- Technical Analysis: Short-term breakthrough pattern established, key resistance at 123,500-125,000 USDT range

- Institutional Momentum: ETF holdings year-on-year increase reaches 217%, regulatory compliance accelerating

- Long-term Value: Halving cycle and Lightning Network adoption rate form double support

BTC Price Prediction

BTC Technical Analysis: Short-term Trend and Key Indicators

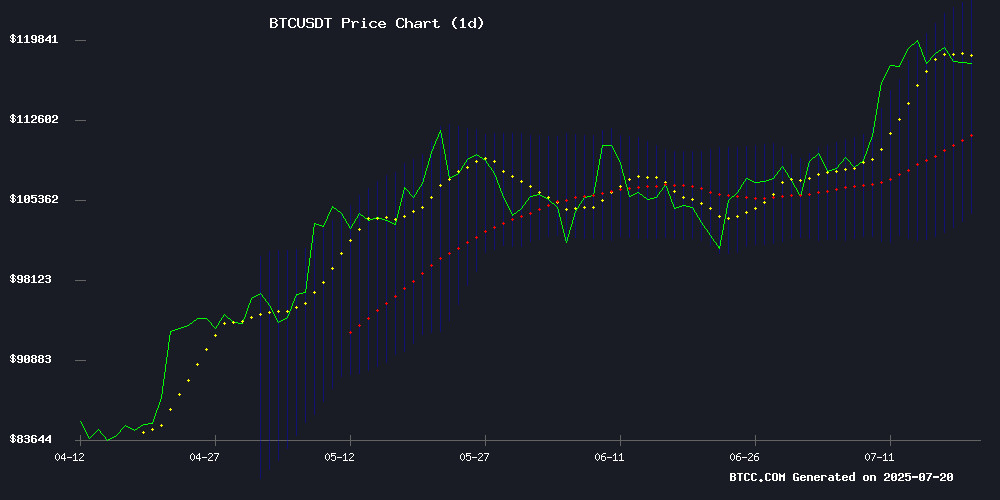

Based on the current BTC price of 118,131.85 USDT (July 20, 2025), BTCC financial analyst Ava points out:

- Price stands above 20-day moving average (113,863.49), showing a bullish arrangement

- MACD (-5,848/-4,853) is in negative value but with converging histogram, indicating weakening downward momentum

- Bollinger Bands channel narrowing (123,577-104,149), price touching above middle rail, may test upper rail resistance in short term

Market Sentiment: A New BTC Era Led by Institutions

BTCC analyst Ava interprets key events:

- US spot ETF holds 1,285,000 BTC (6.46% of circulating supply), forming strong support

- BlackRock ETF scale near $87 billion, institutional allocation demand continues

- After Bitcoin market cap breaks $1 trillion, technical testing and regulatory progress will become price catalysts

- Despite El Salvador's pause, whale wallet activities indicate market rotation beginning

Factors Affecting BTC Price

El Salvador Stops Buying Bitcoin Since February 2025, Contradicting President Bukele's Statement - IMF Report

El Salvador's highly anticipated Bitcoin accumulation strategy encounters obstacles. The International Monetary Fund revealed this week that the Central American country - the first to adopt BTC as legal tender - has not purchased any Bitcoin since February 2025. This contradicts President Nayib Bukele's claims of continuous accumulation on social media.

The disclosed information comes from an IMF document signed by Central Bank Governor Douglas Pablo Rodriguez Fuentes and Finance Minister Jason Rogelio Posada Molina. The report indicates that the government is reducing public sector involvement in the Chivo wallet and restructuring the Bitcoin project to lower fiscal risks. This conservative approach seems related to negotiating a $1.4 billion IMF loan.

Market observers note the growing discrepancy between blockchain data and official El Salvadoran statements. Bukele famously promised to "buy one Bitcoin daily" during market downturns, positioning El Salvador as a crypto pioneer. The purchase pause raises questions about the sustainability of Bitcoin adoption by developing countries.

