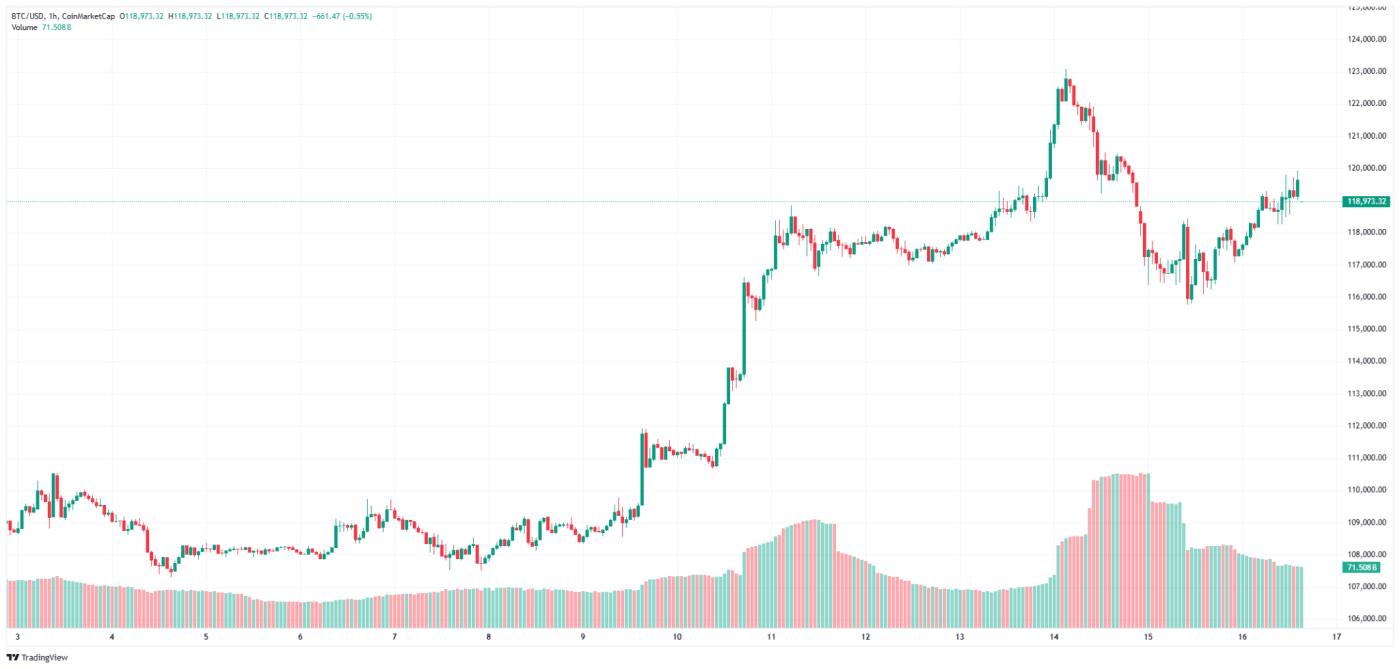

Trump Denies Rumors of Firing Fed Chairman Powell, Helping Bitcoin Rise 1.95% in 24 Hours to $118,946 and Market Capital Reaching $2.38 Trillion.

Bitcoin strongly recovered to the $119,000 level in Wednesday's trading session after President Donald Trump denied rumors about firing Federal Reserve Chairman Jerome Powell. This move eased market concerns about monetary policy instability and created a positive momentum for risky assets.

According to CNBC, an anonymous White House official revealed that on Tuesday, Trump verbally committed to a group of Republican senators about removing Powell due to dissatisfaction with "hawkish" interest rate policies. The President had previously publicly criticized the Fed Chairman for "delaying action" and causing the US to spend "a trillion dollars annually" on national debt interest by maintaining target interest rates between 4.25-4.50% instead of reducing three percentage points as he desired.

However, just one day after the rumors spread, Trump changed his stance with the statement "we have no plans to do so" when asked about Powell's dismissal. He still left the possibility open by adding "but I don't rule out any possibilities", creating a balance between reassuring the market and maintaining political pressure.

Market Reacts Positively to Stability Signals

At the time of recording, Bitcoin was trading at $118,946.51, increasing 1.95% in the past 24 hours. During the session, BTC fluctuated between $116,241.60 and $119,929.93, demonstrating a strong recovery after a period of instability. Over the past week, Bitcoin has increased by 7.74%, showing a solid growth trend.

Bitcoin's market capital increased 2.23% to $2.38 trillion, confirming the leading position of the world's largest digital currency. However, market dominance ratio decreased from 64.05% to 63.42%, indicating that altcoins are also benefiting from the overall positive sentiment.

24-hour trading volume decreased 22.42% to $71.07 billion, reflecting reduced trading activity after market stabilization. This is typically considered a positive sign when price increases without excessive trading volume, suggesting more sustainable growth.

The Bitcoin futures market also reflected an optimistic sentiment with total open contracts increasing 2.27% to $87.63 billion according to Coinglass. Total liquidation value for the day reached $54.91 million, with short sellers suffering heavy losses of $42.05 million being wiped out, compared to only $12.86 million from buyers.