Welcome to Asia Pacific Morning Brief—a spotlight newsletter on overnight cryptocurrency developments shaping regional markets and global sentiment.

Enjoy a cup of green tea and follow today's highlights: Korean cryptocurrency trading volume increased 264% as Bitcoin reaches $120,000; Talos acquires Coin Metrics for over $100 million amid industry consolidation wave; Trump's World Liberty token opens public trading after governance vote.

Korean Trading Increases 264%, but No Kimchi Premium

Korean cryptocurrency exchanges recorded daily trading volume exceeding $8 billion, a 264% increase compared to the same period last year. This increase aligns with Bitcoin's historic breakthrough above $120,000, reviving investor interest in the region.

Market optimism is reinforced by expectations of "Crypto Week" events in the United States; however, Bitcoin prices in Korea are currently trading 1.7% lower than global prices. The absence of the traditional "Kimchi Premium"—where Korean exchanges typically trade cryptocurrencies at higher prices than the global market—reflects current market dynamics and regulatory constraints limiting price arbitrage opportunities.

Meanwhile, the Korean stock market has grown strongly, with the KOSPI index rising 15% since early June when President Lee Jae-Myung began his term, thanks to his market-friendly policies, including corporate law reforms.

Trump-Backed World Liberty Financial Token Opens Public Trading

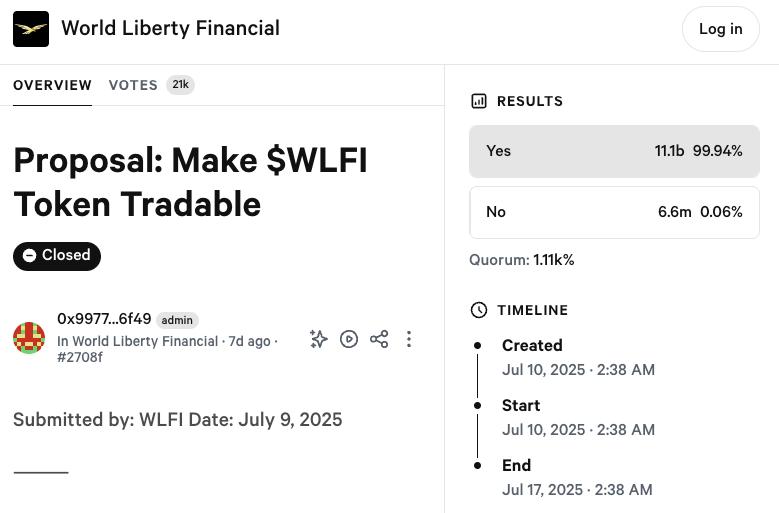

World Liberty Financial's WLFI tokens will soon be available for public trading after a vote ending on Wednesday, expanding access beyond recognized investors. This Ethereum-based decentralized finance project intends to provide cryptocurrency lending services, although its platform has not yet been launched.

The Governance Token allows holders to vote on project changes while maintaining tradable value on exchanges. Previously reserved for wealthy investors, the expanded community ownership of WLFI marks a significant milestone. The project recently received a $100 million investment from UAE-based Aqua 1 Foundation, despite concerns about potential conflicts of interest as Trump disclosed a $57.3 million profit from token sales.

Talos Acquires Coin Metrics for Over $100 Million as Crypto M&A Accelerates

New York-based digital asset trading infrastructure provider Talos has acquired blockchain data company Coin Metrics for over $100 million, marking the latest major deal in the cryptocurrency industry consolidation wave. This acquisition follows Stripe's $1.1 billion purchase of stablecoin Bridge and several significant Coinbase acquisitions.

Founded by former Wall Street veterans in 2018, Talos aims to become the sole destination for institutional cryptocurrency trading, leveraging Coin Metrics' expertise in on-chain and off-chain data. CEO Anton Katz noted that regulatory relaxation during the Trump administration drove institutional adoption, with discussions spanning large financial institutions seeking comprehensive digital asset infrastructure solutions.

Contributions by Shigeki Mori and Paul Kim.