The cryptocurrency market is experiencing a unique moment - both in Washington and on Wall Street. Over the past year, Trump developed his Bitcoin strategy and announced the establishment of an Altcoin reserve fund. Meanwhile, the US Senate passed the GENIUS Act, and the CLARITY Act is in the works.

VX:TZ7971

On the technical front, Ethereum took a significant step with the Pectra upgrade in early May. In traditional finance, Bitcoin spot ETFs have attracted strong capital inflows, with total net inflows reaching $14.4 billion so far this year.

Naturally, the market responded positively. Year-to-date, BTC has risen 15%, double the S&P 500 index's increase, approaching its near $112,000 historical high.

Bitcoin Treasuries Are Booming, But How Long Can It Last?

Over 135 listed companies now hold Bitcoin as a reserve asset, indicating that Bitcoin financial strategy is gradually becoming mainstream.

Large companies like Strategy continue to make significant bets, while newcomers like Metaplanet and Twenty One are quickly joining the game.

However, not everyone believes in the possibility of infinite growth. Some believe the lifespan of Bitcoin fund management strategies will be much shorter than most expect. With the emergence of some new names, this game might already be over.

The market is currently near a saturation point. It's very close to the 'proof' stage, where any company without a truly clear niche market will struggle to maintain high valuations and achieve growth.

Retail investors have been the primary driving force behind this wave of emerging companies, but their needs and capital are not infinite.

While bullish sentiment around Bitcoin may continue, the future path may favor those brave enough to take risks, enter early, and build great brands.

Nevertheless, we still have reason to be optimistic. If current trends repeat previous cycles, the next market top could appear in just six months.

Bitcoin's current rally has far exceeded the cycles of 2013 and 2017, rising nearly 2,000% since the peak of the last cycle - indicating that despite volatility, the growth momentum has not been exhausted.

Ethereum: Competing for the Top Spot

Ethereum (ETH) has long occupied the second position in the cryptocurrency world, but this status is not unchallenged. After lagging behind Bitcoin and fast-growing competitors like Solana (SOL), ETH may finally be at a turning point.

After a significant price drop earlier this year, the Pectra upgrade brought new confidence to the network. The next upgrade is Fusaka, planned for the end of 2025. This upgrade will integrate PeerDAS and Verkle Trees, technologies expected to significantly reduce storage and computational costs across the Ethereum ecosystem, especially for Layer 2 and validators.

Based on the momentum of Layer 2 development and the developer community's vitality, the market has begun predicting ETH will reach $6,000 before year-end.

However, not everyone fully believes in ETH's bull market story. The true momentum remains to be seen, but for now, ETH seems to be slowly but steadily recovering.

Altcoins Break Through Depression, Wall Street Is Watching

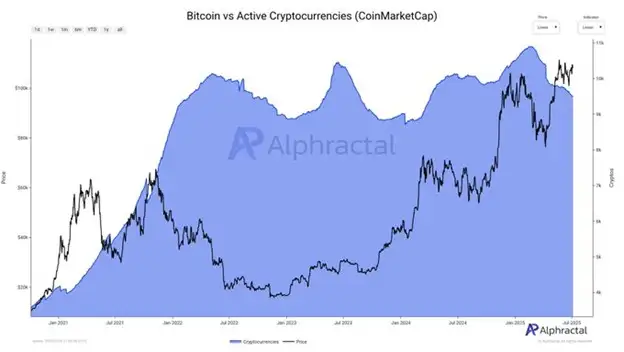

The Altcoin market has just undergone a massive "cleanup" - over 1,400 previously active tokens disappeared in 2025. This indicates the market is entering a more mature stage: only the most resilient projects will survive.

With signs of Bitcoin's dominance weakening, the market begins to speculate: Is this the start of Altcoin 2.0 season?

Meanwhile, channels for investing in cryptocurrencies through public markets continue to expand. Bitcoin and Ethereum ETFs are already online, with asset redemption and staking functions soon to be introduced to improve efficiency. ETFs for other digital assets may also appear in the near future.

Following Circle's high-profile IPO, companies like Galaxy, eToro, and potentially Kraken or ConsenSys are expected to follow suit.

The remaining time this year will be crucial and may determine how far the current cryptocurrency market rally will extend.