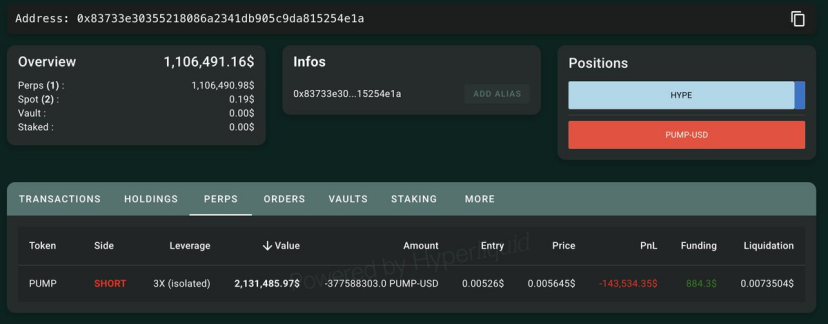

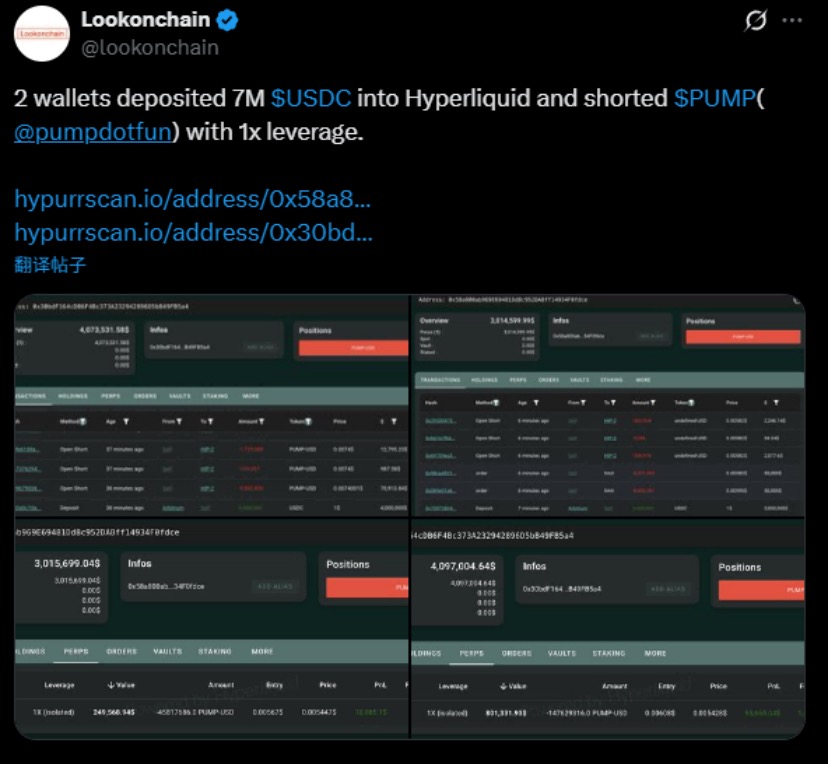

On July 12, 2025, according to LookIntoChain on-chain tracking data, a whale address starting with 0x8373 opened a $2.13 million short position for PUMP tokens on HyperLiquid using 3x leverage.

Just as Pump.fun was preparing for its initial coin offering (ICO), this whale's move undoubtedly touched a sensitive nerve in the market.

Why is everyone watching this short position?

First, the short position's establishment amount is not small:

This whale opened a position of $2.13 million, totaling approximately 3.776 billion PUMP tokens.

Secondly, the timing is crucial:

Just before PUMP's large-scale ICO, the whale's bearish layout raises questions: is it a lack of confidence in the project or an early hedge? The market has various interpretations.

Lastly, the follow-up effect is obvious:

After this large position was tracked on-chain, it sparked extensive community discussion, and short selling pressure subsequently increased. CoinMarketCap data shows that PUMP's price dropped 9.32% within 24 hours.

WEEX Blog Perspective: The Hidden Concerns Behind the Short Position Go Beyond Price Fluctuations

WEEX blog observations suggest that from this whale event, we can see:

Market Psychology is Extremely Fragile

A massive short position is likely not a technical assessment, but a real feedback on liquidity risks after the ICO. Project team silence, community disagreements, and fund sensitivity are common issues in current Web3 projects.

⚠️ Token Risks During ICO Stage Are Not Just About Price Movements

Many users only focus on price, overlooking the importance of "who is buying, who is selling" and "what channels can trade". Such events again emphasize that choosing the right trading platform is crucial when dealing with hot projects.

In the WEEX Weike Exchange community, they are also closely tracking the whale's market chain reaction. The WEEX Weike blog article points out that the current Web3 market is still in a high-risk, high-volatility period, advising users not to blindly follow trends, especially in leveraged and new token trading, and to prioritize platforms with strong risk management and high transparency.

PumpBTC Current Situation: Opportunities and Risks Coexist Between Rises and Falls

Based on CoinMarketCap data (screenshot taken on July 12, 2025, UTC 05:00)

The market is still in a state of strong expected gaming, where whale movements, community sentiment, and trading platform performance could all become key variables triggering dramatic price fluctuations.

Reminder: This article is an observation from the WEEX blog information column and does not constitute investment advice. Please make independent judgments before trading, and choosing a safe and stable trading platform remains the first step.