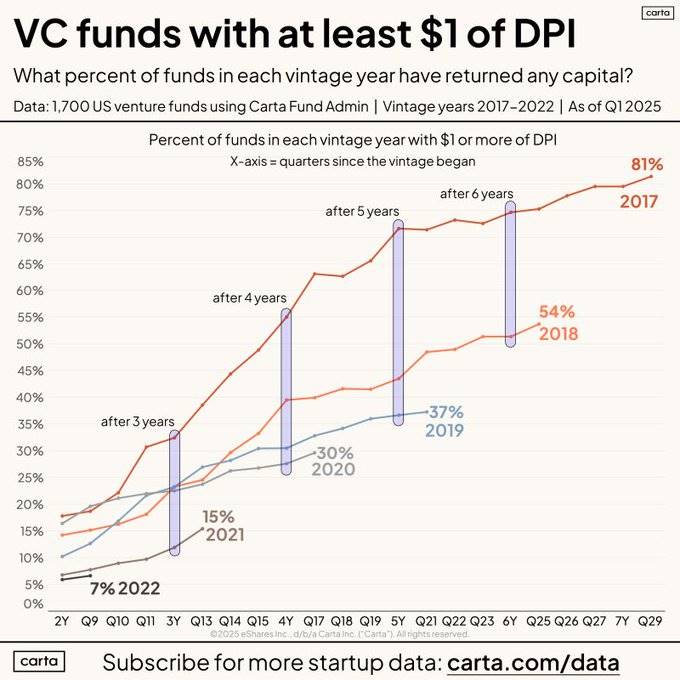

Preface: The financing environment is challenging due to upstream DPI (TechFlow note: a market-cap-weighted index tracking DeFi asset performance) and LP funding challenges, with funds returning less capital to LPs compared to previous periods.

This, in turn, leads to reduced net capital for existing and new VCs, ultimately making the financing environment more difficult for founders.

What Does This Mean for Crypto Enterprises?

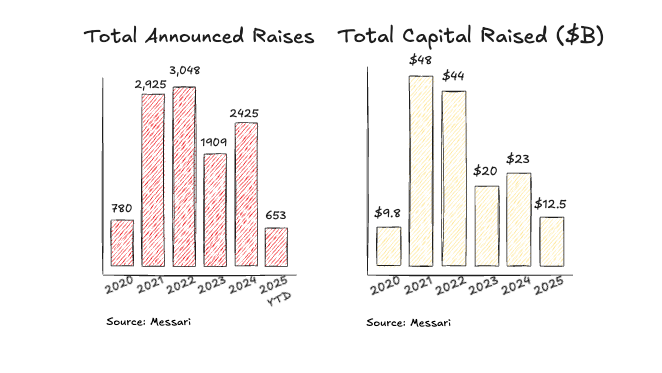

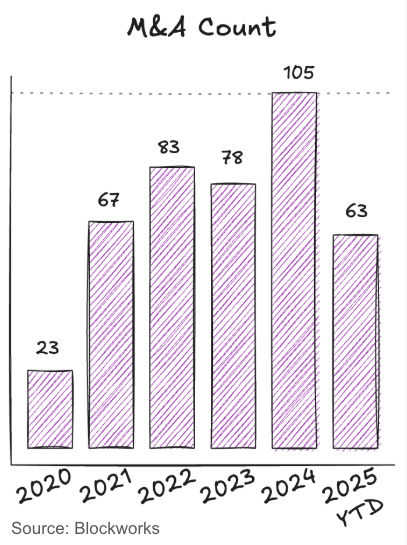

Transaction slowdown in 2025, matching the capital deployment pace of 2024.

- Slowing transaction numbers may be related to many VCs approaching the end of their funds with less deployable capital.

- Some large transactions are still completed by major funds, keeping capital deployment speed on par with the previous two years.

