Welcome to another Nugget of Wisdom! A free weekly post I send out every Thursday. These are designed to be short and sweet, a quick read to (hopefully) impart some sort of wisdom, or at the very least to get you thinking about something interesting.

The Market Doesn't Owe You a Rotation

There’s a coping mechanism that many crypto traders and investors often rely on: the belief that a rotation is inevitable.

They’ll tell themsleves things like:

It’s just a matter of time before my bags pump

Narratives move in cycles, it’ll come back

Everything’s up 200%, surely my bags are next

But the reality is: the market doesn’t owe your bags anything, least of all a rotation.

Not next week. Not next cycle. Not ever.

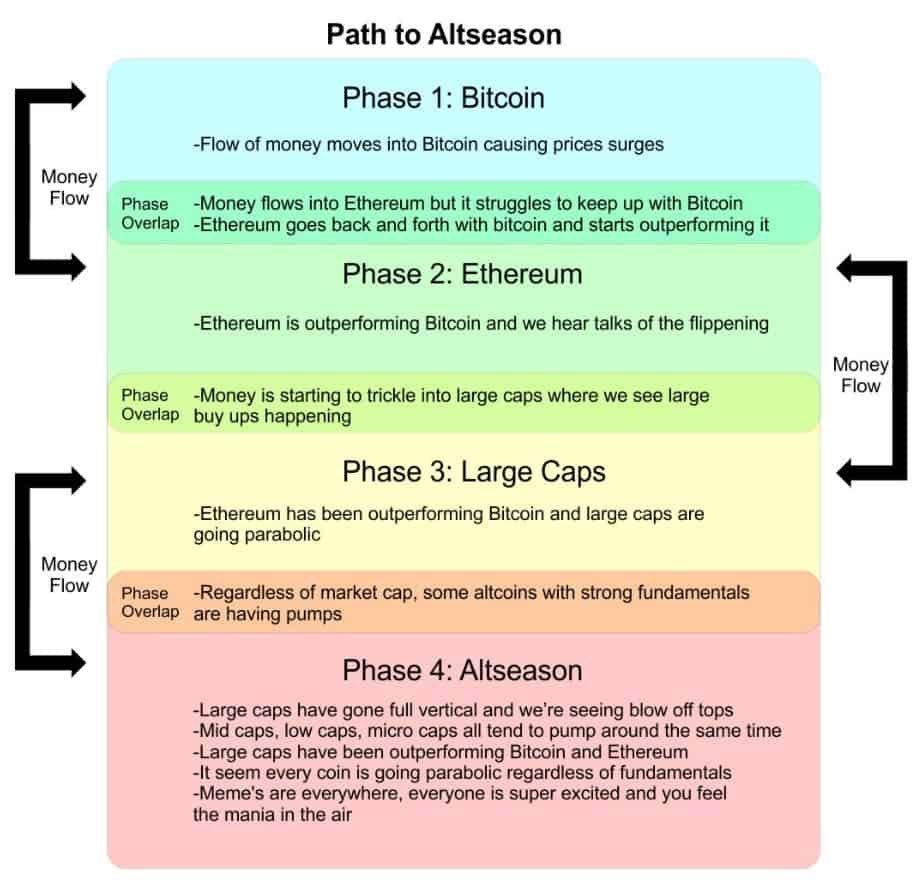

If you’ve been in crypto for a while, chances are you’ve seen this image (or one similar to it):

If you haven’t come across it before, just know that it’s a very popular image and is often shared by people who talk about the fabled “alt season” coming and how it is “inevitable”.

The reason it is so popular is because historically it has played out pretty close to this, because everyone wants it to be true, and because there are certain elements and nuggets of truth to it. Bitcoin usually is the first mover, and only then do other coins move (rarely do you see coins performing brilliantly in the face of a big BTC decline).

My view is that you should take this chart and ones like it with a massive grain of salt, and also that you should use it as a reminder that once again: the market doesn’t owe you anything.

Things are constantly changing and the landscape in crypto today is very different to what it was like in 2021, and 2017, and especially any earlier than that.

How should you think about your bags instead?

Know that rotations, metas, and cycles are features of liquidity — the way money flows isn’t based on some predetermined order, it’s simply capital seeking narratives and returns. If your asset isn’t part of a compelling story anymore, it’s probably not in any sort of rotation queue

Look where liquidity is going, not where it used to be — just cause a chain had a tonne of liquidity in the past and their whole ecosystem pumped, there’s absolutely no guarantee that it’s going to get that liquidity back (see: Tezos and their art NFTs)

Understand that some narratives don’t ever come back — there is a graveyard of dead narratives in crypto; almost all things that have been tried have failed (remember metaverse coins? or the cute zoo animal meme coin meta?)

Audit your portfolio with brutal honesty — would you buy your current positions today? (aka employ the Magic Wand Thought Experiment)

Hold fewer moonshots and don’t succumb to the sunk cost fallacy — easier said than done, I know, but the more you understand this, the better your results will be

It’s tough to fight against your internal hopes and dreams that your bags are surely going to pump any day now, and it’s also tough to fight against the potential mental angst you would feel if you sold something you’ve been holding for years 3 days before it does a 100x.

But you have to fight against these things if you want to be a great trader and investor; you have to fight against your emotions, and try as much as you can to focus on logic and reason instead.

Thanks for reading! In case you missed it, check out Monday’s post below 👇