Written by: Godfrey Benjamin, Thecoinrepublic

Translated by: Jessica, Techub News

Key Points:

- Ethereum is considered a critical blockchain infrastructure, supporting institutional-level DeFi, asset tokenization, and stablecoins.

- Large financial institutions are building tokenized assets on Ethereum Layer 2 networks.

- The thriving stablecoin market and market catalysts are driving Wall Street's investment enthusiasm for Ethereum as a reserve asset.

Due to Ethereum's (ETH) critical role in blockchain infrastructure and the crypto market, Wall Street's interest in it as a reserve asset is growing.

Renowned crypto researcher Vivek Raman specifically pointed out that stablecoins and asset tokenization are important factors driving this trend.

Ethereum's Infrastructure Role Attracts Institutional Attention

Ethereum has become Wall Street's preferred reserve asset due to its core function in infrastructure development within the crypto ecosystem.

Crypto market authority Vivek Raman elaborated on this perspective in a widely circulated tweet thread on X platform.

First, he explained that Ethereum supports most of today's distributed finance (DeFi), while serving as the underlying infrastructure for asset tokenization and stablecoins.

Raman noted that Wall Street has traditionally favored infrastructure investments that stand the test of time, which is the second major reason for Ethereum's current appeal.

In past eras, such infrastructure included railways and telecommunications networks. Today, Ethereum provides a digital version of what is called "digital oil".

Given its foundational role, institutional investors are viewing Ethereum as a long-term strategic asset.

Ethereum's Layer 2 networks have been crucial in this development. For example, JPMorgan developed a tokenized deposit platform called Kinexys using Ethereum's Layer 2 network Base.

Robinhood achieved stock tokenization through another Ethereum Layer 2 network, Arbitrum.

Raman emphasized that institutional interest is not just in cryptocurrencies themselves, but in the underlying platforms driving financial innovation. Holding Ethereum is equivalent to owning part of the infrastructure supporting these services—a perspective consistent with traditional market valuation logic for entities enabling large-scale economic activities.

Tokenization and Stablecoins Consolidate Ethereum's Position

Tokenization of real-world assets is another reason Wall Street is focusing on Ethereum. Raman noted that financial institutions are more inclined to use blockchain for asset representation rather than participating in crypto market speculation. Ethereum provides the most active development environment for such tokenization projects.

Raman gave examples, such as giants like JPMorgan deploying tokenization projects on the Ethereum network: 'The core argument that banks prefer "blockchain over cryptocurrency" is tokenization—and institutional-level tokenization is being realized on Ethereum. Evidence: JPMorgan is conducting deposit tokenization on Ethereum's Layer 2 network Base. Want to own the infrastructure? Hold ETH.'

Image source: Vivek Raman on X

These practices make Ethereum the natural choice for more institutions exploring similar strategies.

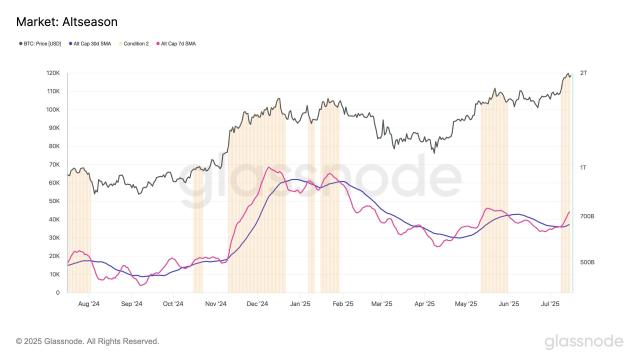

Stablecoins are the third major reason Wall Street is betting on Ethereum. Crypto market data shows that the total stablecoin market cap is close to $250 billion and may exceed $2 trillion in the future—with the vast majority issued on the Ethereum network. Companies like Circle, which issues the USDC stablecoin, have already received equity investments from traditional financial institutions. Raman analyzes that Ethereum might become the next stop for these institutions' crypto asset allocation.

Analyst Tom Lee suggested that banks might start purchasing Ethereum to ensure the stability of stablecoin businesses.

Market Catalysts and Valuation Revaluation Potential

Raman also listed market catalysts driving Ethereum investment growth, such as:

- Companies like SharpLink Gaming and BitMine Immersion Technologies continue to attract new fund inflows to ETH-related assets

- These enterprises involve heavyweight figures like Joseph Lubin (Ethereum co-founder) and Tom Lee

Wall Street has always been sensitive to positive price catalysts and emerging narratives. Ethereum's deep connection with stablecoin development and financial infrastructure construction continues to attract such attention.

Finally, Raman specifically mentioned Ethereum's potential to become the "next Bitcoin". Many investors missed Bitcoin's early explosive growth, and Ethereum's sideways consolidation over the past five years resembles some market patterns before breakthrough rises. The tweet suggested that if Ethereum's application scenarios continue to expand, its valuation system might be reconstructed—with its leading position in tokenization, stablecoins, and DeFi being key driving factors.

Regardless, Wall Street's current interest in Ethereum reflects a long-term strategic layout. Raman's analysis lists infrastructure value, tokenization practices, and market momentum as core reasons. As blockchain finance evolves, Ethereum's role boundaries seem to continue expanding.