Over the past two years, cryptocurrency M&A transactions have continuously improved, signaling good developments in liquidity and exit opportunities. Recent large M&A transactions including NinjaTrader, Privy, Bridge, Deribit, HiddenRoaad, etc., indicate promising signs of integration and underwriting more crypto equity venture capital.

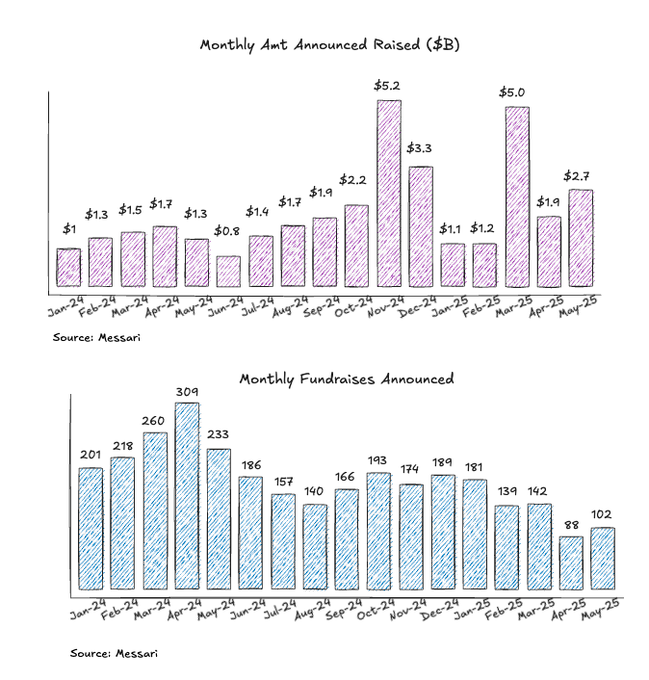

Transaction numbers remained relatively stable over the past year, with some large, late-stage transactions completed (or announced) in Q4 2024 and Q1 2025.

This is mainly because more transactions are in early Pre-seed, seed, and accelerator stages, which always have relatively abundant funding.

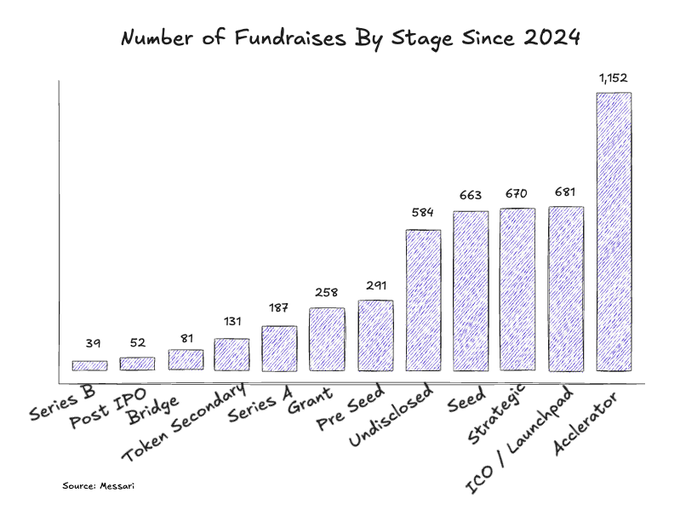

Accelerators and Launchpads Lead Transactions Across Stages

Since 2024, numerous accelerators and launchpad platforms have emerged in the market, possibly reflecting a more severe capital environment and founders choosing to launch tokens earlier.

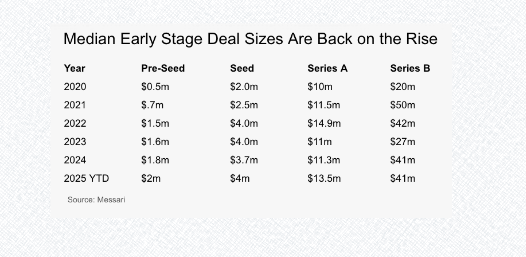

Early-Stage Transaction Median Size Rebounds

Pre-seed financing scale continues to grow year-on-year, indicating abundant early-stage market funding. Seed, A, and B round financing medians have approached or rebounded to 2022 levels.