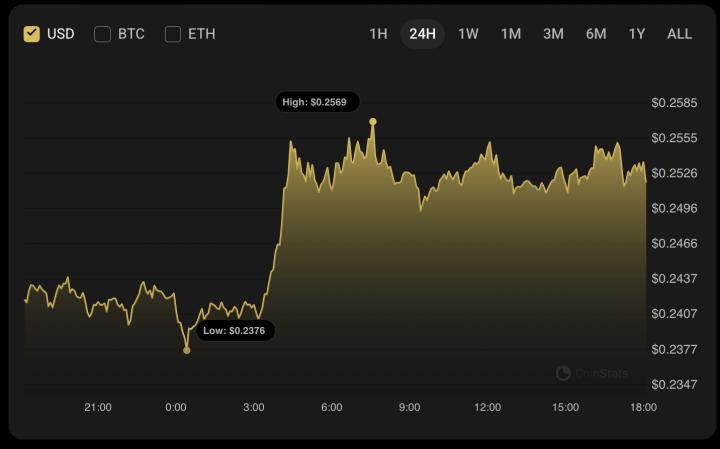

Altcoin Season Index Rises to 47, Bitcoin Dominance Continues

The crypto market shows early signs of altcoin momentum but remains under Bitcoin's shadow. CoinMarketCap's Altcoin Season Index climbed to 47, rising 4 points from yesterday's 43.

In the past 90 days, only 47 out of the top 100 cryptocurrencies outperformed Bitcoin, falling short of the 75% threshold needed to declare a true altcoin season. This indicator serves as a real-time barometer measuring market rotation between Bitcoin and alternative cryptocurrencies.

Market participants continue to watch whether altcoins can sustain outperformance, potentially signaling fund movement from market leaders. Historical patterns suggest such shifts often presage broader market expansion.

El Salvador Continues Bitcoin Accumulation Amid Market Volatility

El Salvador added 8 more Bitcoins to its reserves in the past week, bringing the national total to 6,243.18 BTC. At current valuation, the Central American country's crypto reserves are worth over $735 million.

This continues President Nayib Bukele's aggressive accumulation strategy since adopting Bitcoin as legal tender in 2021. Market observers note that despite recent price fluctuations, El Salvador's continued buying demonstrates its firm belief in digital assets' long-term store of value characteristics.

Bitcoin Faces Critical Technical Test, Institutional Interest Continues Growing

After hitting a historical high of $123,091 on July 14, Bitcoin recently retreated to $117,600, a crucial moment for the crypto market. Despite a daily decline of 1.32%, underlying strength remains - BTC stays above all key moving averages, with RSI stable at 64.37, indicating a healthy consolidation rather than trend reversal.

Despite price pullback, market structure remains bullish. Price maintains a 16.9% premium over the 200-day moving average ($97,723), while MACD continues showing positive momentum. Daily trading volume remains strong at $82.25 billion, supporting Bitcoin's $2.34 trillion market cap.

Institutional catalysts are significant. Charles Schwab's new BTC trading service and Trump's "Genius Act" potentially releasing funds from a $9 trillion retirement market create strong liquidity tailwinds. The market now watches whether this technical pause signals another rally or temporary weakness.

Bitcoin Realizes Market Cap Breakthrough of $1 Trillion, But Warning Signs Emerge

Bitcoin's realized market cap first broke the $1 trillion milestone, creating a historic marker. This indicator calculates market value based on the last on-chain transaction price for each Bitcoin, reflecting genuine fund inflow rather than speculative valuation. Glassnode data shows 25% growth in 2025 alone, indicating strong investor confidence.

Despite optimistic fundamentals, warning signals have appeared. Whale wallets are transferring large amounts of Bitcoin to exchanges, while leveraged long positions have reached dangerous levels. This combination might trigger a severe long squeeze - excessive bullish bets potentially causing chain liquidation.

Market structural strength forms a tug-of-war with increasingly growing leverage risks. Although long-term holders' accumulation provides support, whale activities and derivative exposure concentration suggest future volatility intensification. Traders face a split landscape: robust fundamentals vs technical fragility.

US Spot Bitcoin ETF Holdings Surpass 1.285 Million BTC, Representing 6.46% of Circulating Supply

According to the latest dune analytics data, the on-chain holdings of US spot Bitcoin ETFs have accumulated to an impressive 1.285 million BTC, equivalent to 6.46% of Bitcoin's total circulating supply, with a dollar value approaching $151.8 billion.

