HyperLend launched a points reward program where users can earn points by using the protocol, potentially receiving token airdrops in the future.

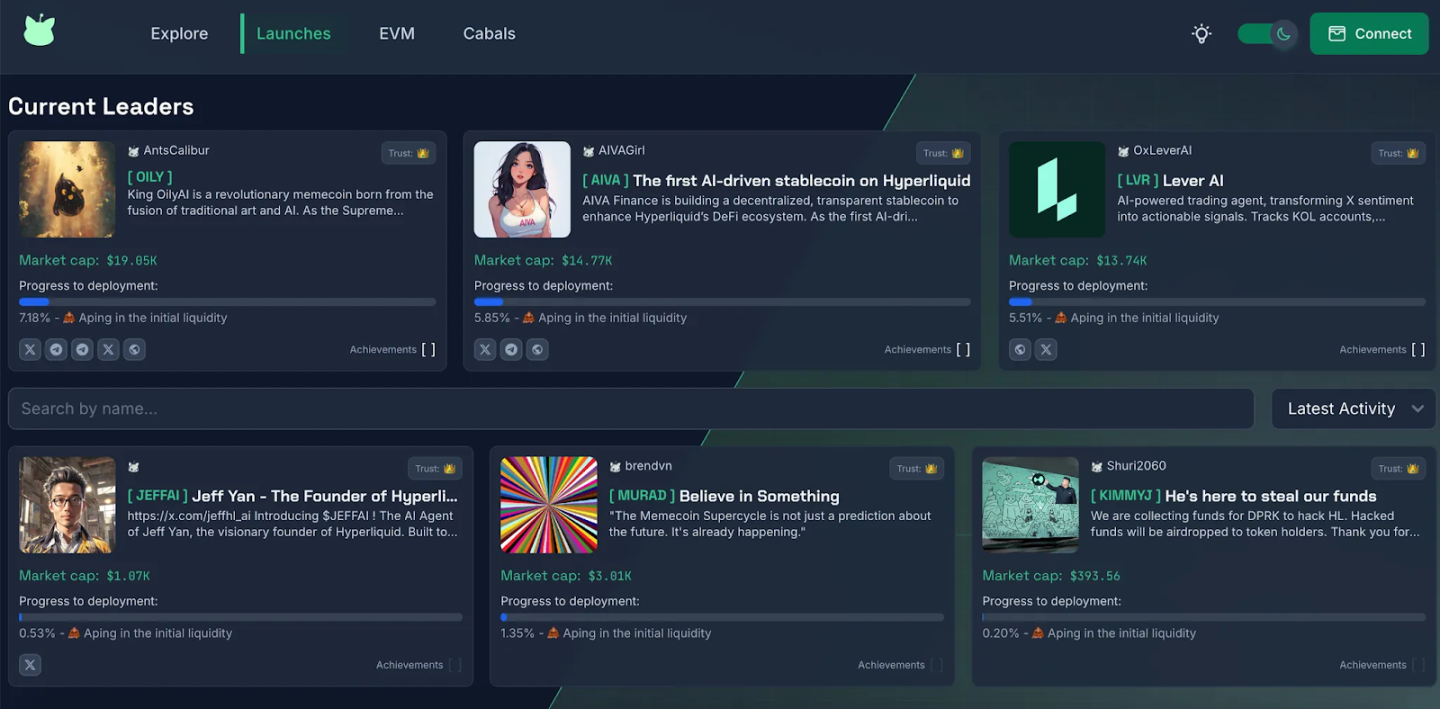

2. Hypurr Fun

Hypurr Fun is a meme launch platform on HyperEVM, providing a Telegram bot and web interface that enables users to trade quickly and serves as a major traffic entry point on HyperEVM. Website: https://hypurr.fun/

Key features include:

- One-click token issuance and trading: Users can easily issue new tokens and participate in trading through the bot.

- Advanced trading tools: Supports TWAP (Time-Weighted Average Price), sniping, and portfolio management functions.

- Buyback mechanism: All transaction fees will be used to buyback $HFUN tokens, enhancing their market value.

- Community interaction: Provides social features like Whale Chats to promote user communication.

$HFUN is the native token of Hypurr Fun, with a maximum supply of 1 million.

