Since breaking the $100,000 mark on May 8th, Bitcoin's price has maintained daily closing above this psychological level. Although BTC price dropped to $98,300 on June 22nd, the crypto asset remains close to breaking a new high of $111,800.

VX: TZ7971

While dropping to $100,000 represents only a 9% pullback, some indicators suggest that the range between $100,000 and $110,000 could become the new bottom before BTC experiences another parabolic rebound in the second half of 2025.

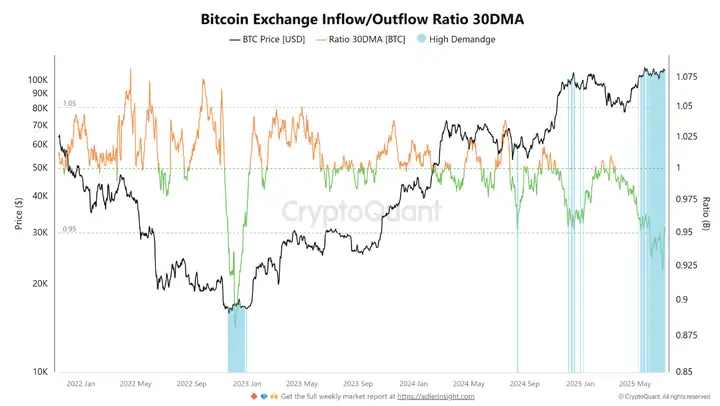

According to CryptoQuant data, market activity is moving towards a confident long-term recovery, with on-chain data showing outflows exceeding inflows. The monthly outflow/inflow ratio has dropped to 0.9, reaching its highest level since the end of the 2022 bear market, typically indicating strong demand.

This ratio measures the balance of Bitcoin flowing in and out of exchanges and can serve as a market sentiment indicator. A value below 1 indicates investors are withdrawing assets from exchanges, usually reflecting accumulation. Conversely, historically, values above 1.05 typically coincide with increased selling pressure and local market tops.

Notably, the recent decline is similar to the levels in December 2022, when Bitcoin touched a macro bottom near $15,500. This turning point triggered a rebound lasting several months, reinforcing the theory that low ratios often signal price reversals.

The current dominance of capital outflows and increasing long-term investor participation strongly suggest a structural bottom is forming. If historical patterns hold, Bitcoin may be approaching a critical demand-driven turning point that could mark the beginning of the next bull market.

Bitcoin Absorbs Short-Term Selling Pressure

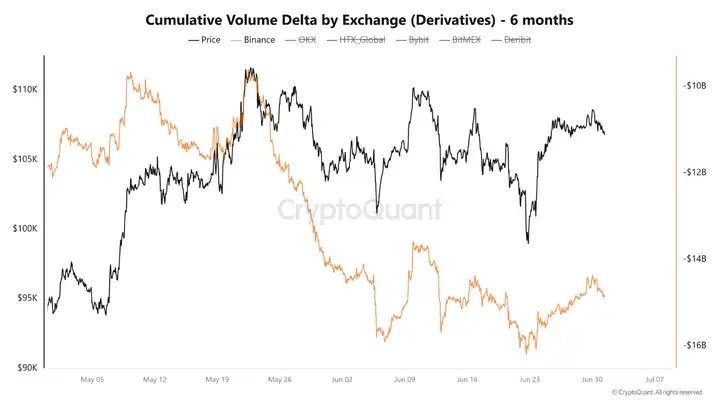

Despite continuous selling by Binance derivatives contract sellers over the past 45 days, Bitcoin's price remains stable in the $100,000 to $110,000 range. Cumulative Volume Delta (CVD) data remains negative, indicating short-term selling pressure from traders. However, the price's inability to fall further suggests this capital is being absorbed, meaning funds are being accumulated.

This structural resilience may be reinforced by on-chain activity indicating institutional migration.

Such moves are typically not impulsive but often involve strategic positioning, meaning large entities may intervene when prices remain stable under significant short-term pressure.

Continued selling, moderate pullbacks, and large-scale accumulation strengthen the argument that Bitcoin is establishing a bottom around $100,000. While short-term volatility may persist, investor support (likely from institutional investors) makes a significant drop below this level increasingly unlikely.

Today's fear index is 66, still in a greedy state.

U.S. spot ETF, MicroStrategy, and other institutional Bitcoin public purchases, while generally favorable for Bitcoin's price increase, represent only the tip of the iceberg in total demand, merely a positive news-level factor but insufficient to drive prices to a new all-time high. If overall demand from whales and other retail investors is simultaneously declining, Bitcoin will struggle to break new highs through spot market buying power alone.

The tariff has been confirmed to be postponed to August 1st, and once the negative factors are settled, it will be the beginning of a push to new highs.