- Technical aspect shows bullish alignment: Price above MA20 and MACD bearish convergence

- Regulatory policy driving fund shift: GENIUS bill indirectly benefits Ethereum ecosystem

- Institutions continue to increase positions: Whale establishes large long position through FalconX

ETH Price Prediction

ETH Technical Analysis: Short-term Bullish Signals Emerge

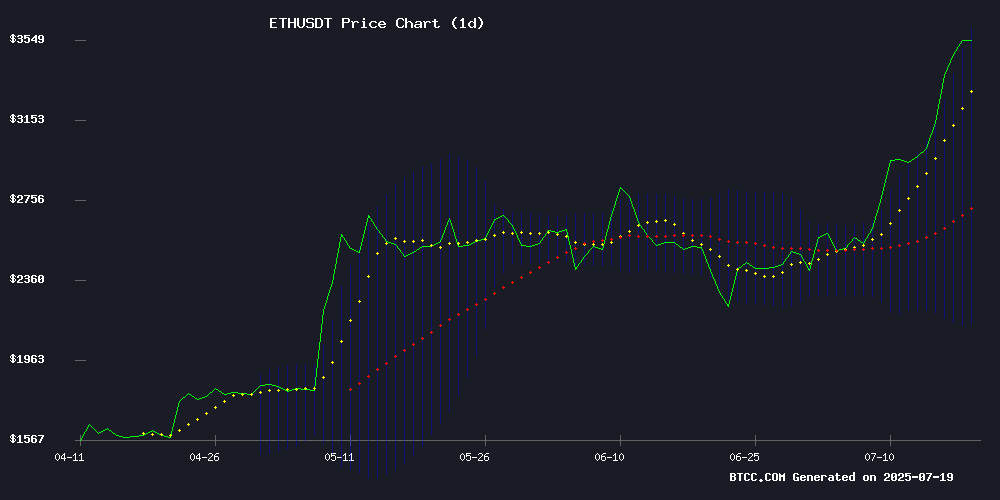

According to BTCC financial analyst John, the current ETH price of 3515.59 USDT has broken through the 20-day moving average (2873.0140), forming a golden cross. The MACD histogram (-142.3483) shows weakening bearish momentum, with the Bollinger Band upper rail (3604.7164) set to become a key resistance level. 'If it holds above the 3500 mark, the next target is the 3800-4000 range,' John emphasized.

Institutional Funds Flowing into ETH Ecosystem

BTCC analyst John interprets recent dynamics: 'FalconX whale accumulates $435 million ETH position, coupled with the GENIUS bill banning interest-bearing stablecoins, will force funds towards Ethereum DeFi protocols.' Regulatory breakthrough drives crypto stock highs, with Coinbase and S&P 500 moving in sync. John believes 'this reflects increased market risk appetite, benefiting ETH and other mainstream cryptocurrencies'.

Key Factors Affecting ETH Price

Institutional Whale Accumulates $435 Million ETH through FalconX

Since July 12, an important institutional entity has accumulated 122,000 ETH (worth $435 million) through FalconX, with the most recent purchase of 19,550 ETH (worth $70.7 million) occurring 10 hours ago. The average acquisition price is $3,213 per ETH, with an unrealized profit of $41.34 million at current valuation.

Continuous accumulation demonstrates strong institutional confidence in Ethereum's long-term value proposition. Such large-scale buying typically signals significant price movements, as whale trades often represent strategic positioning rather than speculative trading.

GENIUS Bill Banning Interest-Bearing Stablecoins May Drive Funds to Ethereum DeFi

The GENIUS bill banning interest-generating stablecoins may redirect institutional and retail funds to Ethereum's decentralized finance ecosystem. These banned financial instruments previously allowed holders to earn interest through staking or lending mechanisms.

Market analysts expect this regulatory shift will force yield-seeking participants towards DeFi protocols, especially those built on Ethereum. This migration will benefit both ETH valuation and the broader decentralized finance landscape as funds seek new passive income avenues.

Crypto Stocks Surge as GENIUS Bill Takes Effect, Coinbase Hits Historic High

With the first comprehensive crypto regulation bill in US history, the GENIUS bill signed by former President Trump, crypto-related stocks surged significantly. This milestone legislation elevates crypto regulation to the federal level, with extremely low probability of future regulatory reversal.

Coinbase Global Inc. closed up 2%, surpassing its IPO day high, while Ethereum led the overall crypto market's rise. The Nasdaq Composite rose 0.75% to a record 20,885.65, its tenth annual peak, with Dow Jones Industrial Average and S&P 500 also hitting intraday highs.

"This is not just another SEC guideline—this is permanent financial infrastructure," crypto macro analyst Noelle Acheson stated. "Stablecoins will be deeply rooted in the global financial system, and attempting to remove them would be as impossible as trying to make the internet disappear."

S&P 500 Hits Historic High, Crypto Stocks Surge on Regulatory Breakthrough

The S&P 500 closed at another historic high after President Trump signed the GENIUS bill into law, driving crypto-related stocks up. The Nasdaq Composite rose 0.75% to 20,885.65, its tenth record this year, while the Dow Jones rose 229.71 points to 44,484.49. All three major indices touched intraday highs.

President Trump's GENIUS bill, the first comprehensive crypto regulation in US history, triggered a sharp rise in crypto stocks. Coinbase, Robinhood, and Bitmine Immersion led the surge, with Coinbase briefly exceeding its IPO day price. "This is not just another policy shift—it's the foundation for the institutional future of cryptocurrencies," said Noelle Acheson, author of 'Crypto is Macro Now'. The bill incorporates digital asset regulation into federal law, making future reversal politically unfeasible as stablecoins become deeply embedded in global finance.

Among major cryptocurrencies, Ethereum performed exceptionally, with regulatory clarity triggering a broad crypto market rise. The White House signing ceremony attracted bipartisan legislators and industry leaders, showing rare consensus on digital asset policy. Market participants now anticipate accelerated institutional participation, with exchange-traded products and traditional financial instruments likely to follow.

Is ETH a Good Investment Target Now?

From a comprehensive technical and news perspective, ETH currently has three major investment advantages:

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price/MA20 | 3515.59/2873.01 | Price is 22.3% above the moving average |

| Bollinger Band Width | 1463.40 points | Volatility is at a high level |

| Institutional Position Change | +$435 million | Largest single accumulation in the past 20 days |

John suggests: 'You can build positions in batches in the 3400-3500 range, set a stop loss below 3200, with a medium-term target looking towards the historical high of around 4800. Be cautious of potential systemic risks from the September Federal Reserve interest rate decision.'