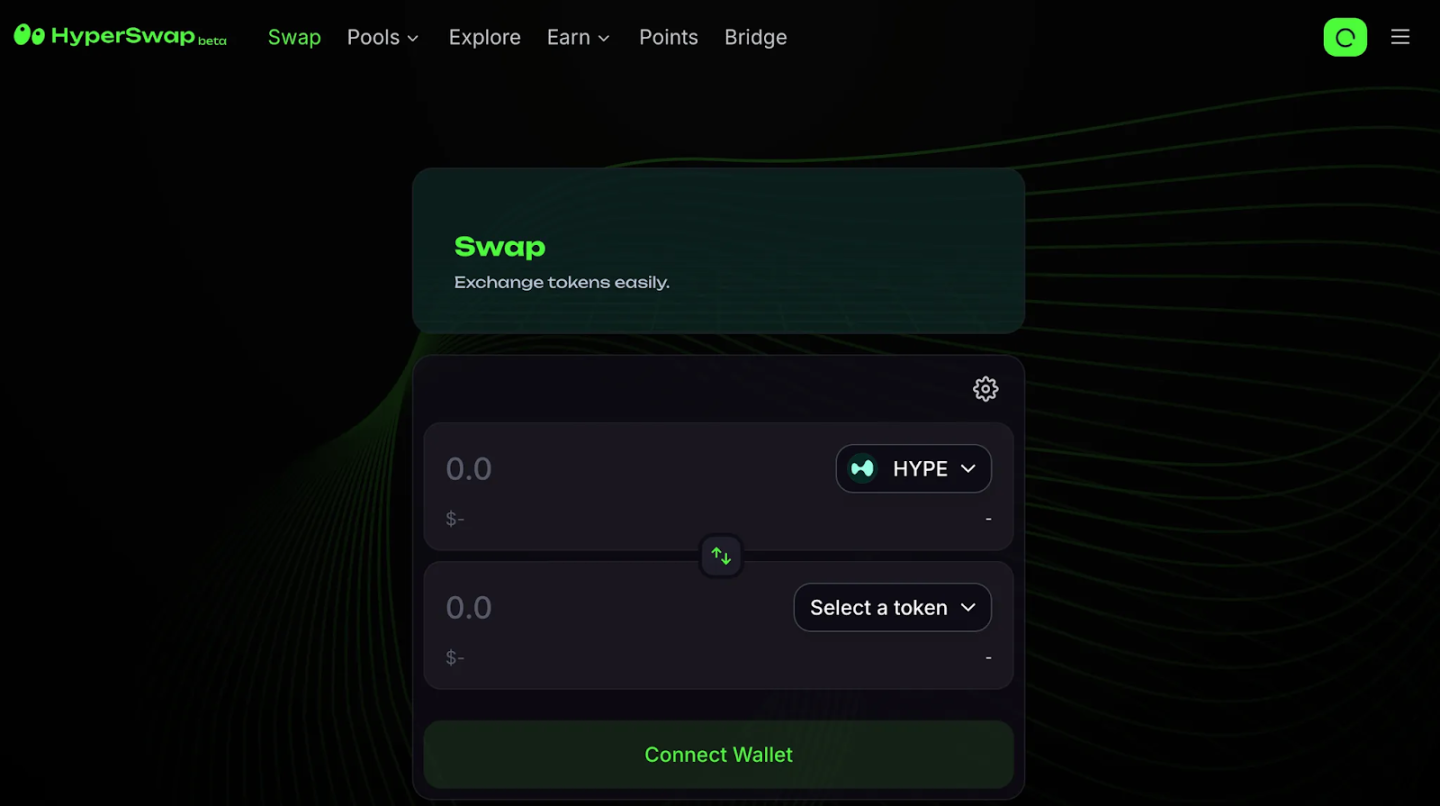

3. HyperSwap

HyperSwap is a low-slippage AMM on HyperEVM.

Main functions include:

- Token trading: Supports exchange of multiple tokens, providing a fast and low-slippage trading experience.

- Liquidity provision: Users can create and manage liquidity pools, earning transaction fees and platform rewards.

- Token issuance: Allows users to issue their own tokens in a permissionless environment.

HyperSwap adopts a dual-token model, consisting of $xSWAP (liquidity mining token) and $SWAP (governance and revenue sharing token). Users obtain $xSWAP by providing liquidity and can convert it to $SWAP to participate in platform governance and revenue distribution.

Additionally, HyperSwap launched a points program where users accumulate points through trading, liquidity provision, and token issuance activities.

Summary

Hyperliquid's rise is the result of multiple factors including technology, products, marketing, and economic models. Its marketing strategy and economic model design are particularly worth learning. However, regulatory pressure and cyclical challenges are two key risks to note. The HyperEVM ecosystem is in its early stages and developing rapidly.