Author: PowerTrade

Compiled by: Blockchain in Plain Language

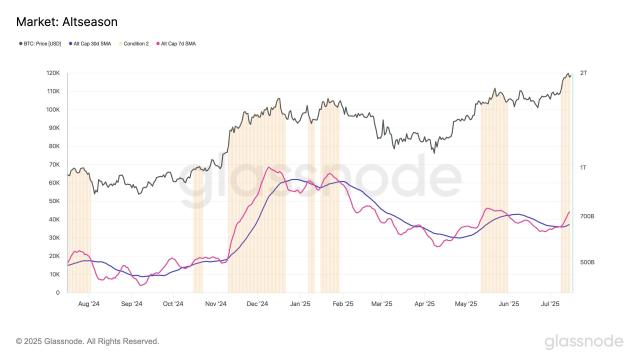

The supply dynamics of Bitcoin are rapidly changing. Institutions are buying large amounts of Bitcoin through new investment tools, causing a sharp decrease in the number of Bitcoins in circulation. Meanwhile, long-dormant whale wallets have suddenly become active, transferring billions of dollars worth of Bitcoin for the first time in over a decade, a move that has historically often triggered market panic. This article will analyze the current state of Bitcoin supply, explain why these "supply crisis" signals are crucial to market sentiment and volatility, and explore how to protect your investment portfolio.

Institutions Frantically Hoarding Bitcoin, Exchange Supply Sharply Reduced

As institutions store Bitcoin in cold storage, only about 11% of Bitcoin remains available for trading on exchanges. The reduction in circulating Bitcoin means a tight supply - as shown in the image, Bitcoin is securely locked away. This scarcity could drive up prices but also makes the market more sensitive to large sell orders.

A new wave of institutional adoption is rapidly absorbing Bitcoin supply, locking it away from the open market. Over the past year, spot Bitcoin ETFs and funds have opened the floodgates for pension funds, hedge funds, and corporations to massively purchase Bitcoin. For example, BlackRock's iShares Bitcoin Trust (IBIT) had daily inflows of approximately $430 million in late May 2025, with total monthly inflows of $6.35 billion, setting a historical record. Every Bitcoin purchased through such tools by these institutions is withdrawn from exchanges and stored in custodial cold storage, further tightening the tradable liquid supply. Other institutional products like Fidelity's Bitcoin fund (FBTC) are also hoarding large amounts of Bitcoin, exacerbating the supply tightness.

The result? Bitcoin reserves on exchanges have dramatically decreased. On-chain data shows that as of early June 2025, Bitcoin held on exchanges dropped below 11% of total supply, a low not seen since 2018. (For comparison, exchanges held over 17% of Bitcoin supply in the 2020 market, now almost halved.) The reduction in available Bitcoin means that large amounts are locked up by long-term holders and institutional custodians, with only 10-11% of float available for trading. This scarcity is a double-edged sword: the decrease in circulating Bitcoin could quickly drive up prices due to buying pressure; conversely, any sudden sell orders could have an outsized impact due to low liquidity. In short, Bitcoin's scarcity is more apparent than ever, with "strong hands" hoarding Bitcoin and public supply increasingly drying up.

Dormant Whales Awaken: Billions of Bitcoin Begin to Move

Dormant Bitcoin whales could suddenly create waves - as shown in the image, whales lurk behind Bitcoin, symbolizing how large holders can influence the market. When long-inactive wallets transfer massive funds (often worth billions), it raises market fears of potential selling. Even if these funds are not immediately sold, such movement can inject fear and volatility into the market.

While institutions lock up supply, ancient Bitcoin whales have suddenly become active. In the past few weeks, several wallets from the "Satoshi era" (2010-2011) have suddenly come to life after a decade of dormancy. For instance, on July 4, 2025, two whale wallets from April 2011 - inactive since Bitcoin was priced below $1 - suddenly transferred a total of 20,000 Bitcoins (worth over $2 billion) to new addresses. On-chain analysts also noted a single whale entity controlling multiple 2011 addresses transferring tens of thousands of Bitcoins in one day, shocking the market. These Bitcoins have grown in value by over 13 million% since 2011, representing billions of dollars in long-term holdings.

Why is this important? Because crypto traders pay close attention when ancient whale funds move. Such massive transfers by long-term holders are extremely rare and often associated with market turning points or volatility spikes. In past market cycles, the reactivation of dormant Bitcoin wallets - especially at this scale - often signal potential selling or market turbulence. The logic is that if a whale holding for over 10 years suddenly decides to move funds, they might be preparing to sell part of their assets and realize massive gains. Even if these Bitcoins are not directly sent to exchanges (in recent cases, whales transferred Bitcoin to new personal wallets, not immediately to exchanges), the psychological impact is enough to unsettle traders. It introduces uncertainty: Why now? Will these Bitcoins be dumped on the market?

We recently saw this fear manifest. When news of a 14-year-old wallet transferring funds spread, Bitcoin's price dropped nearly 2% in a day. Market participants were nervous about the transfer scale, with rumors even linking this activity to Bitcoin's founder Satoshi Nakamoto (unfounded, but showing market anxiety). Bitcoin's price dropped below $108,000, demonstrating how sensitive the market is to any hint of large holder selling. In short, whale movements can create waves: they remind everyone that large amounts of Bitcoin could flood the market, and the mere possibility is enough to cause volatility.

Market Sentiment Shift and Volatility Risk

These intertwined dynamics - tight supply and whale awakening - create an uncertain environment. On one hand, the supply crisis brings bullish sentiment: with so few available Bitcoins, any demand surge could trigger a price spike (a typical "supply shock" scenario). Big buyers seem confident, long-term accumulating Bitcoin even as circulating supply continues to shrink. "Strong hands" are accumulating, which is usually a positive signal.

On the other hand, the market is also aware of the risks of concentrated holdings. When few large holders possess massive Bitcoin amounts, their actions (or even rumors about their actions) can cause severe market volatility. We see "whales" holding thousands of Bitcoins - some beginning to cash in profits after years. Even small sell orders from these whales could have an outsized impact in low liquidity conditions. The recent 2011 whale movements remind us: if whales sell, with insufficient Bitcoin liquidity, prices could rapidly fluctuate. The delicate balance between bullish scarcity and fear of whale selling makes the current market particularly volatile.

For traders and investors, the conclusion is clear: be prepared for volatility. Bitcoin continues pushing towards new highs (driven by stock market optimism and institutional adoption), but these internal supply dynamics could lead to severe price swings in both directions. How to handle this uncertainty? The answer is: take protective measures like diversifying investments, setting stop-loss orders, or exploring financial instruments to hedge risks, ensuring your portfolio remains robust during market turbulence.

Take Control of Your Crypto Strategy

As the Bitcoin supply crisis intensifies and whale-induced volatility risks approach, now is the time to proactively manage risks. Don't let your investment portfolio be caught off guard by the next whale movement or sudden market shock. Through careful strategy and risk management, you can find opportunities or protect gains from uncertainty while limiting downside risks. Take action, protect your portfolio, and prepare for future market volatility.