An ultra-rare bullish signal has just flashed for XRP, and analysts are paying close attention. According to Ali, a cryptocurrency analyst, the MVRV ratio (Market Value to Realized Value) has triggered a golden cross, a signal that previously preceded a massive surge for the token.

"The last time the MVRV ratio flashed a golden cross, XRP soared 630%. That signal just appeared again," Ali wrote on X.

The last time the MVRV ratio flashed a golden cross, $XRP soared 630%. That signal just appeared again. pic.twitter.com/hatA0Jfvt2

— Ali (@ali_charts) July 17, 2025

This rare setup sparks speculation that XRP could be on the verge of a major breakout. If history repeats itself, a 630% surge from XRP's current prices would imply a lofty target of about $20.

XRP was recently up 10.03% in the last 24 hours to $3.28, extending its rally from a low of $2.87 on Wednesday.

Several analysts believe XRP's recent rally was underpinned by its strong technical structure, with veteran trader Peter Brandt highlighting the formation of an ultra-rare compound fulcrum pattern on the XRP chart, with the potential to reach $4.4. Some other predictions target $5.

XRP price skyrockets

XRP broke out of a prolonged consolidation range, recording a sharp surge early Thursday due to strong institutional interest in the ProShares XRP Futures ETF, which is expected to launch on July 18.

Volume-sustained surge through $3.00 marks a departure from recent sideways price action, with whales and treasury desks reentering near breakout zones.

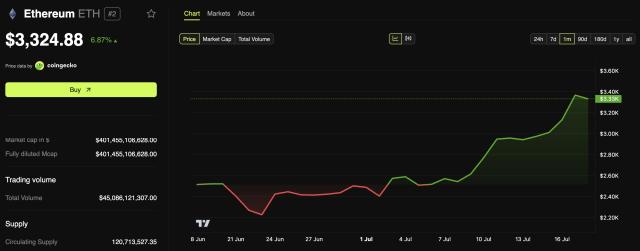

As XRP's price rose to a six-month high, so did its notional open interest. XRP has also set a new market capitalization record, reaching $192.82 billion, solidifying its position as the third-largest cryptocurrency by market capitalization, ahead of Tether (USDT), which has a market value of $160.2 billion.

XRP reached an intraday high of $3.28, with the next target being the $3.40 high, ahead of $4 and $5.