This accelerating institutional adoption trend reflects growing market confidence in Bitcoin as a treasury reserve asset. The highly concentrated holdings of such regulated investment instruments may reduce liquidity supply and potentially create upward price pressure during periods of high demand.

Jack Dorsey's Block Company Included in S&P 500, Stock Surges 9%

The financial technology company Block, Inc., led by Jack Dorsey, will join the S&P 500 index, replacing Hess Corp. This news caused Block's after-hours stock price to surge 9%, climbing to $79. The company's inclusion highlights its growing influence in traditional finance and cryptocurrency domains.

Block's Bitcoin strategy remains a focal point. The company holds 8,584 BTC in its treasury, making it one of the top listed companies with significant Bitcoin exposure. WiseSummit commented: "This is more than a headline; passive capital flows are gradually approaching Bitcoin's trillion-scale."

The company plans to integrate Bitcoin payment functions for merchants through Square and leverage the Lightning Network for improved efficiency. Block's inclusion in the S&P 500 index meets strict qualification criteria, including a market cap exceeding $18 billion and consistent GAAP profitability.

Bitcoin Whale Transfers Surge Alongside Market Rotation, Signaling Potential 'Altcoin Season'

After Bitcoin reached a historical high of $123,091 on July 14th, a slight pullback occurred, while altcoins simultaneously demonstrated strong performance. Large tokens showed significant gains, with blockchain data indicating whales are transferring substantial BTC to exchanges.

A glassnode report noted that whale transfers to exchanges' 7-day moving average approached 12,000 BTC, reaching levels seen before the November 2024 bull market. Historically, such fund rotation patterns have signaled altcoins outperforming the broader market. BTC transfers to exchanges typically represent profit-taking or asset reallocation—current market dynamics lean towards the latter.

BlackRock Bitcoin ETF Holdings Approach $87 Billion Mark

According to data disclosed on July 20th, BlackRock's spot Bitcoin ETF (IBIT) currently holds over 731,515 BTC, with a total market value nearing $87 billion. This milestone demonstrates accelerating institutional investor adoption of cryptocurrency investment instruments.

The world's largest asset management company continues accumulating Bitcoin at a pace far exceeding most corporate fund management strategies. At current valuation, IBIT's holdings represent approximately 3.7% of Bitcoin's total circulating supply.

Australian Monochrome Bitcoin ETF Holdings Reach 950 BTC

As of July 17th, Monochrome Asset Management's spot Bitcoin ETF (IBTC) in Australia has accumulated 950 BTC, valued at approximately 174 million Australian dollars. This growth indicates institutional investors are accelerating cryptocurrency adoption through regulated investment tools.

The Australian crypto ETF market continues heating up, with Monochrome becoming a key participant. The fund's continuously increasing BTC reserves reflect growing investor confidence in Bitcoin as a value storage mechanism amid global macroeconomic uncertainty.

US Accelerates Cryptocurrency Legislation, Bitcoin Becomes National Policy Tool

The US House of Representatives passed three critical cryptocurrency bills—the GENIUS Act, CLARITY Act, and Anti-CBDC Act, marking a strategic shift to officially establish Bitcoin as a reserve asset. These measures targeting stablecoins, digital asset classification, and central bank digital currencies reflect increasing institutional cryptocurrency acceptance.

US authorities currently hold approximately 198,012 Bitcoin, primarily from law enforcement seizures like the Silk Road case. The Trump administration plans to establish a strategic Bitcoin reserve by 2025. The GENIUS Act could be signed into law as early as this week, with other bills entering Senate review.

Globally, sovereign nations are transforming from observers to active cryptocurrency market participants. This legislative trend highlights Bitcoin's evolving role in geopolitical finance, with its holdings now comparable to traditional reserve assets.

How Will BTC Develop Over the Next 10 Years?

BTCC analyst AVA proposed a ten-year cycle framework:

| Stage | Time Frame | Key Characteristics | Price Range Prediction |

|---|---|---|---|

| Institutionalization | 2025-2028 | ETF-dominated liquidity/national reserve allocation | 150,000-300,000 USDT |

| Monetization | 2029-2032 | Mature payment infrastructure/Lightning Network proliferation | 300,000-800,000 USDT |

| Reserve Asset | 2033-2035 | Global settlement layer status established | 800,000+ USDT |