Crypto VC Future Stage Predictions

1: Tokens Will Become Primary Investment Mechanism

Shifting from a dual structure of tokens and equity to a unified asset appreciation structure. One asset, one value appreciation story.

Original tweet link: Click here

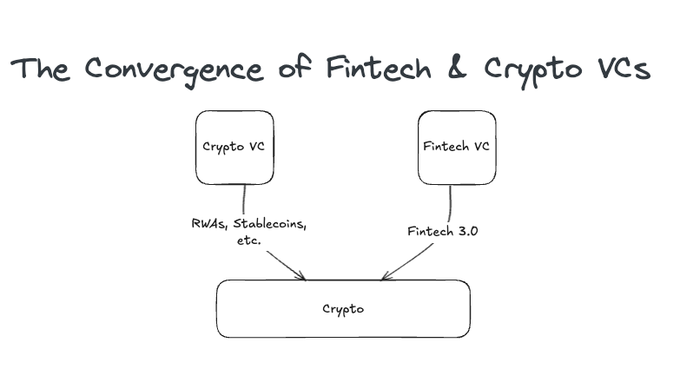

2: Fintech and Crypto VC Convergence

Every fintech investor is transforming into a crypto investor, as they want to invest in next-generation payment networks, new banks, and tokenized platforms built on crypto rails.

Crypto VC competition is imminent, and many crypto VCs that haven't invested in stablecoins/payment sectors will struggle to compete with experienced fintech VCs.

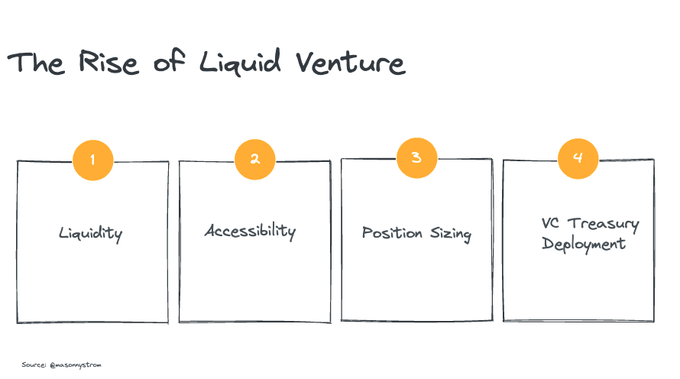

3: Rise of Liquidity Venture Capital

"Liquidity venture capital" - venture investment opportunities in liquid token markets.

Liquidity - public assets/tokens liquidity means faster liquidity.

Accessibility - In private venture capital, gaining access isn't easy, but liquidity venture capital means investors don't always need to win deals; they can directly purchase assets. OTC options are also available.

Position Sizing - As companies issue tokens earlier, this means small funds can still establish meaningful positions, and large funds can similarly deploy into larger market cap liquid assets.

Capital Allocation - Many top-performing VCs historically held risk capital as tokens like BTC and ETH, which have generated excess returns. I personally believe that calling more funds in bear market cycles will become more normal.

Cryptocurrency Will Continue to Lead VC's Frontier

The convergence of public and private capital markets is the direction of venture capital, with more traditional VCs choosing to invest in liquid markets (post-IPO holding tools) or secondary markets as companies delay going public. Cryptocurrency is at the forefront of venture capital.

Cryptocurrency continues to innovate in forming new capital markets. Moreover, as more assets move on-chain, more companies will focus on on-chain priority capital formation.

Finally, crypto returns are often more power-law-like (TechFlow note: In a power-law distribution, most events have a very low probability of occurrence, while extremely few events have a very high probability), with top crypto assets competing to become sovereign digital currencies and the foundation of a new financial economy. This decentralization will be greater, but crypto's super power-law and volatility will continue to drive capital into crypto venture capital, seeking asymmetric returns.