In the second half of the year, focus on the Federal Reserve's policy shift, progress in US crypto legislation, TradFi and crypto merger wave, stablecoin payment penetration, RWA, and other developments.

Written by: Binance Research Institute

Translated by: Chopper, Foresight News

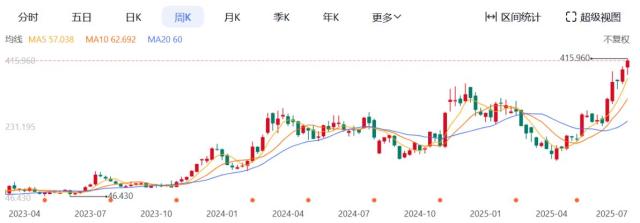

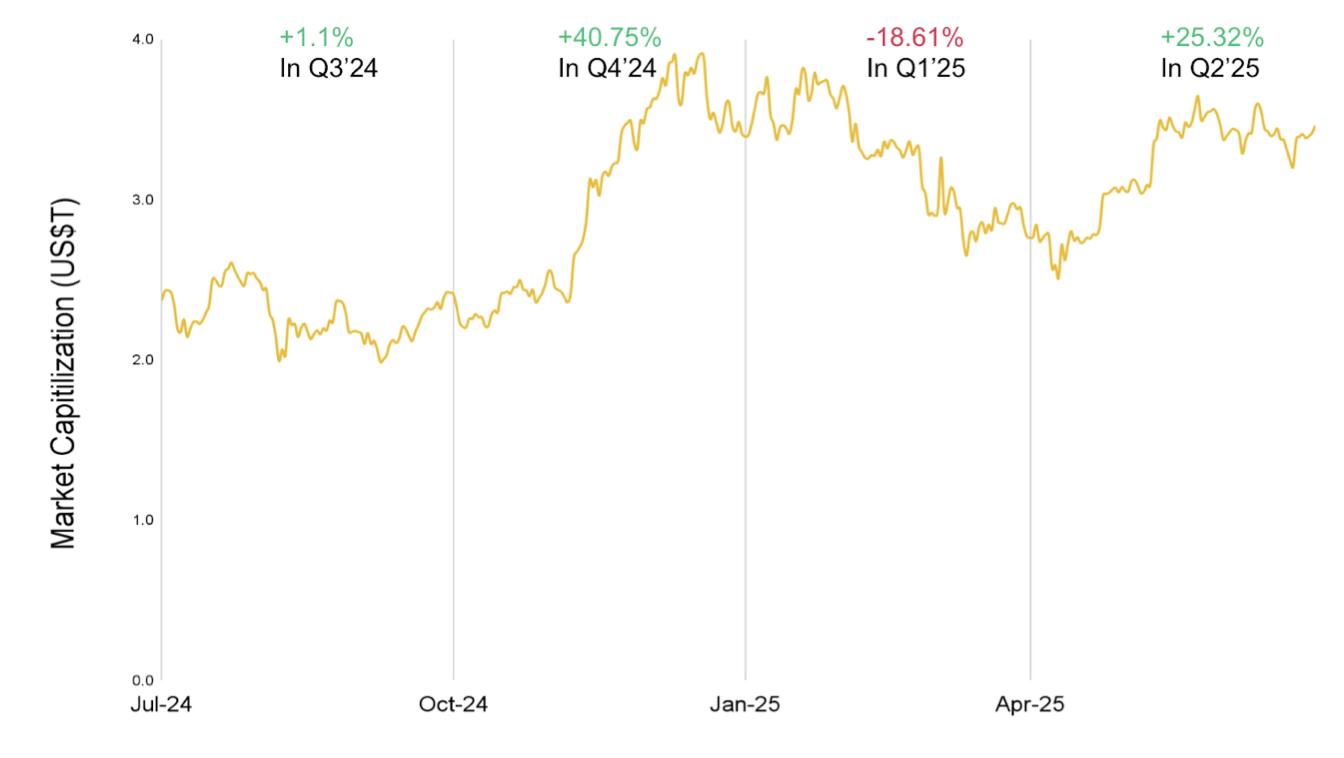

In the first half of 2025, the crypto market showed a "first suppressed, then rising" oscillating pattern: the total market value dropped by 18.61% in the first quarter, rebounded by 25.32% in the second quarter, and ultimately increased slightly by 1.99% year-on-year in the first half of the year.

Year-to-date, the total crypto market value increased by 1.99%

This dynamic stems from multiple factors:

- The expectation of Federal Reserve rate cuts and regulatory relaxation after the US election in the second half of 2024 will drive the market to reach $3 trillion;

- Inflation stickiness, weak economic data, and the universal tariffs implemented by the Trump administration in April 2025 suppressed market sentiment;

- Recent tariff suspension and improved clarity in stablecoin and DeFi regulation have driven market recovery.

- United States: Shifting from "law enforcement regulation" to "legislative leadership", the CLARITY Act and GENIUS Act clearly define digital asset classification and stablecoin rules, promoting institutional compliance entry.

- European Union: MiCA fully implemented, USDT delisted by some exchanges due to non-compliance, while compliant stablecoins like USDC increase market share.

- Asia: Hong Kong attracts innovation through open licenses and tax incentives; Singapore strictly combats regulatory arbitrage, leading to corporate migration.

Second Half Outlook

The Federal Reserve's policy shift, US crypto legislation advancement, TradFi and crypto merger wave, stablecoin payment penetration, and RWA explosion will dominate the crypto market direction in the second half.