"Trading Star Tuesday" Issue 15: In-depth analysis of hot spots in the crypto market

This article is machine translated

Show original

On July 8, 2025, the fifteenth issue of "Trading Star Tuesday" sparked heated discussion in the Chinese Web3 community. Host Qie Ge, with his usual relaxed and humorous style, joined hands with Alex from Bifinance, Matthew, co-founder of LYs Lab, Coral, the Chinese region ambassador of Citrea, and Meg, a builder from the Shanghai Mankun (Shenzhen) Law Firm, to conduct an in-depth discussion on recent hot topics in the crypto market. This episode focused on three major topics: current market conditions and trends, the US stablecoin bill and US debt tokenization, and the impact of US tariffs. The guests shared professional insights from different perspectives, providing listeners with multi-dimensional insights into macroeconomic and crypto market dynamics.

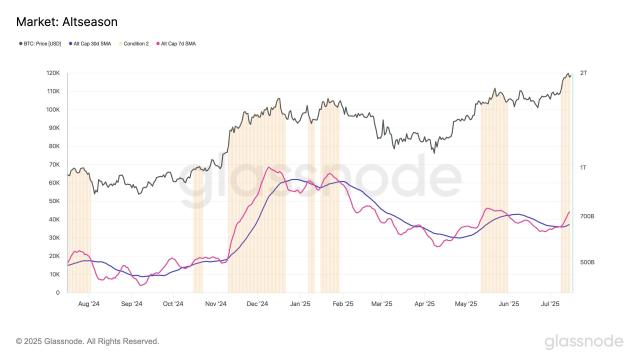

Meg noted that the market is in a high-level oscillation, with Bitcoin's new highs difficult to predict. However, US policies and the integration of traditional finance with blockchain are injecting positive signals. She observed strong Bitcoin liquidity, while Altcoins are in a bear market. She emphasized that projects with product market fit (PMF) are gradually overlapping with traditional business models, such as Tether's revenue exceeding $15 billion, resembling a Web2 enterprise operating in the Web3 track.

Matthew agreed with the Bitcoin high-level consolidation view but believed potential opportunities exist in some Altcoins. He mentioned the "Big Beautiful Act" and Hong Kong's stablecoin regulation attracting traditional institutions, suggesting investors follow large capital trends and focus on RWA, US stock tokenization, and payment tracks.

Alex analyzed Bitcoin's market dominance maintaining 60%, with small market fluctuations. He suggested following institutional funds and being cautious, seeing potential in RWA and payment tracks.

Coral divided the market into two categories: mainstream Altcoins following Bitcoin, ETH, and US stocks, and newly listed coins influenced by market makers. She believed the market is highly sensitive to sudden news and recommended that retail investors "take profits and run".

Regarding the US stablecoin bill and US debt tokenization, guests discussed potential opportunities and challenges. Meg viewed the stablecoin bill as part of Trump's policy, potentially triggering a "thousand coin war". Alex highlighted the competitive landscape of Hong Kong stablecoin licenses and potential regulatory challenges.

On US tariffs, Matthew saw them as a negotiation tool with limited direct financial market impact. Coral focused on US-EU trade negotiations, noting that the market has become "desensitized" to Trump's policies.

The episode concluded by emphasizing the industry's transformation from a "trade" to a mature industry, calling on investors to maintain research spirit, focus on compliance and opportunities, and embrace the next wave of Web3.

Sector:

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share