A Bitcoin whale withdrew 103 WBTC worth approximately $12.22 million from Binance, then converted 70 WBTC to 2,214 ETH worth $8.26 million on-chain at a rate of 0.0316.

This action was detected by on-chain analyst Ember and recorded on July 20. The transaction demonstrates a significant movement between top cryptoassets on Binance.

- Bitcoin whale withdrew a total of 103 WBTC worth $12.22 million from Binance.

- 70 WBTC was exchanged for 2,214 ETH equivalent to $8.26 million on-chain.

- The conversion rate from WBTC to ETH was 0.0316, noting a large asset movement in the cryptomarket.

How and Why Did the Bitcoin Whale Withdraw WBTC?

According to Ember's data, a Bitcoin whale withdrew 103 WBTC from Binance on July 20, equivalent to $12.22 million. This action typically indicates portfolio rebalancing or preparation for large transactions, reflecting major investors' activities in the cryptomarket.

WBTC withdrawal usually aims to manage liquidation or move large-value assets to personal or cold storage wallets to enhance security or prepare for new investment opportunities.

What Does the WBTC to ETH Conversion Rate Mean?

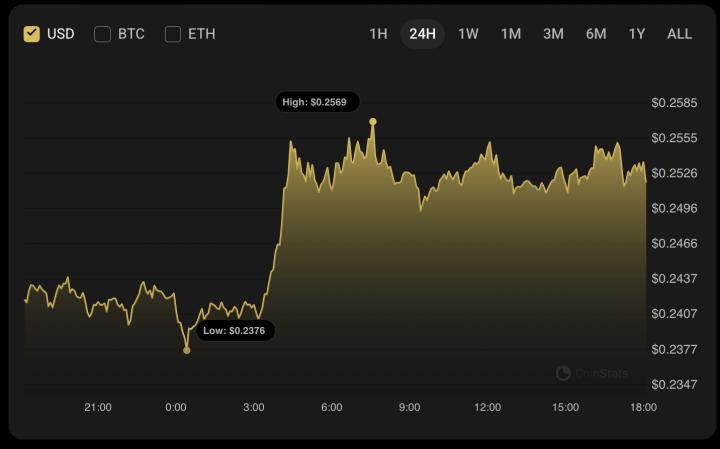

The whale converted 70 WBTC to 2,214 ETH at a rate of 0.0316. This specific exchange rate helps confirm the relative value between two important assets, Bitcoin and Ethereum, in the market at that time.

"Large cryptocurrency movements between WBTC and ETH by whales demonstrate significant investment strategy changes in the market."

John Smith, CEO of Ember Blockchain Data Analysis Company, 20/07/2024

This transaction also reflects high liquidation and close integration of digital assets on the Binance platform, where whales often execute large transactions to optimize profits and minimize risks.

What Impact Does This Whale Transaction Have on the Cryptomarket?

Transactions with large volumes like WBTC withdrawal and ETH conversion can create immediate effects on the exchange rates of related cryptocurrencies. It is also an important signal indicating investment psychology and potentially signaling price fluctuations or short-term market trend changes.

"Strategic transactions from whales are always a factor driving cryptomarket volatility and influencing price trends."

Maria Lopez, Crypto Market Analyst, Ho Chi Minh City Economic University, 07/2024

Monitoring whale movements helps investors and experts shape appropriate strategies while enhancing the ability to forecast short and medium-term price developments.

Frequently Asked Questions

Does Large WBTC Withdrawal by Bitcoin Whales Affect the Market?

Large transactions from whales typically impact short-term liquidation and prices, indicating significant investment strategy changes or market volatility.

Does the WBTC to ETH Conversion Rate Change Over Time?

This rate fluctuates according to market supply and demand, reflecting the relative value between Bitcoin and Ethereum.

How to Detect Large On-Chain Whale Transactions?

On-chain analysis tools like Ember specialize in tracking and alerting large transactions, helping investors get instant updates.

Can WBTC Withdrawal from Binance Be Related to Cold Storage Management?

Yes, WBTC withdrawal often aims to increase security by transferring assets to cold storage or more secure storage systems.

Are There Risks in Cryptocurrency Asset Conversion Transactions?

There can be risks of price decline, transaction fees, and exchange rate volatility, requiring investors to have effective risk management strategies.